1

NASA Common Leading Indicators

Detailed Reference Guide

National Aeronautics and Space Administration

Office of the Chief Engineer

January 2021

2

Table of Contents

Background ....................................................................................................................................... 3

1.1. Why Is NASA Defining a Set of Common Leading Indicators? ...................................................... 3

1.2. Required and Recommended Set of Common Leading Indicators ............................................... 4

Introduction ...................................................................................................................................... 5

2.1. What Is a Leading Indicator? ......................................................................................................... 5

2.2. How Are They Used? ..................................................................................................................... 5

Common Technical Leading Indicators ............................................................................................. 8

3.1. Requirement Trends ..................................................................................................................... 8

3.2. Interface Trends .......................................................................................................................... 15

3.3. Verification Trends ...................................................................................................................... 19

3.4. Review Trends ............................................................................................................................. 22

3.5. Software-Unique Trends ............................................................................................................. 25

3.6. Problem Report/Discrepancy Report Trends .............................................................................. 27

3.7. Technical Performance Measures ............................................................................................... 29

3.8. Manufacturing Trends ................................................................................................................ 32

Programmatic Leading Indicators ................................................................................................... 35

4.1. Cost Trends ................................................................................................................................. 35

4.2. Schedule Trends .......................................................................................................................... 41

4.3. Staffing Trends ............................................................................................................................ 43

References ...................................................................................................................................... 46

Appendix A Acronyms ................................................................................................................................. 47

Appendix B Glossary ................................................................................................................................... 48

Appendix C Summary of Common Indicators ............................................................................................ 49

Appendix D Additional Indicators to Consider ............................................................................................ 53

3

Background

1.1. Why Is NASA Defining a Set of Common Leading Indicators?

In the FY 2011 House Appropriations Report, Congress directed NASA to develop a set of measurable

criteria to assess project design stability and maturity at crucial points in the development life cycle. These

criteria or metrics would allow NASA to objectively assess design stability and minimize costly changes late

in development. The report further directed the NASA Chief Engineer to (1) develop a common set of

measurable and proven criteria to assess design stability and (2) amend NASA’s systems engineering policy

to incorporate the criteria. As such, the Office of the Chief Engineer undertook an effort to determine a set

of common metrics—leading indicators—to assess project design stability and maturity at key points in the

life cycle.

NASA’s response was three-fold. First, NASA identified three critical parameters that all programs and

projects are required to report periodically and at life-cycle reviews. These are mass margin, power

margin, and Requests for Action (RFAs) (or other means used by the program/project to track review

comments). These three parameters were placed into policy via NPR 7123.1, NASA Systems Engineering

Processes and Requirements. Second, NASA identified and piloted a set of augmented entrance and

success criteria for all life-cycle reviews as documented in Appendix G of NPR 7123.1. Third, NASA

identified a common set of programmatic and technical indicators to support trending analysis throughout

the life cycle. These highly recommended leading indicators have been codified in the Program/Project

Plan and Formulation Agreement Templates of NPR 7120.5, NASA Space Flight Program and Project

Management Requirements.

Since the 2011 report, NASA has continued to identify indicators that would help predict future issues not

only during the design phase, but also throughout the life cycle. This Leading Indicator Guide provides

detailed information on each of the required and highly recommended indicators as well as a list of

potential other indicators and measures that each program or project might consider (See Appendix D).

Each program and project selects a set of technical and programmatic indicators that best fits their type,

size, complexity, and risk posture. The selected set of indicators is included in the Program or Project Plan

per the templates given in NPR 7120.5. These indicators are then measured and tracked over time and

reported at each of their life cycle (see NPR 7123.1 Appendix G tables) and Key Decision Point reviews.

Similar indicators also may be tracked by an independent review team or Standing Review Board (SRB)

who may report out at these reviews to provide a check and balance viewpoint. The set of indicators the

independent review team or SRB will be tracking are typically identified in the Terms of Reference that

documents the nature, scope, schedule, and ground rules for the independent assessment of the

program/project.

4

1.2. Required and Recommended Set of Common Leading Indicators

A summary of the set of required and recommended common leading indicators that each

program/project should consider includes:

• Requirement Trends (percent growth, To Be Determined (TBD)/To Be Resolved (TBR) closures,

number of requirement changes)

• Interface Trends (% Interface Control Document (ICD) approved, TBD/TBR burndown, number

of interface change requests)

• Verification Trends (closure burndown, number of deviations/waivers approved/open)

• Review Trends (RID/RFA/Action Item burndown per review)

• Software-unique Trends (number of requirements/features per build/release vs. plan)

• Problem Report/Discrepancy Report Trends (number open, number closed)

• Technical Performance Measure (mass margin, power margin)

• Program/project-specific Technical Indicators

• Manufacturing Trends (number of nonconformance/corrective actions)

• Cost Trends (plan vs. actual, Unallocated Future Expenditures (UFE) usage, Earned Value

Management (EVM))

• Schedule Trends (critical path slack/float, critical milestone dates)

• Staffing Trends (Full Time Equivalent (FTE)/Work Year Equivalent (WYE) plan vs. actual)

This set of indicators was selected based on work done by the International Council on Systems

Engineering, a NASA cross-agency working group, and a validating survey performed in 2019 across

selected NASA programs and projects. The remaining sections of this guide will describe each of these

indicators in detail.

5

Introduction

2.1. What Is a Leading Indicator?

A leading indicator is a measure for evaluating the effectiveness of how a specific activity is applied on a

program in a manner that provides information about impacts likely to affect the system performance

objectives. A leading indicator is an individual measure or collection of measures that predict future

performance before the performance is realized. The goal of the indicators is to provide insight into

potential future states to allow management to act before problems are realized. (See Reference 1.)

So, a leading indicator is a subset of all the parameters that might be monitored on a program or project

that has been shown to be more predictive as far as impact to performance, cost, or schedule in later life

cycle phases. They are used to determine both the maturity and stability of the design, development, and

operational phases of a project. These indicators have been divided into two types: Technical Leading

Indicators (TLI), which apply to the technical aspects of a project, and the Programmatic Leading Indicators

(PLI), which apply to the more programmatic aspect. The TLIs may be a subset of or in addition to the set

of Technical Performance Measures (TPM) that may be unique to a program/project. According to the

International Council on Systems Engineering (INCOSE), the definition of a TPM is a measure used to assess

design progress, compliance to performance requirements, and technical risks. TPMs focus on the critical

technical parameters of specific system elements. They may or may not be predictive in nature. For

additional information on TPMs, see NASA/SP-2016-6105 “NASA Systems Engineering Handbook,” Section

4.2.

2.2. How Are They Used?

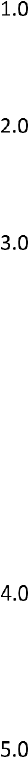

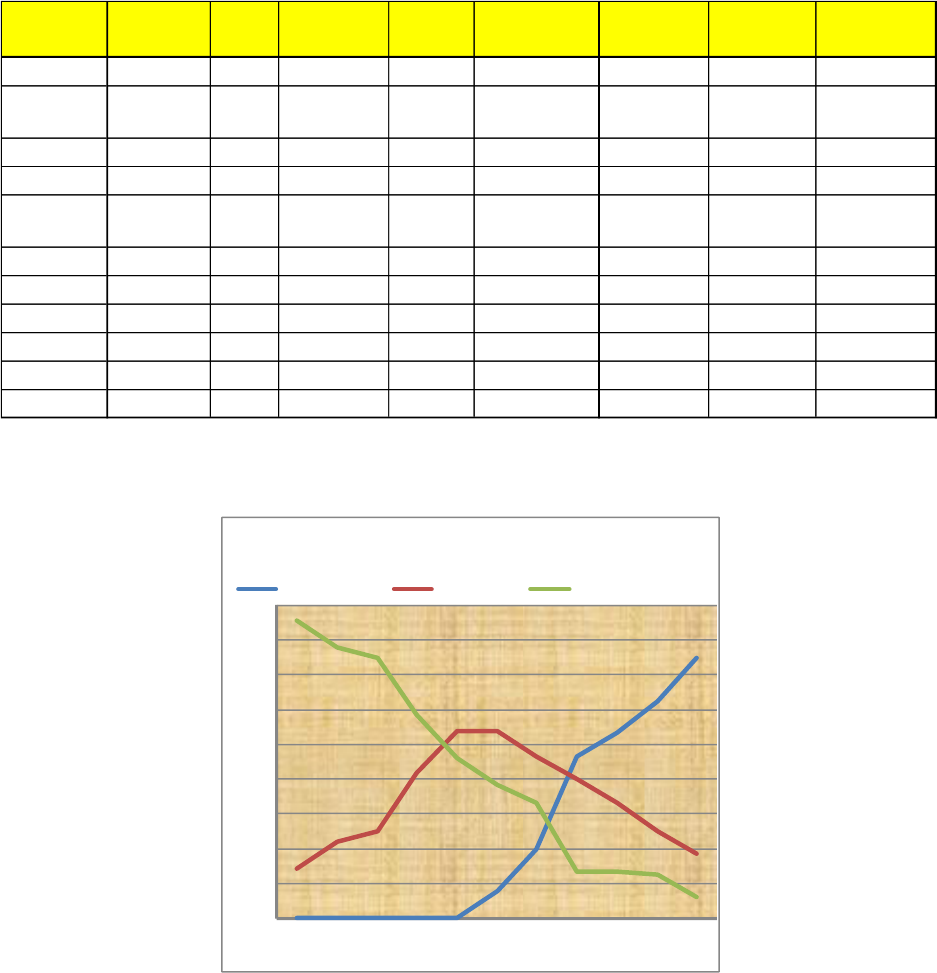

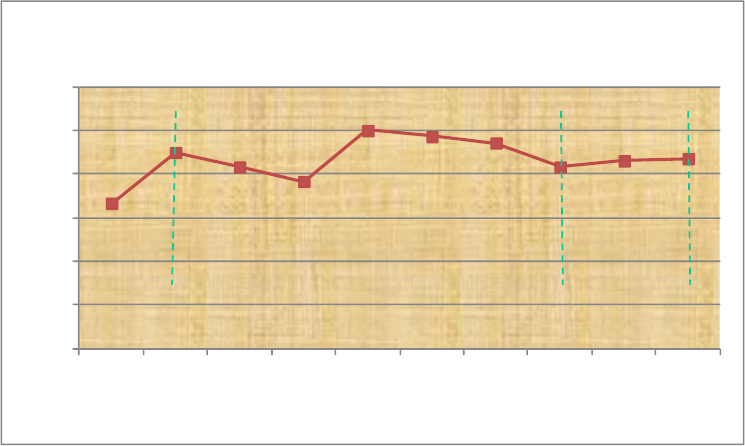

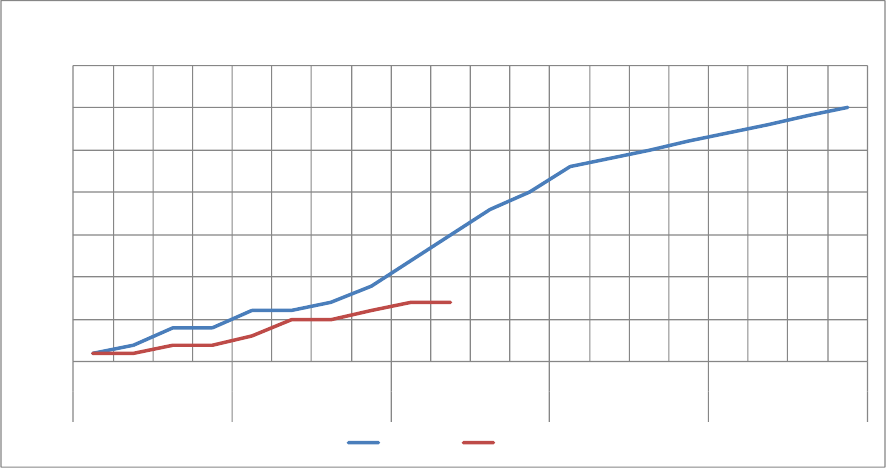

As shown in Figure 2-1, leading indicators are used throughout the program/project life cycle. However,

any one indicator may be useful only during a few of the phases. For example, verification trends are

useful only during the times leading up to and during the phases in which the product is verified. Also, note

that the leading indicators may exist first in an estimated form and then, as more information becomes

available, they may be refined or converted into actual measured values. For example, early in Pre-Phase A

the number of requirements can be estimated and tracked. As the set of requirements is being defined in

Phase A, they can be counted and the actual number can replace the estimated values in the indicators.

6

Figure 2-1 Use of Leading Indicators Throughout the Life Cycle

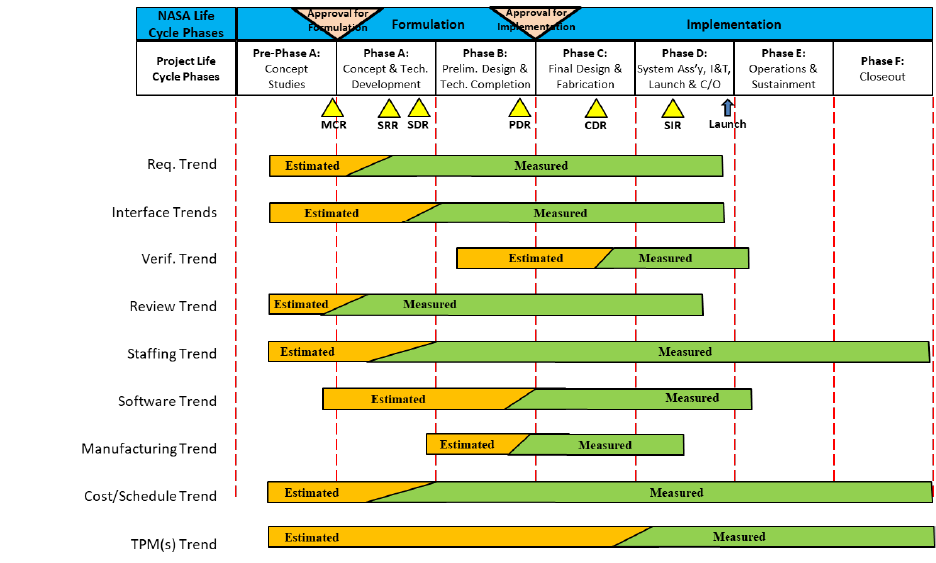

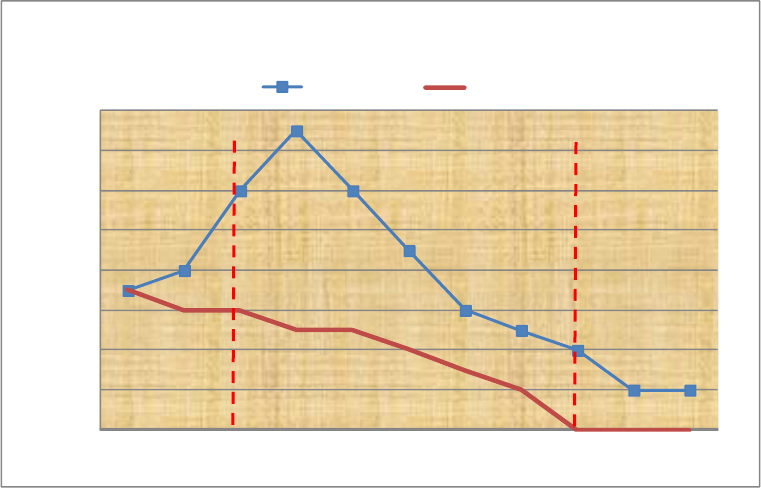

Leading indicators are always viewed against time to see how the measure is progressing so that the

product’s stability and maturity can be determined. This may be depicted in tabular form or perhaps more

usefully in graphical form. The parameters also may be plotted against planned values and/or upper or

lower limits as shown in Figure 2-2. These limits, if used, would likely be defined by the program/project

based on historical information.

By monitoring these trends, the program or project managers, systems engineers, other team members,

and management can more accurately assess the health, stability, and maturity of their program/project.

Trend analysis can help predict future problems that might require attention and mitigation before they

become too costly. How often these parameters should be measured and tracked will depend on the

length, complexity, and size of the program/project. The updated measurements may be provided weekly,

monthly, or quarterly. It is recommended that measurements be taken at least quarterly. However, this

may be too long a period for some projects to catch potential problems in a timely manner. The interval of

measurement for each of the indicators should be identified early in the planning phases and noted in the

Program/Project Plan or other documentation.

7

Figure 2-2 Example Trend Plot from BAE Presentation “Technical Performance Measure,” Jim Oakes, Rick

Botta, and Terry Bahill

By combining these periodic trending indicators with the life-cycle review entrance and success criteria,

the program/project will have better insight into whether their products are reaching the right maturity

levels at the right points in the life cycle, as well as an indication of the stability of the program/project.

The entrance criteria, in particular, address the maturity levels of both the end product as well as the

project documentation that captures its design, development, planning, and risks. However, just looking at

maturity levels is not sufficient. If, for example, the product is appropriately designed to a Critical Design

Review (CDR) maturity level but there are still significant changes in the requirements, the project cannot

be considered stable. An evaluation of the aggregate set of indicators is needed to develop an overall

understanding of both the maturity and stability of the program/project.

8

Common Technical Leading Indicators

A recommended set of common Technical Leading Indicators (TLI) are described in this section. The

common Programmatic Leading Indicators (PLI) are described in Section 4.0. Each section discusses

applicable trend categories, explaining why trends in each category are important and describes the

specific trend measurements that need to be monitored. Each measurement is described, and sample

plots shown. Note that these are only examples. These indicators may be portrayed by the project in the

format that is most useful to the project. The complete set of Common Technical Leading Indicators is

presented in Appendix C along with the minimum characteristics for the displays. As long as the minimum

set of plotting characteristics is satisfied, how the project chooses to depict the trend is left up to the

project and its decision authorities.

3.1. Requirement Trends

This category includes three trends that should be monitored to assess the stability and maturity of the

products: Percent Requirement Growth, To be Determined/To Be Resolved (TBD/TBR) Closures, and the

Number of Pending Requirement Changes. Each is separately discussed in the following sections.

3.1.1. Why Are the Leading Indicators Important?

Controlling the growth of requirements is one of the best ways to reduce unplanned cost and schedule

delays later in a project life cycle. For each new requirement that is added, dozens more may be derived as

the project moves deeper into the product hierarchy. Each of these new and derived requirements will

then need to be verified, again potentially adding more cost and schedule time. Therefore, creating or

defining new requirements must be performed with care. Ensure that each requirement is truly “required”

and not just a desire or wishful thinking. Requirements should convey only those things that absolutely

must happen to produce a product that will accomplish the desired outcome. They should not dictate a

single solution nor strangle the creativity of the designer. The requirement set should allow for multiple

design options that can then be traded against key parameters such as performance, cost, and schedule.

Depending upon where the project is in the life cycle, requirement growth is not necessarily a bad thing.

During Phase A, the project moves from having no requirements to the formal definition of the

requirements culminating with the System Requirement Review (SRR). So naturally, there should be a

drastic increase in requirements. Also within phase A is the System Definition Review (SDR) at which the

architectures are presented. It is also expected that there may be additional requirements defined during

this part of the life-cycle phase.

As the project moves to Phase B and the Preliminary Design Review (PDR), the requirement growth or

velocity should be significantly slowed but realistically may see some small growth as the designs are

prototyped, gaps in the requirement set are found, unforeseen need for a requirement is identified, etc. As

the project moves into Phase C and the Critical Design Review (CDR) and the product design is finalized,

requirement growth should be very small. The later requirements are added to a project, the more difficult

they may be to enact and the more cost and schedule they may be adding. As the project completes Phase

9

C, culminating with the System Integration Review (SIR) and moves into Phase D, requirements growth

should be virtually zero. Adding significant requirements at this point will likely mean scrapping previously

designed parts and starting a redesign cycle.

3.1.2. Percent Requirement Growth Trend Description

This indicator provides insight into the growth trend of the program/project’s requirements and their

stability. Requirements growth, sometimes called “requirements creep,” can affect design, production,

operational utility, or supportability later in the life cycle. For each requirement added, there is a

corresponding cost of time and schedule involved for its handling, maintenance, and verification. The basic

question being answered by this indicator is “Is the program/project effort driving towards requirements

stability?”

Base measurement for this indicator is the total number of requirements in each of the program/project’s

requirement documents. The program/project first determines where all its requirements are located and

how far down within the product hierarchy the requirements will be tracked. For example, there may be

several layers of requirements as they flow down to systems, subsystems, elements, assemblies, and

components within the overall project. Some requirements will be the responsibility of the NASA

program/project team; some requirements may be the responsibility of a contractor or vendor. The

program/project will need to decide how far down it is practical to determine this metric. How far down

they will be tracking requirements should be part of the discussion in their Formulation Agreement and/or

Program/Project Plan on how they will provide this indicator.

Since most program/projects use a tool to help keep track of their requirements (Cradle, DOORS, Excel

spreadsheet, Word document, etc.), counting should be a simple matter of asking the application they are

being stored in how many there are or how many times the word “shall” appears in their document. This

can be automated in many cases. This assumes that the program/project is following good requirements

definition practices of only using “shalls” to define a requirement and that there is only one “shall” per

requirement. The practice of having one sentence with a “shall” to introduce a number of requirements

(e.g. “The product shall perform the following characteristics: a. Breathable atmosphere for 30 days b.

continuous pressure of 8.1 psia, etc.) is not used or if it is used that each of these obscured requirements is

numbered. A spreadsheet that keeps track of these measurements might be as shown in the first and

second column of Table 3-1 (the third column will be discussed in the next section). This would be a

representation for a snapshot of the number of requirements on a certain date. Other snapshots would be

taken periodically and results tracked over time.

10

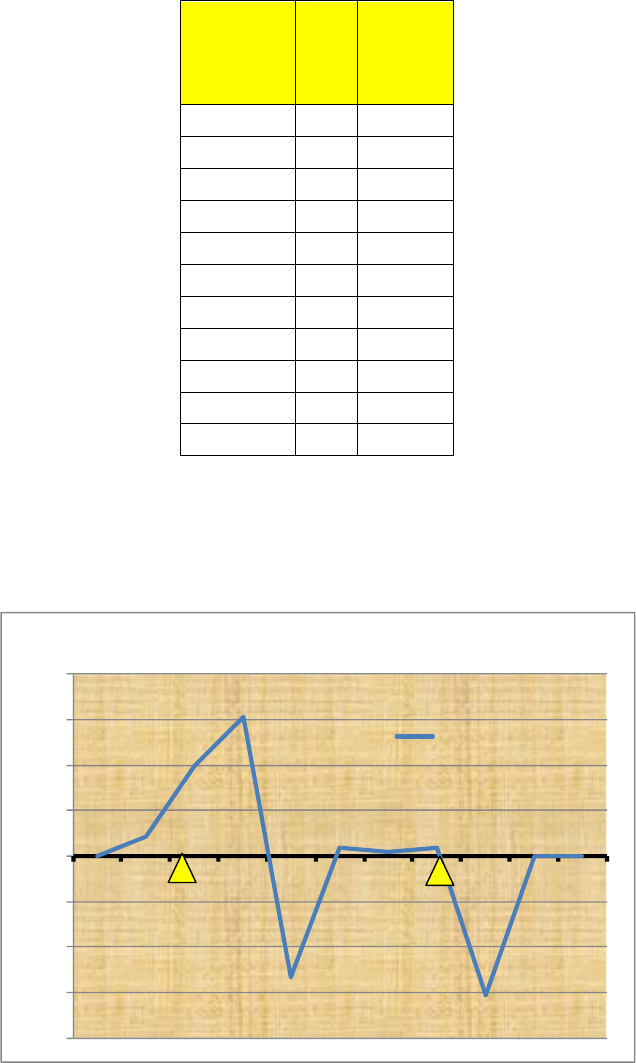

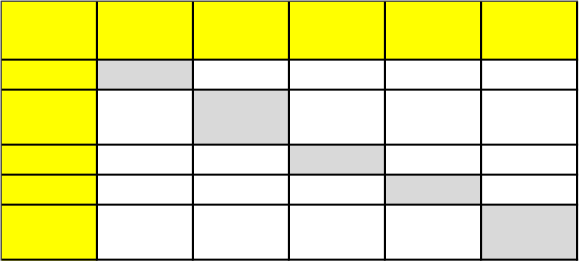

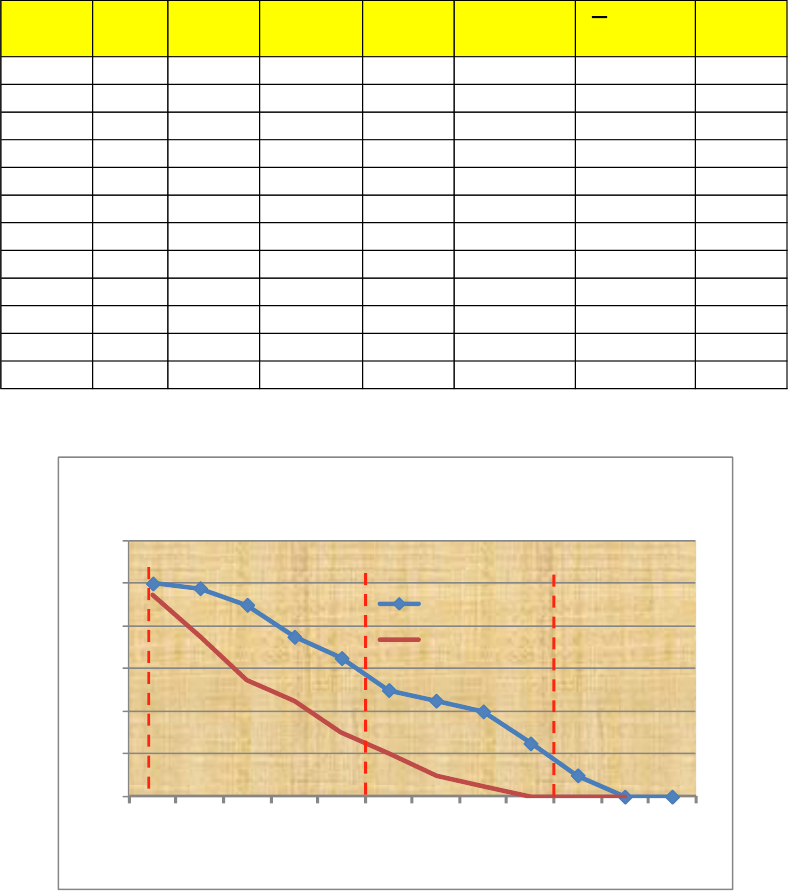

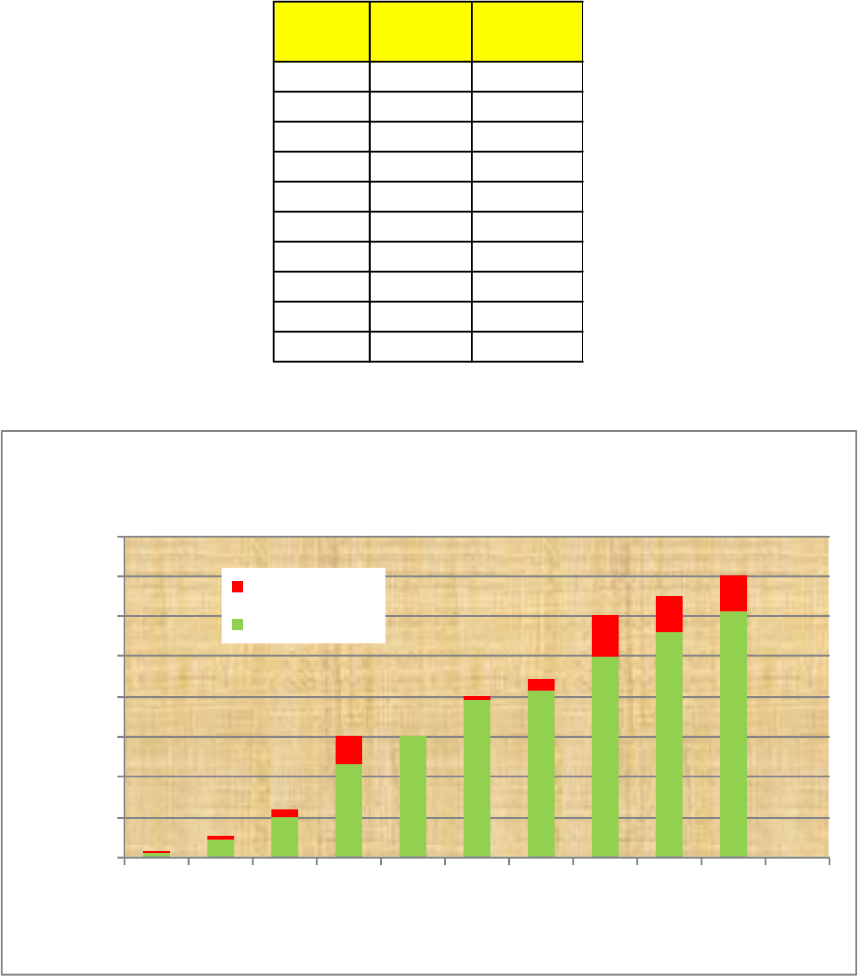

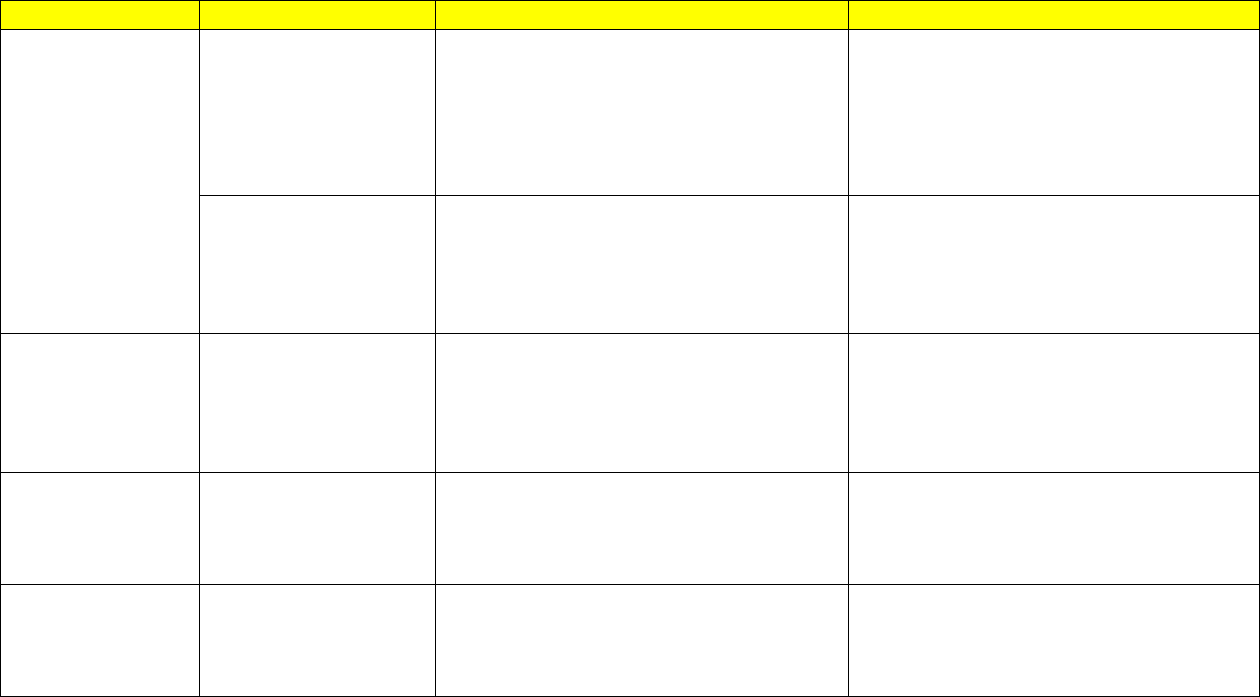

Table 3-1 Simple Snapshot Requirement Tracking Spreadsheet

The first column lists the documents within the project that contain requirements. The project has decided

to track requirements at the project, system, subsystem, and ICD level (more about ICDs will be discussed

in later sections). The second column captures what date the count was taken, and the third column

captures how many requirements were in the document at that date. This information would be taken

periodically at an interval that makes sense for the program/project. It must also be decided whether to

track the requirements at the individual document level and/or in total of all the documents. Again, this

strategy should be included in the Formulation Agreement or Program/Project Plan.

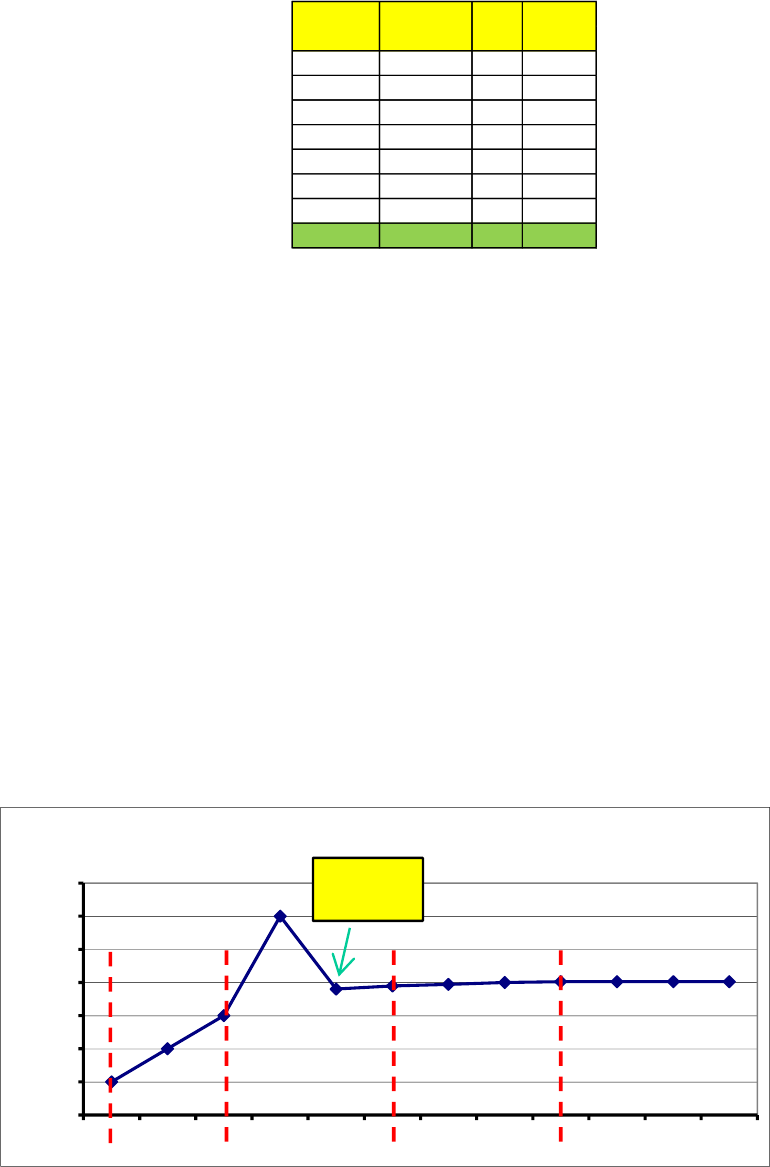

As these requirement snapshots are built up over time, they can then be tabularized and plotted. Figure 3-

1 is a simple plot of requirements using raw number of requirements—this could be per document or as a

total for the project. For this type of graph, it is not the raw number of requirements that is of interest

(large projects may have many requirements while small project may have few), it is the shape of the

curve that indicates how the number is growing or has become stable. It is useful to include notes about

unusual characteristics on the graph—in this case a requirement scrub activity was noted to bring the

number of requirements back into control. It is also good to put key milestones such as life-cycle reviews,

on the graph so that the data can be evaluated within context.

Figure 3-1 Simple Requirements Growth Plot – Raw Count

PRD xx/xx/xx 90

5

SRD xx/xx/xx 150

8

SSRD 1 xx/xx/xx 300

15

SSRD 2 xx/xx/xx 200

10

ICD 1 xx/xx/xx 25

5

ICD 2 xx/xx/xx 53

20

ICD 3 xx/xx/xx 16

3

Total 834

66

Document

Date

# Req

# TBD/

TBRs

Requirements Growth Trends

0

50

100

150

200

250

300

350

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Number of Requirements

SRR

PDR

CDR

SAR

SRD

Requirement

scrub

11

Another way of plotting this information is in the percentage of growth since the last measurement period.

Table 3-2 shows an example spreadsheet for the requirements within a single document, say SSRD1 from

the above spreadsheet.

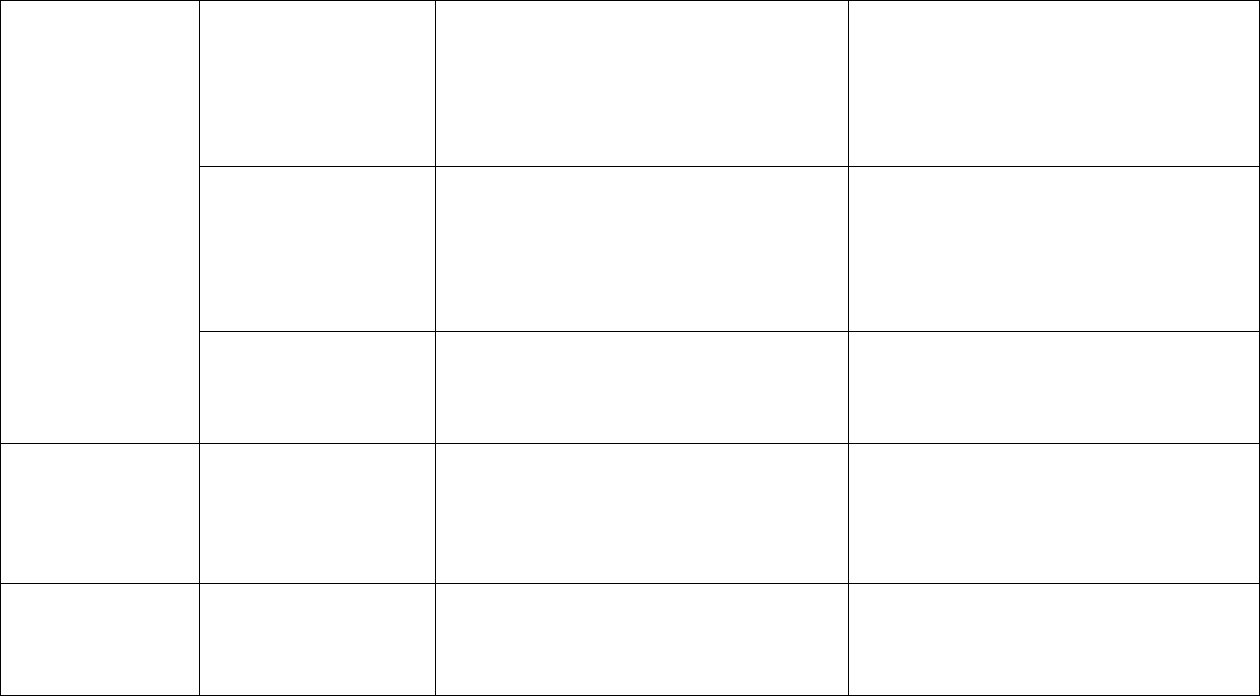

Table 3-2 Simple Spreadsheet for Percent Requirements Growth

Date

#

Req

% Req

Growth

2/1/2011

92

0%

3/1/2011

96

4%

4/1/2011

115

20%

5/1/2011

150

30%

6/1/2011

110

–27%

7/1/2011

112

2%

8/1/2011

113

1%

9/1/2011

115

2%

10/1/2011

80

–30%

11/1/2011

80

0%

12/1/2011

80

0%

The percent growth is calculated by subtracting the number of requirements on a date from those on its

previous date and dividing by the number of requirements on the previous date and then multiplying by

100 (e.g., (96-92)/92 x 100 = 4%). When plotted the data would look like Figure 3-2:

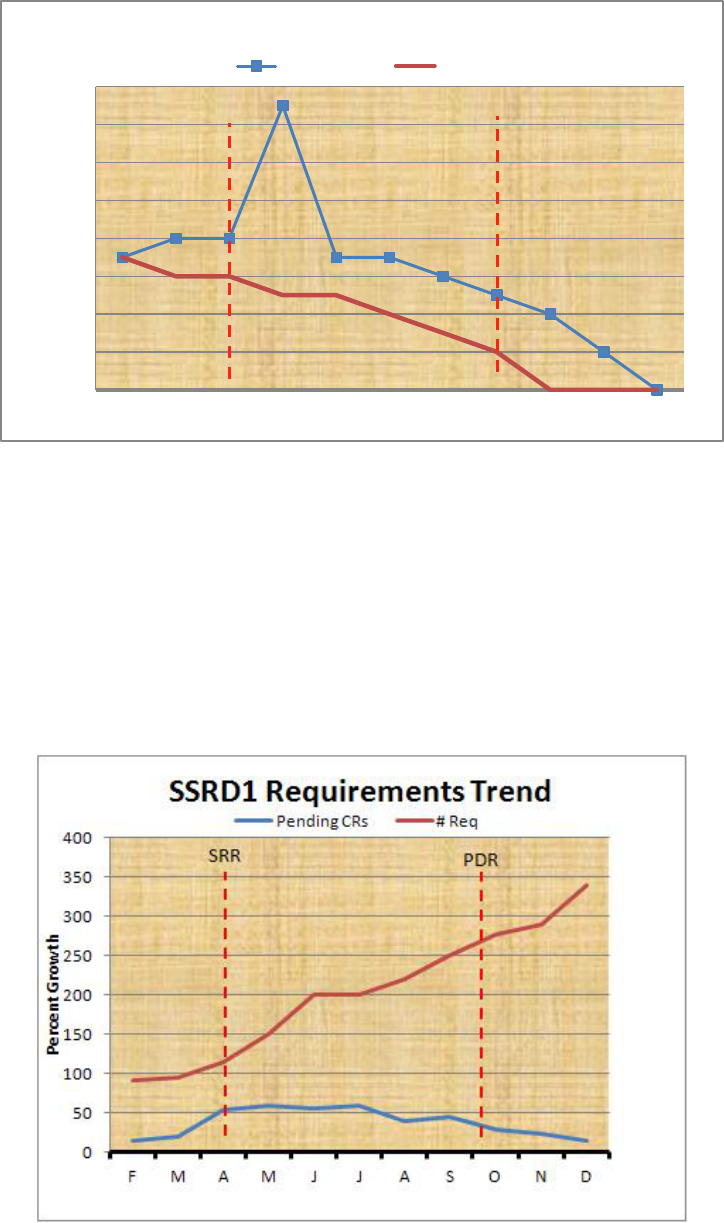

Figure 3-2 Simple Requirements Growth Plot

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

F

M

A

M

J

J

A

S

O

N

D

Requirements Growth

% Req Growth

SRR

PDR

12

As can be seen, the requirements were growing up through SRR as expected, but then continued to grow

thereafter. At some point a requirements scrub took place and so the requirements growth went negative

and then stabilized until just after PDR when some requirements were deleted and then remained stable

again.

So the question is—is this a “good” project or not? In the ideal model, requirements would grow through

SRR at which time all requirements would be perfectly defined and then growth would be zero thereafter.

In the real world, this rarely happens. As concepts are refined, designs deepened, and the realities of the

political and budgetary changes affect the projects, it is customary to see requirements grow and ebb.

After SRR, it is always desirable to keep requirements growth to a minimum, but some change is to be

expected. It is clear that in the project example shown in Figure 3-1, requirements have continued to grow

well after PDR. This should trigger a flag that a closer look at the requirements situation is warranted. This

might be completely explainable but at least the trend would indicate that more attention might need to

be paid to the situation. As historical data is gathered across multiple projects, guidelines or upper/lower

boundary conditions can be developed against which this data could be plotted. Some Centers or projects

may already have this type of boundary information available and if so, plotting against predictions or

plans would be very useful.

3.1.3. TBD/TBR Closures Trend Description

As noted in Table 3-1, another useful indicator is the number of “to be determined” (TBD) or “to be

resolved” (TBR) requirements within each document. TBDs/TBRs are used whenever the project knows

they need a requirement for some performance level but may not yet know exactly what that level is.

Typically, a TBD is used when the level has not been determined at all, whereas a TBR is used when a likely

level has been determined but further analysis or agreements need to be obtained before setting it

officially as the requirement level. Additional analysis, prototyping, or a more refined design may be

required before this final number can be set. As the project moves later in the life cycle, remaining

TBDs/TBRs hold the potential for significant impact to designs, verifications, manufacturing, and

operations and therefore present potentially significant impacts to performance, cost, and/or schedule.

Typically, this indicator is viewed as a “burndown” plot, usually against the planned rate of closures. An

Example is shown in Figure 3-3.

13

Figure 3-3 TBD/TBR Burndown

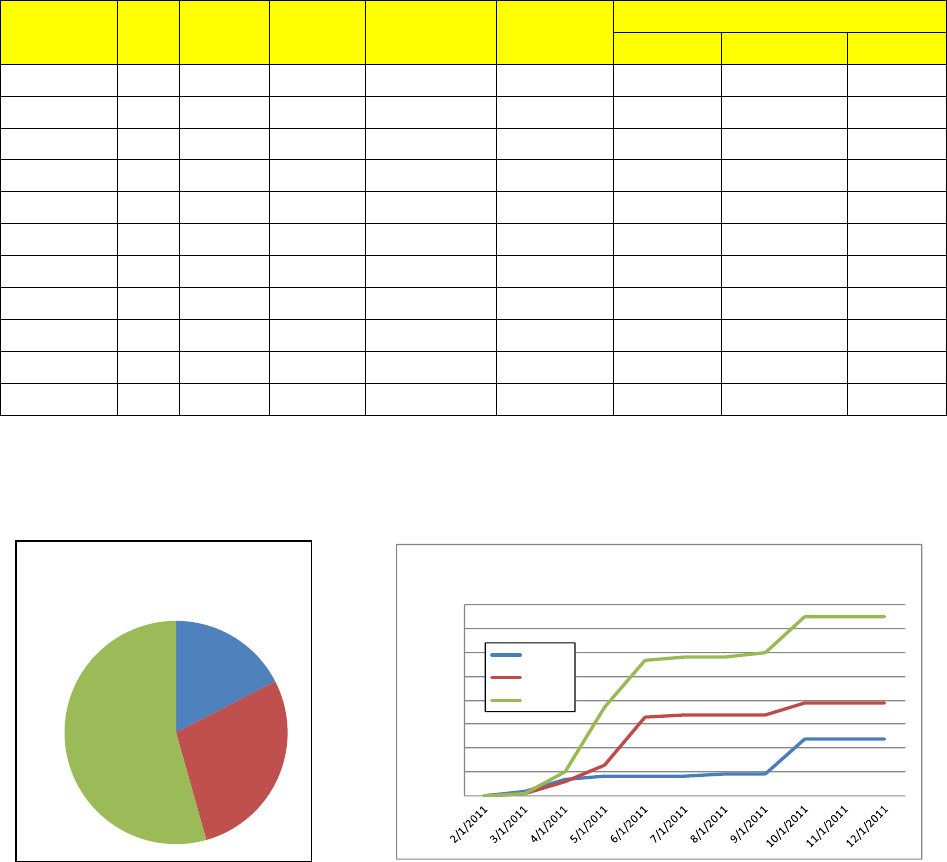

3.1.4. Number of Pending Requirement Changes Trend Description

In addition to the number of requirements that are already in the program/project documentation, there

are usually a number of potential changes that may be working their way through the requirements

management process. Keeping up with this bow wave of potential impacts is another way of analyzing the

requirements indicator trend. The number of pending change requests can be plotted along with the

previous requirement trend graphs as shown in Figure 3-4.

Figure 3-4 Pending Requirement Change Requests

0

2

4

6

8

10

12

14

16

F M A M J J A S O N D

Number TBD/TBRs

TBD/TBR Burndown

# TBD/ TBRs Plan

SRR

PDR

14

The program/project may elect to keep track of additional information. One useful indicator is the reason

for the change—is it a new requirement that is being driven by sources external to the project and

therefore not within their control? Is it driven by the customer adding new requirements and therefore

the customer should expect a potential increase in cost and/or schedule? On the other hand, is it a

requirement that the project just missed or did not realize they needed and therefore represents an

internal change that may need to be justified to the customer (especially if it involves a cost/schedule

increase)? Table 3-3 shows a more complete spreadsheet that keeps up with this rationale as well as the

previous spreadsheets for number of requirements, number of TBD/TBRs, and the percent growth

indications.

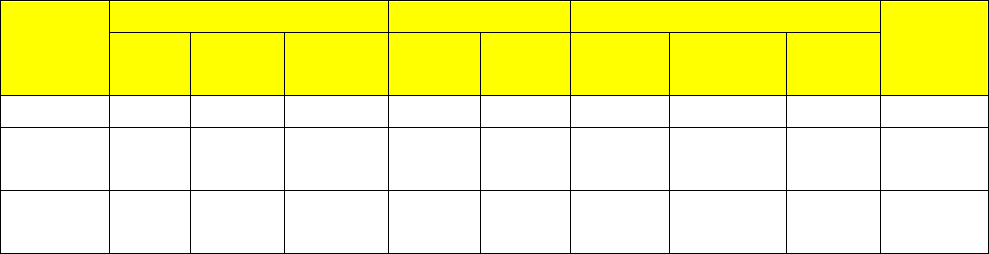

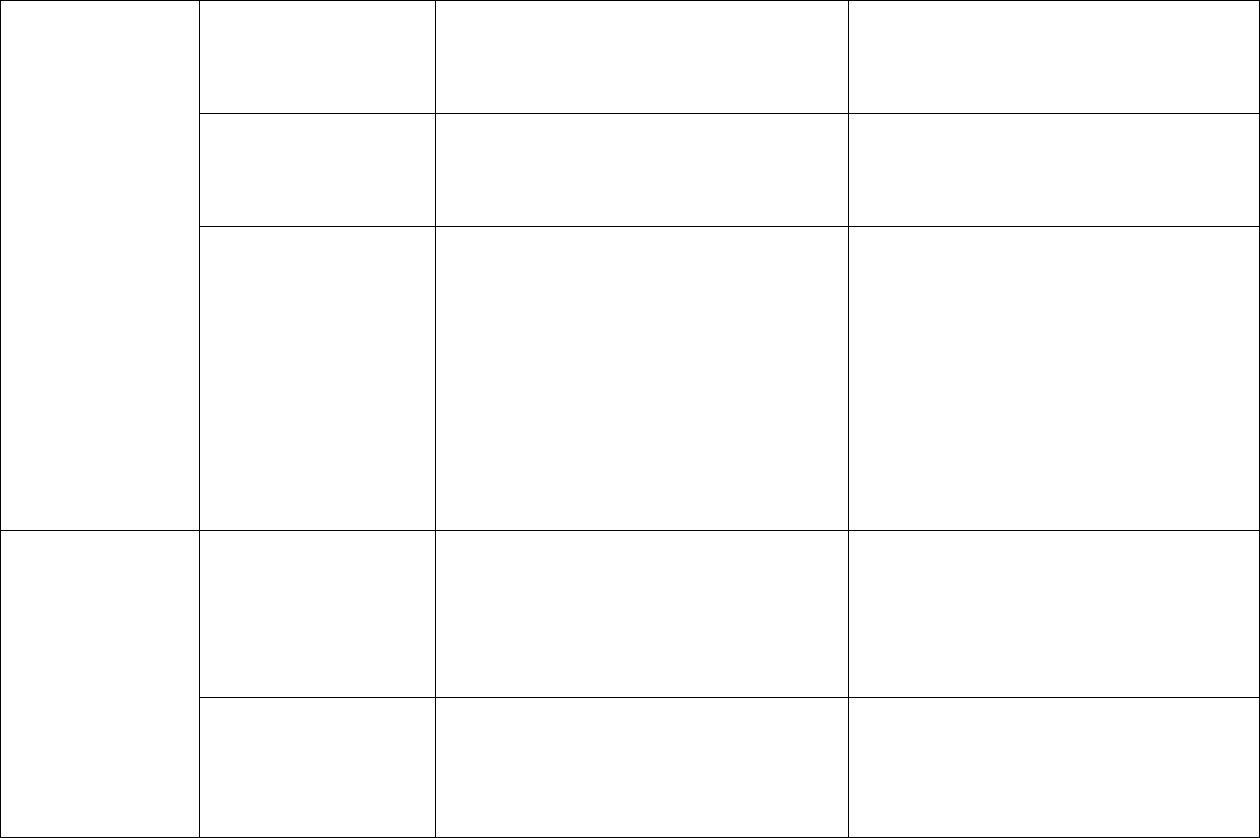

Table 3-3 Requirement Changes and Reason

Date

#

Req

# TBD/

TBRs

% Req

Growth

% TBD/TBR

Growth

No. Req

Changes

Reason

External

Customer

Internal

2/1/2011

92

7

0%

0%

0

0

0

0

3/1/2011

96

8

4%

14%

4

2

1

1

4/1/2011

115

8

20%

0%

19

5

5

9

5/1/2011

150

15

30%

88%

35

1

7

27

6/1/2011

110

7

– 27%

–53%

–40

0

20

20

7/1/2011

112

7

2%

0%

2

0

1

1

8/1/2011

113

6

1%

–14%

1

1

0

0

9/1/2011

115

5

2%

–17%

2

0

0

2

10/1/2011

80

4

–30%

–20%

–35

15

5

15

11/1/2011

80

2

0%

–50%

0

0

0

0

12/1/2011

80

0

0%

–100%

0

0

0

0

A snapshot plot of this information could be generated as shown in Figure 3-5 or a trend line graph

developed as shown in Figure 3-6. There are many ways to represent this information.

Figure 3-5 Change Source Snapshot Figure 3-6 Change Source Trend

External

18%

Customer

28%

Internal

54%

Req Growth Driver

0

10

20

30

40

50

60

70

80

No. Req Changes (Cum)

Requirement Change Source

Internal

Customer

External

15

Some projects may want to maintain additional information about each requirement change, such as the

cost and schedule impacts. Table 3-4 is an example of additional information that may be useful.

Table 3-4 Additional Data for Understanding Requirement Changes

Require-

ment

Req. Change

Impact

Reason

Status

Added

(New)

Deleted

Modified

Cost

Sched

External

Customer

Internal

SRD # 42

X

$3M

6 mo.

X

Approved

ICD 1004

Req. 14.1

X

– $90K

– 8 mo.

X

Pending

PRD

Req. 45

X

0

0

X

Approved

3.2. Interface Trends

This category of trends includes the percentage of ICDs that have been approved, the burndown of

TBDs/TBRs within those documents, and the number of interface change requests.

3.2.1. Why is the Leading Indicator Important?

This indicator is used to evaluate the trends related to growth, stability, and maturity of the definition of

system interfaces. It helps in evaluating the stability of the interfaces to understand the risks to other

activities later in the life cycle. Inadequate definition of the key interfaces in the early phases of the life

cycle can drastically affect the ability to integrate the product components in later phases and cause the

product to fail to fulfill its intended purpose. The longer these interfaces are left undefined, the more likely

problems will occur and therefore negative impacts to performance, cost, and schedule.

Interface requirements may be contained in various documents depending upon the program/project.

Some program/projects will define them at a high level in an Interface Requirements Document (IRD).

These may be taken by the subsequent engineering teams, (often a prime contractor, or vendor) to be

further detailed as an ICD. If a program/project is interfacing to a legacy system, they may be working to

what is often called a “one-sided ICD” or an Interface Definition Document (IDD). Other programs/projects

may put the high level and/or detailed interface requirements and agreements into other documents. For

simplicity, the term ICD will be used here, but it is intended to be whatever document(s) contain the

interface requirements and definitions for the program/project.

Note that the requirements within the interface documents as well as the number of requirement TBDs

and TBRs need to be included with the overall requirement trend as discussed in section 3.1.1. However,

the program/project may also choose to account for the interface-related requirements trends separately

16

from the non-interface related requirements due to their importance. How the accounting is made needs

to be clear in the Formulation Agreement and/or Program/Project Plan.

3.2.2. Percent ICDs Approved

The program/project will need to identify how many documented interfaces it needs both between

elements within their system as well as to the interfacing elements external to their product. Once the

total number of interface documents has been identified, this indicator will reflect trends in their approval.

One way of capturing where interfaces exist within a system, what kind of interfaces they are (bottom left

half) and where the interface definition and requirements are documented (upper right half) is shown in

Table 3-5.

Table 3-5 Example Matrix for the Identification of Interfaces for a Program/Project

Once the interfaces are determined, a program/project can track how many of them have been developed

and approved. For programs/projects with few interfaces, this can be done in a tabular form as shown in

Table 3-6 for example. Programs/projects with many interfaces may want to display the trend graphically

as shown in Figure 3-7.

ICDs Element 1 Element 2 Element 3 Element 4 Element 5

Element 1 ICD 1 ICD 2 ICD 3

Element 2

Data,

Fluid

Drawing 1

Element 3 Power None IDD 1

Element 4 None Data None

Element 5

Data,

Power

None

Fluid,

Power

None

17

Table 3-6 Example of Tabular Tracking of Interface Documents

Figure 3-7 Example Plot Trending Interface Documentation

3.2.3. ICD TBD/TBR Burndown

In addition to the requirements TBD/TBRs that are discussed in Section 3.1.3, there may be others within

the interface documentation. This indicator will track them. The program/project may elect to lump them

together with the requirement TBD/TBRs if desired. Similar tracking is done as for the requirement

# ICDs Planned Actual # Approved

# In

work

# Not Started

%

Approved

% In work

% Not

Started

2/1/2019

7 7 0 1 6 0% 14% 86%

3/1/2019

7 9 0 2 7 0% 22% 78%

4/1/2019

7 12 0 3 9 0% 25% 75%

5/1/2019

8 12 0 5 7 0% 42% 58%

6/1/2019

8 13 0 7 6 0% 54% 46%

7/1/2019

9 13 1 7 5 8% 54% 38%

8/1/2019

9 15 3 7 5 20% 47% 33%

9/1/2019

9 15 7 6 2 47% 40% 13%

10/1/2019

9 15 8 5 2 53% 33% 13%

11/1/2019

10 16 10 4 2 63% 25% 13%

12/1/2019

10 16 12 3 1 75% 19% 6%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

F

M

A

M

J

J

A

S

O

N

D

Number of ICDs

% Approved

% In work

% Not Started

18

TBD/TBRs in Section 3.1.3 and plotting the information can be made in several ways. A simple example is

shown in Figure 3-8.

Figure 3-8 Example ICD Non-Requirement TBD/TBR Burndown vs. Plan

3.2.4. Number of Interface Change Requests

Similar to the need to track requests for changes to the program/project requirements, tracking change

requests to the interface documentation is also an indication of a pending set of changes that might affect

the future performance, cost, and schedule. As these changes come later in the life cycle, they may affect

agreements or designs that have already started in the manufacturing process. Changes coming this late in

the life cycle can affect many organizations, requiring redesign, scrapping of parts, and recertification.

Like the requirements change requests discussed in Section 3.1.4, similar information may be gathered

about the interface change requests. For example, Table 3-7 shows an example of the information that

might be gathered. In addition, the cost or schedule impact and status of the requests also may be

gathered and plotted.

0

2

4

6

8

10

12

14

16

F

M

A

M

J

J

A

S

O

N

D

Number TBD/TBRs

ICD Non-Requiremnt TBD/TBR Burndown

# TBD/ TBRs

Plan

SRR

PDR

19

Table 3-7 Example Information for Interface Trending

3.3. Verification Trends

Verification of a program/project’s product is the proof of compliance with its requirements. This is done

through test, analysis, demonstration, or inspection. Each requirement will need to be verified through

one or more of these methods. This category includes two indicators: verification closure burndown and

the number of deviations/waivers requested as a result of the verification activities.

3.3.1. Why is the Leading Indicator important?

Tracking which requirements have and have not been verified can be accomplished through various means

as appropriate for the size and complexity of the program/project. Complex programs/projects may use a

tool such as CRADLE or DOORs, others may use spreadsheets or word documents. Whatever method is

chosen, it is important to know which requirements have been verified (i.e., “closed”) and which are still to

be verified (“open”). This can be indicated by flags or other indicators within a selected tracking tool, using

separate Verification Closure Notices (VCN), or other means chosen by the program/project.

Leaving verification closure too late in the life cycle increases the risk of not finding significant design issues

until the cost of correcting them is untenable. Often, this means additional cost and schedule to correct

the problems or having to work around the problems through more complex operational scenarios.

External Customer Internal

2/1/2011 15 7 0% 0% 0 0 0 0 7

3/1/2011 15 8 0% 14% 0 2 1 1 6

4/1/2011 20 12 33% 50% 5 5 5 9 6

5/1/2011 30 15 50% 25% 10 1 7 27 5

6/1/2011 50 12 67% -20% 20 0 20 20 5

7/1/2011 60 9 20% -25% 10 0 1 1 4

8/1/2011 62 6 3% -33% 2 1 0 0 3

9/1/2011 65 5 5% -17% 3 0 0 2 2

10/1/2011 80 4 23% -20% 15 15 5 15 0

11/1/2011 80 2 0% -50% 0 0 0 0 0

12/1/2011 80 2 0% 0% 0 0 0 0 0

Delta I/F

Date

# I/F

# TBD/

TBRs

%

Interfac

% TBD/TBR

Growth

Reason

Plan

20

3.3.2. Verification Closure Burndown

This indicator tracks the closure of the requirement verifications as an indication of project maturity and

stability. Table 3-8 is an example of the parameters a program/project may track over time. This

information can be displayed graphically as either numbers or percentages of open verifications. It is useful

to plot them against a predicted or planned rate of closure for better insight as shown in Figure 3-8.

Table 3-8 Example Matrix for Tracking Verification Closure Burndown

Figure 3-8 Example Plot of Verification Burndown

1/1/19 90

90 0 100% 90 100% 0

2/1/19 90

88 2 98% 85 94% 0

3/1/19 100

90 10 90% 75 75% 3

4/1/19 100

75 25 75% 55 55% 3

5/1/19 100

65 35 65% 45 45% 5

6/1/19 100

50 50 50% 30 30% 7

7/1/19 100

45 55 45% 20 20% 10

8/1/19 100

40 60 40% 10 10% 20

9/1/19 100 25 75 25% 5 5% 25

10/1/19 100 10 90 10% 0 0% 30

11/1/19 100 0 100 0% 0 0% 35

12/1/19 100 0 100 0% 0 0% 35

#

Waivers

# Planned

Open verif.

% Planned

Open verif.

Date

# Verif

open

verif.

Closed

verif.

% Open

verif.

0%

20%

40%

60%

80%

100%

120%

J

F

M

A

M

J

J

A

S

O

N

D

Percent of Open Verifications

% Open verif.

"Planned"

CDR

SIR

SAR

21

3.3.3. Number of Deviations/Waivers Approved/Open

A waiver or deviation is a documented agreement intentionally releasing a program/project from meeting

a requirement. The standard definition of a deviation is alleviating a program/project from a requirement

before the set of requirements are baselined and a waiver is after the requirements are baselined. Some

programs/projects make the distinction that a deviation is granted when the program/project is in the

Formulation Phases (Pre-Phase A, Phase A, Phase A or Phase B) and a waiver when in the Implementation

Phases (Phase C, D, E, or F). In either case, it is important to document and track both the approved and

pending requests. Increasing numbers of deviations/waivers may indicate potential issues later in the life

cycle as the product begins to vary from the set of requirements deemed necessary to satisfy the customer

and other stakeholders.

Table 3-9 is an example spreadsheet of how these indicators might be tracked. The program/project may

choose to gather and track other information about the waivers such as the reason, who submitted, cost if

not approved, etc.

Table 3-9 Example Tracking of Approved and Pending Waivers

This information also can be plotted against the verification closures to give a more complete picture of

the verification activities as shown in Figure 3-9. Figure 3-10 shows an example of another important

parameter to track—the number of waivers/deviations that have been requested but not yet

dispositioned (i.e., “pending”). This may represent a bow wave of waivers that could affect future cost and

schedules.

Date 1 90

90 0 0

Date 2 90

88 0 1

Date 3 100

90 3 3

Date 4 100

75 3 2

Date 5 100

65 5 4

Date 6 100

50 7 6

Date 7 100

45 10 14

Date 8 100

40 20 38

Date 9 100 25 25 35

Date 10 100 10 30 25

Date 11 100 0 35 15

Date 12 100 0 35 10

Date

# Verif

Open

Verif

#

Approved

Waivers

#

Waivers

Pending

22

Figure 3-9 Example Plot of Waivers Granted and Verification Burndown

Figure 3-10 Example of Waivers Approved and Pending

3.4. Review Trends

This indicator tracks the activities resulting from a life-cycle review. Depending on the program/project,

the items that are identified for further action by the reviewing body may be called Action Items (AI),

Requests for Action (RFA), Review Item Discrepancies (RID) or other nomenclature. Whatever they are

called, it is important to track their disposition and eventual closure. There is one indicator in this category:

RID/RFA/AI burndown per review

0

20

40

60

80

100

J

F

M

A

M

J

J

A

S

O

N

Number of Open Verifications

open verif.

Planned

"Waivers"

CDR

SIR

SAR

0

20

40

60

80

100

120

J

F

M

A

M

J

J

A

S

O

N

D

Number of Waivers

# Total Verifications

Open Verif.

Approved Waivers.

Pending Waivers.

23

3.4.1. Why is the Leading Indicator Important?

The purpose of a life-cycle review is to reveal the work of the program/project during that phase of the life

cycle to a wider audience so that any issues, problems, design deficiencies, clarification of interpretations

are presented and general buy-in by the stakeholders may be obtained. These comments (RFAs, RIDs, AI,

etc.) are usually gathered and then dispositioned in some way. Some comments may not be valid or may

be out of scope and so may be rejected. Some comments may be approved as is or modified in some way

that is acceptable to both the submitter and the program/project. Those that are approved will need to be

executed and the agreed-to work accomplished. At that point, the submittal is considered “closed.”

While closing some comments may need to wait for a key triggering activity, not closing review comments

in a timely manner may be pushing work off later and later in the life cycle where its implementation could

have a cost and schedule impact. Critical design issues may be dragging on, which could affect subsequent

design, manufacturing, testing, and/or operational activities. While some of these issues may be very

tough and contentious, it is always better to face them as early as possible and drive to an agreed-to

solution.

Note that another related indicator, life-cycle review date slippage, is addressed in the Schedule Trend

section with the life cycle being one of several key milestones. (See Section 4.2.)

3.4.2. RID/RFA/Action Item Burndown per Review

This indicator is required per NPR 7123.1. Table 3-10 shows an example spreadsheet that is tracking the

number of RID/RFA/AIs for a given life-cycle review. Note this measure is gathered periodically, in this case

quarterly, not just at the next life-cycle review. Trending works best if the measurements are taken

regularly.

24

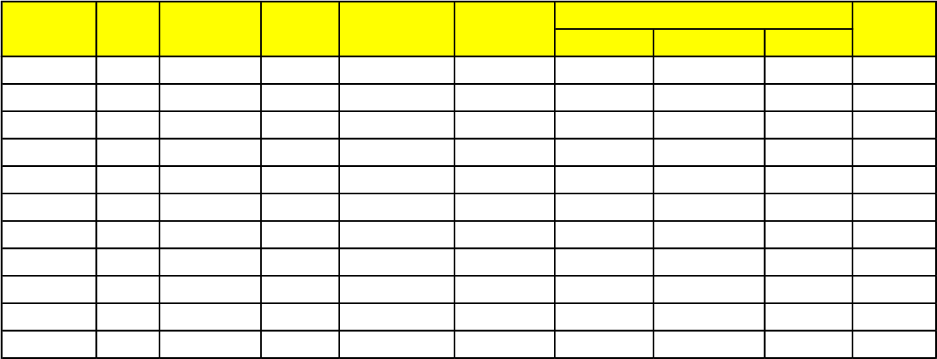

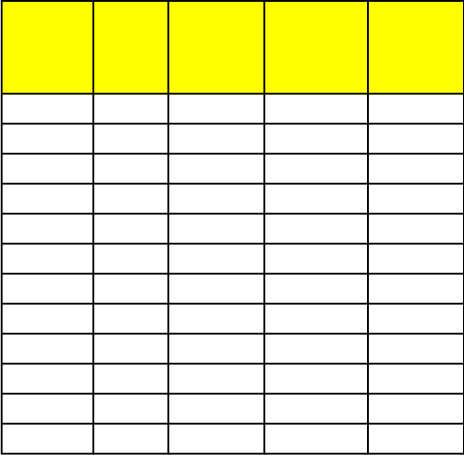

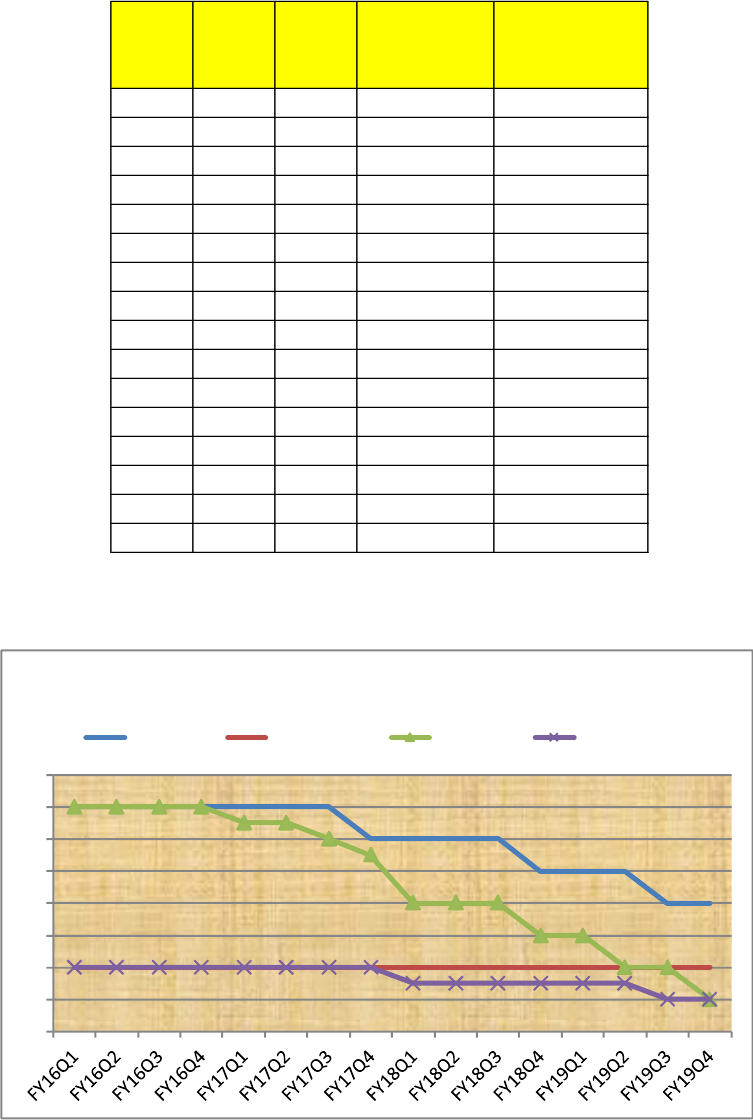

Table 3-10 Number of Open RFAs/RIDs/AIs per Review

This information perhaps can be better seen graphically. Figure 3-11 is an example.

Figure 3-11 Number of Open RFAs/RIDs/AIs per Review

Date MCR SRR PDR

Total 35 40 55

FY16Q1 30

FY16Q2 25

FY16Q3 20

FY16Q4 10 40

FY17Q1 5 30

FY17Q2 2 20

FY17Q3 0 15

FY17Q4 0 12 50

FY18Q1 10 45

FY18Q2 8 40

FY18Q3 6 30

FY18Q4 4 25

FY19Q1 2 20

FY19Q2 2 15

FY19Q3 2 12

FY19Q4 2 10

0

10

20

30

40

50

60

Number Open

Open RFA/RIDs/AI

MCR

SRR

PDR

25

3.5. Software-Unique Trends

Software metrics or indicators are used to measure some property of a piece of software—its

specifications, plans, or documentation. While Software Engineering has a rich history and large potential

selection of measures, the single software metric “Number of Requirements/Features per Build/Release

versus vs. Plan” continues the emphasis on requirements compliance measurement early in the

program/project life cycle when it can be of maximum benefit and cost-effectiveness.

3.5.1. Why is the Leading Indicator Important?

This measure is used to evaluate the trends in meeting the required characteristics or features of a specific

software build or release and the overall build/release development plan. Failure to meet the planned

features of a build or release may indicate the inability to support the required development, analysis,

verification, and testing of dependent hardware, software, or systems or of larger, more complex tasks

ahead. A common occurrence on software projects in trouble is inability to meet the requirements and

features of planned builds/releases and deferral of requirements and verifications to later builds/releases.

This metric reveals program/project risk in terms of rework, infeasible schedule, and deferred work to later

builds/releases. It can also mean several other things: the Program/Project may not have planned well

and does not have the productivity they expected; they may be having staffing problems and can't make

their schedules; some of the requirements may still be TBD or unclear or they may be having difficulty

implementing some of them; they could be waiting on hardware deliveries, etc.

3.5.2. Number of Requirements/Features per Build/Release vs. Plan

This metric/indicator provides a quantitative measure of the number of requirements or features in a build

vs. the number of requirements or features that were planned.

It is illustrated by counting the total number of requirements or features that were planned for each

build/release, counting the total number of requirements or features that were actually included in the

build/release, and then comparing the two to show how well the plan is being met by the development

effort. They can also be linked to major system or software milestones to suggest the overall impact to the

program/project/system.

A simple illustration of this is shown in Table 3-11.

26

Table 3-11, Table of Plan vs. Actual Requirements/Features by Build/Release

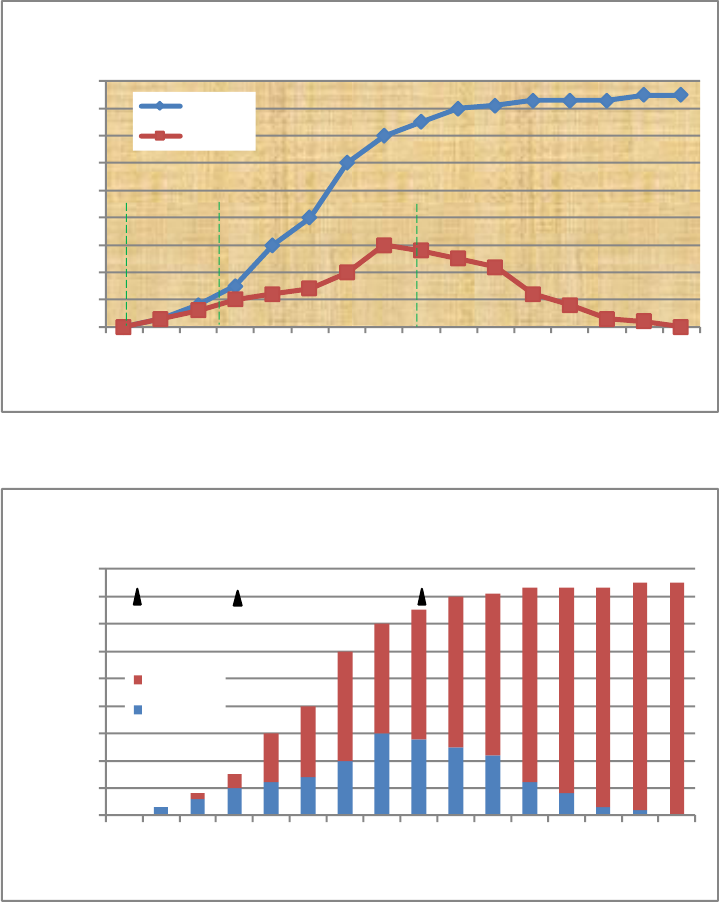

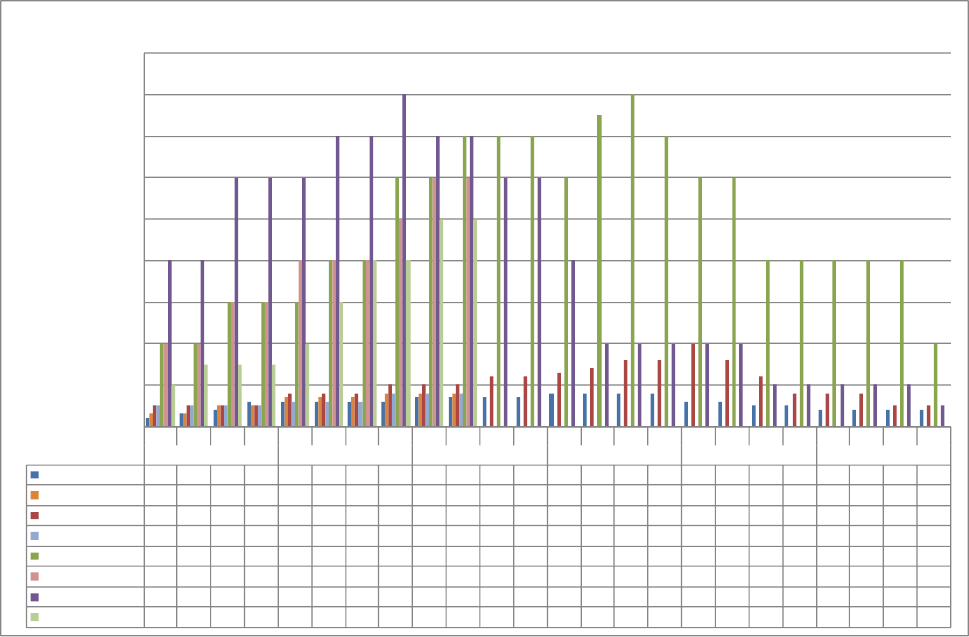

Another approach is a more graphic software build trend histogram illustrated in Figure 3-12.

Figure 3-12 Software Build Trend Histogram

Another method of displaying this indicator is shown in Figure 3-13, which links the parameter to

program/project milestones and build version numbers.

Build No.

# Planned

Features

# Features

in Build

0.5 15 10

1.0 50 45

1.1 120 100

1.2 300 230

1.3 300 300

1.4 400 389

1.5 440 415

2.0 600 500

2.1 650 560

3.0 700 610

5

5

20

70

0

11

25

100

90

90

0

100

200

300

400

500

600

700

800

0.5

1.0

1.1

1.2

1.3

1.4

1.5

2.0

2.1

3.0

No. Features

Build Version

SW Build Requirements

# Not Met

# Features in Build

27

Figure 3-13 Percent Features Met per Build Version

3.6. Problem Report/Discrepancy Report Trends

Programs and projects conduct verification, validation, and quality control activities during the

implementation life-cycle phases to ensure requirements and stakeholder expectations will be satisfied in

advance of launch or being sent into the field. Where possible and determined practical, these activities

are conducted in an environment as close to operational as possible, that exercise all the operational

modes and scenarios as fully as possible, and that use the actual flight procedures and databases that will

used during launch and operations. If during the conduct of these activities, the product fails to meet

requirements or accepted standards, the problem is captured, reported to program/project management,

and a corrective action or work around is developed. Depending on the Center, program, or project these

problem identifications may be called problem reports or discrepancy reports.

3.6.1. Why is the Leading Indicator Important?

The systems that are built by NASA are often complex; distributed across people, organizations, and

geography; implemented in multiple releases, builds, and patches; and affected by changes to baseline

requirements approved by a configuration change board during the implementation phases. This

demanding environment means that virtually no system is ever delivered without discrepancies, i.e.,

deviations from expected and/or required performance. The programs/projects are required to capture

these discrepancies and compile the information so corrective action can be documented. When

normalized against the project complexity, discrepancy reports can be used as a predictor of system

performance. This leading indicator is applicable to both hardware and software projects.

0%

20%

40%

60%

80%

100%

120%

0.5

1.0

1.1

1.2

1.3

1.4

1.5

2.0

2.1

3.0

Build Version

Percent Features Met per Build

PDR CDR SIR

28

In order to offer the most accurate predictor of future performance of the system being verified it is

important that the discrepancy process be applied across all parties involved. This means both government

and commercial suppliers should be required to participate in the process often requiring a single

synchronized reporting timeline be used. Additionally, supporting information intended to characterize a

discrepancy and document its history should be included in the regular reporting process.

3.6.2. Number of Discrepancy Reports (DRs) Open, Total Number of DRs

Depending on the specific project, there will be multiple types of discrepancy report information available

for evaluation. Projects are encouraged to use this information to improve visibility into the actual

condition of the system being developed. As a minimum, all projects should utilize a minimum of two data

types in their regular reporting process: 1) number DRs/Problem Reports (PRs) open and 2) total number

DRs/PRs.

This information is used to evaluate trends in the rate of closure and closure percentage of PRs and/or

DRs. Large deviations for the planned closures of DRs/PRs vs. the schedule defined at the start to address

them may be indicative of:

• Work not being completed as planned – in certain cases, the project team may be focused on

commitments to deliver new functionality and not have the resources to address DR

remediation in the workflow.

• Low quality of re-work – workmanship issues, problem parts, flawed fabrication steps are

examples of problem sources that will result in frequent re-work despite the best efforts of a

project to repair the problems the first time.

• Insufficient resources – Negative trends associated with DRs may be symptomatic of project

resources becoming strained. This may be due to incorrect assumptions regarding the

complexity of the solutions needed to resolve the problems; optimistic planning of workforce

levels or workforce skill mix used to address the discrepancies found plus new ones entering

the system; or insufficient resources (i.e., time and/or schedule) allotted for regression testing

of fixes before the DR can be closed.

Figures 3-14 and 3-15 illustrate report formats that could be used to track project DRs and PRs. In

preparing the specific format to be employed on the project, consider showing progress on closing PR/DRs

vs. time, indicating key life-cycle milestones for reference, and including descriptions of these key

milestones to ensure an accurate understanding across all stakeholders.

29

Figure 3- 14 DR/PR Closures Over Time

Figure 3-15 DR/PR Trend as Stacked Percentage

3.7. Technical Performance Measures

According to NPR 7123.1, TPMs are the set of critical or key performance parameters that are monitored

by comparing the current actual achievement of the parameters to that anticipated at the current time

and on future dates. They are used to confirm progress and identify deficiencies that might jeopardize

meeting system requirements. Assessed parameter values that fall outside an expected range around the

anticipated values indicate a need for evaluation and corrective action. There are two types of TPMs

discussed in this section: the required common TPMs of mass margin and power margin and the other

project unique TPMs (the selection of which will depend upon the type of product the program/project is

producing).

0

10

20

30

40

50

60

70

80

90

1/1/18

2/1/18

3/1/18

4/1/18

5/1/18

6/1/18

7/1/18

8/1/18

9/1/18

10/1/18

11/1/18

12/1/18

1/1/19

2/1/19

3/1/19

4/1/19

No. Discrepancies

Discrepancy Report Trend

Cum DRs

Open DRs

PDR CDR

SIR

0

10

20

30

40

50

60

70

80

90

1/1/18

2/1/18

3/1/18

4/1/18

5/1/18

6/1/18

7/1/18

8/1/18

9/1/18

10/1/18

11/1/18

12/1/18

1/1/19

2/1/19

3/1/19

4/1/19

No. Discrepancies

PR/DR Trend

Closed DRs

Open DRs

PDR

CDR

SIR

30

3.7.1. Why is the Leading Indicator Important?

TPMs help the program/project keep track of their most critical parameters. These parameters can

drastically affect the ability of the program/project to successfully provide the desired product. These

indicators are usually shown along with upper and/or lower tolerance bands, requirement levels, and

perhaps stretch goal indications. When a parameter goes outside of the tolerance bands, more attention

may be required by the program/project to understand what is happening with that indicator and to

determine if corrective action is warranted.

While there are a number of possible parameters that could be tracked in a project, selecting a small set of

succinct TPMS that accurately reflect key parameters or risk factors, are readily measurable, and that can

be affected by altering design decisions will make the most effective use of resources. Some TPMs may

apply to the entire program/project, such as mass and power margins; some parameters may apply only to

certain systems or subsystems. The overall set of TPMs that the program/project will be tracking should be

documented in the Formulation Agreement and Program/Project Plan.

3.7.2. Mass Margin and Power Margin

These two indicators are required per NPR 7123.1. For most programs/projects that produce a product

that is intended to fly into space, mass and power consumption are critical parameters and are therefore

considered a common Technical Leading Indicator. Programs/projects may choose to track raw mass and

power, but perhaps a more informative indication is that of mass or power margins. As the concepts are

fleshed out, a determination of how much a given launch vehicle can provide lift to the desired

orbit/destination will be determined. This in turn will place limits on the products that the

program/projects may be providing. Availability of solar, nuclear, battery, or other power sources will also

place a limit on how much power the various systems may consume. These parameters will be flowed

down and allocated to the subsequent systems, subsystems, and components within the

program/project’s product. Tracking the ability of the overall product and its lower level components to

accomplish their mass and power goals becomes critical to ensure the success of the program/project.

How far down into the product hierarchy that the program/project decides to track these parameters is

left up to the program/project.

Table 3-12 is an example of a spreadsheet that tracks the mass margin of a product. The margins are

estimated prior to the actual manufacturing of the product and measured after it is produced. When

reporting at the overall program/project level, the parameter may be a combination of estimates for

subsystems/components that have not yet been produced and measured mass of those that have been

produced. A similar spreadsheet can be developed for power margins.

31

Table 3-12 Example Spreadsheet for Tracking Mass Margin

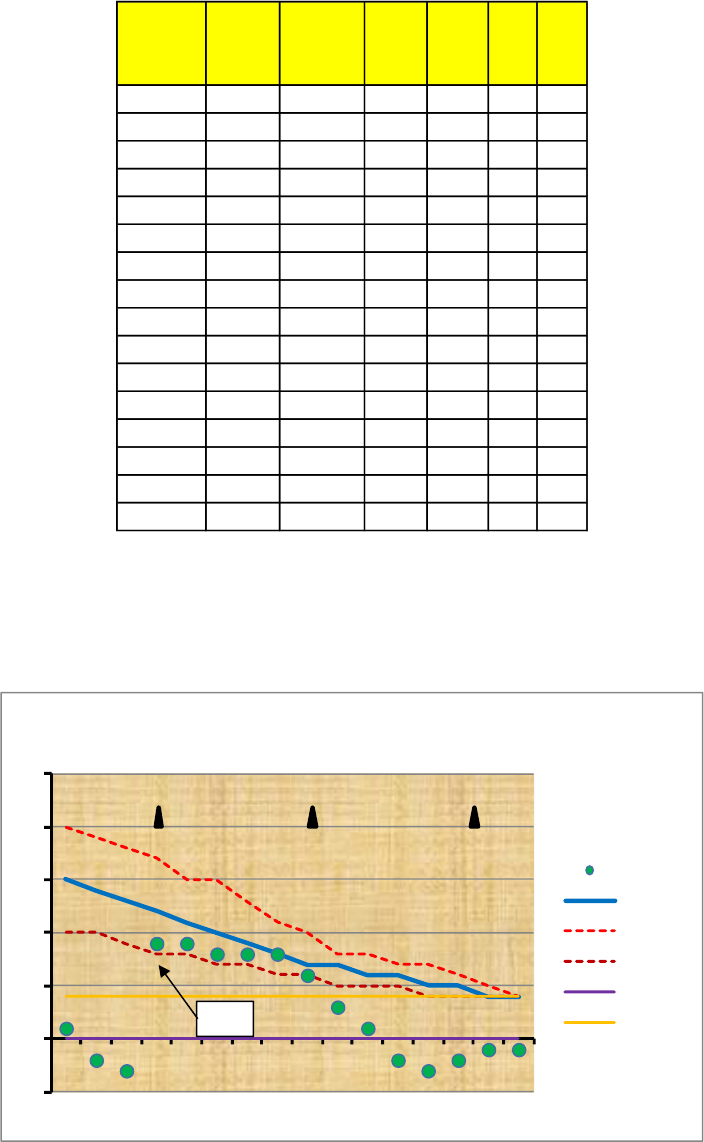

Perhaps a more effective way of displaying power or mass margin TPMs is graphically. Figure 3-16 is an

example of displaying the mass margins for a particular program/project. A similar plot can be developed

for power margin TPM.

Figure 3-16 Example Plot for Mass Margin Indicator

Date

Mass

Margin

Planned

Margin

Upper

Tol

Lower

Tol

Req. Goal

1/1/11 1 15 20 10 0 4

2/1/11 -2 14 19 10 0 4

3/1/11 -3 13 18 9 0 4

4/1/11 9 12 17 8 0 4

5/1/11 9 11 15 8 0 4

6/1/11 8 10 15 7 0 4

7/1/11 8 9 13 7 0 4

8/1/11 8 8 11 6 0 4

9/1/11 6 7 10 6 0 4

10/1/11 3 7 8 5 0 4

11/1/11 1 6 8 5 0 4

12/1/11 -2 6 7 5 0 4

1/1/2012 -3 5 7 4 0 4

2/1/2012 -2 5 6 4 0 4

3/1/2012 -1 4 5 4 0 4

4/1/2012 -1 4 4 4 0 4

-5

0

5

10

15

20

25

J

F

M

A

M

J

J

A

S

O

N

D

J

F

M

A

Mass Margin TPM

Mass

Planned

Upper Tol

Lower Tol

Req.

Goal

PDR

CDR

SIR

Mass

Scrub

32

3.7.3. Project-Unique TPMs

In addition to Common Leading Indicators, a program/project may need to identify other TPMs that are

unique to the particular type of program/project that is being conducted. For example, if the project is

avionics based, additional performance parameters such as bandwidth, pointing accuracy, and memory

usage may be important to track in order to ensure that the project is meeting its design requirements.

However, if the project is more mechanically based, these parameters may not be important/applicable,

but others such as stress, envelope size, or actuator force may be. There are many parameters that a

project can and will measure at some level. TPMs should be that selected subset that most affect the

design or performance of the program/project and should be tied to the Measures of Effectiveness and

Measures of Performance as described in NPR 7123.1 and NASA/SP-2007-6105, NASA Systems Engineering

Handbook.

Table 3-13 is an example of some other TPMs that the program/project may consider. The specific project

unique TPMs that the program/project decides to use should be documented in the Formulation

Agreement and the Program/Project Plan and/or the Systems Engineering Management Plan.

Table 3-13 Example Project-Unique TPMs

3.8. Manufacturing Trends

Manufacturing trends are intended to provide quantifiable evidence of potential technical problems,

monitor performance, and reveal the most important problems that affect a system that could

substantially affect cost, schedule, and quality and threaten a project’s success. During manufacturing,

nonconformances are typically documented and resolved using a Materials Review Board (MRB) process,

or its equivalent. Once non-conforming material or parts (items that fail inspection, i.e., are rejected) have

been identified, the MRB reviews them and determines whether the material or parts should be returned,

reworked/repaired, used “as is,” or scrapped. The MRB also identifies potential corrective actions for

implementation that would prevent future discrepancies.

Pointing error Database Size RF Link Margin

Data Storage Lines of code Torque Factor

Throughput Thrust Strength Factor

Memory available Time to restore Cooling capacity

Speed Fault Tolerance Range

Reliability Utilization MTBF

Human Factors Pointing Accuracy Specific Impulse

Response time Jitter Other Margins

Availability Propellant Control stability

Example Project-Unique TPMs

33

3.8.1. Why is the Leading Indicator Important?

Leading indicators are important so the manufacturing discipline can conduct analysis and trending on

component and system requirements, materials, controlled/critical processes, and production problems.

At the manufacturing stage of the life cycle, problems can quickly become critical path schedule drivers

with accompanying adverse cost impacts. Early warning indicators are needed to provide triggers for

project risk mitigation decisions. For example, a pattern of frequent inspection failures of a particular

vendor’s printed circuit boards might indicate a need to investigate and correct root cause(s) or change

vendors. A trend showing a high number of scrapped weldments might be the result of an inadequate

weld schedule. Such problems can slow down or even bring production work to a halt. Finding and

qualifying a new printed circuit board vendor or going back into research and development to tighten up a

weld schedule could impose serious cost and schedule penalties.

3.8.2. Number of MRB Non-conformance/Corrective Actions

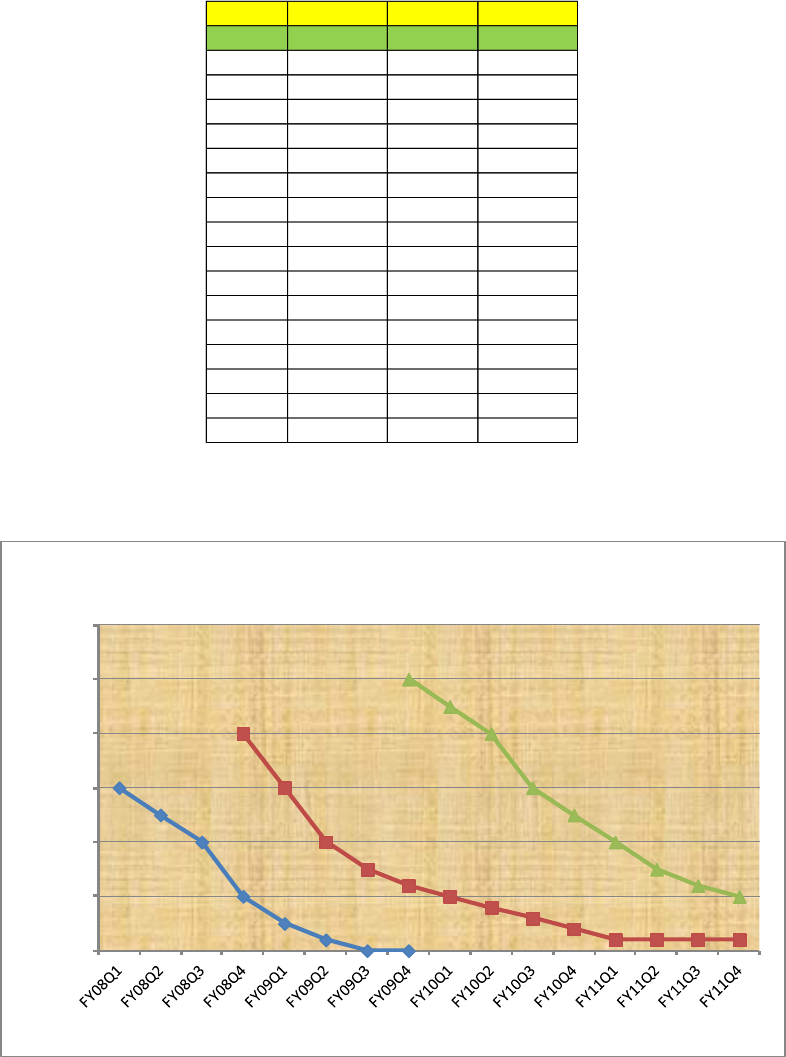

The program/project should establish a measure of nonconformances as a function of time. Figure 3-17

shows an example of how this can be depicted. In this case, “units” could refer to piece parts of an

assembly or subassembly item.

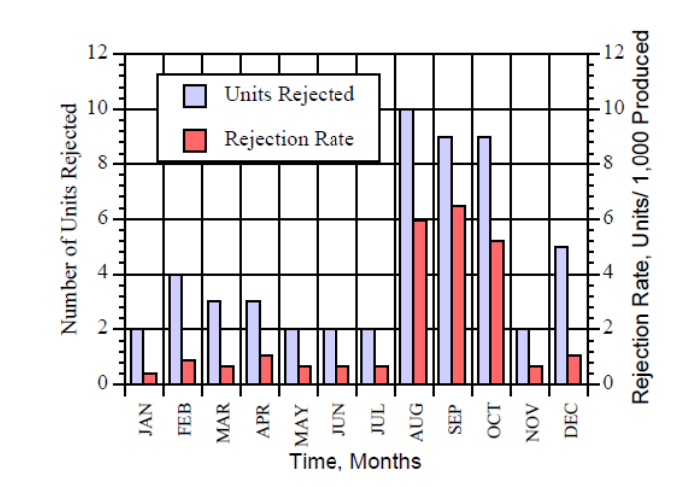

Figure 3-17 Parts Rejection Rate over Time

Programs/projects should compare such information against production schedules. For example, the

number of rejected units should be assessed against both the actual and planned number of items in

manufacturing using the same time scale as the nonconformance metric. Trends in performance can be

identified by observing the percentages of non-conformances over time, looking for increases or

decreases.

34

The number of corrective actions initiated and implemented over time will provide an indication of the

health of the corrective action system. Measuring the initiation of corrective actions shows the quality

system’s sensitivity to deficiencies. Measuring implemented corrective actions and comparing them with

trends in non-conformances post-implementation would be an indicator of the effectiveness of the overall

manufacturing, quality control, and supply chain systems and risks.

35

Programmatic Leading Indicators

Like Technical Leading Indicators, Programmatic Leading Indicators are intended to provide program and

project personnel and Agency leaders with insight into cost, schedule, and staffing performance trends.

Sustained underperformance in these areas can result in project or program failure to meet internal or

external programmatic commitments. The indicators recommended here are intended to supplement

other reporting conventions and requirements that may be specified by other functional or programmatic

authorities.

4.1. Cost Trends

This category is intended to provide a longer temporal perspective than is sometimes provided in reporting

required by the owner of the cost function.

4.1.1. Why is the Leading Indicator Important?

Living within the internal and external cost commitments is becoming increasingly important. Stakeholders

are requiring more stringent cost and schedule control for projects. Since cost and schedule are so tightly

correlated, schedule growth frequently translates into cost growth. The earlier that cost and schedule

issues can be identified and addressed, the less the impact to total cost. With more effective cost and

schedule management, NASA can maximize the return on its investment of taxpayer resources.

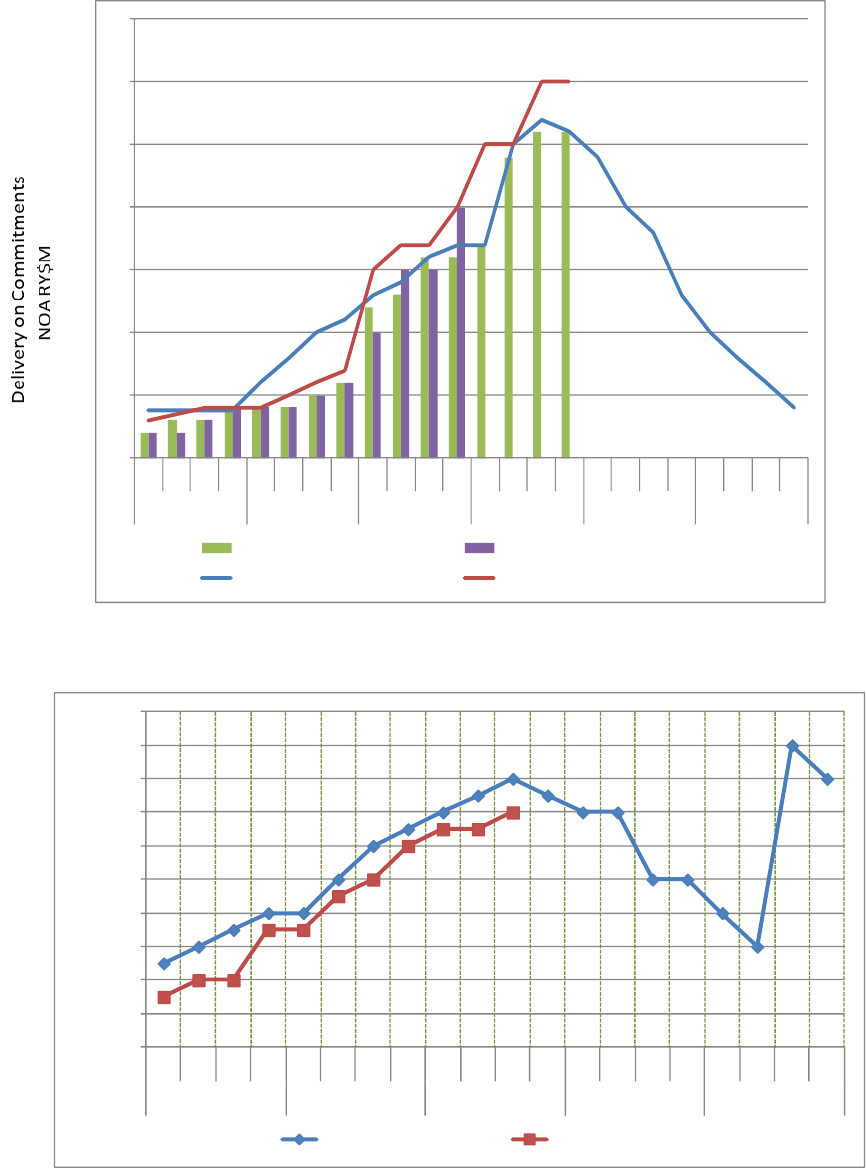

4.1.2. Plan vs. Actual

Tracking the performance of actuals against the plan enables recognition of the potential impacts of

delayed receipt of funds and the effects of spending above or below the plan. Since most Centers,

programs, and project organizations will have preferred formats for tracking the cost and obligations

performance for the current year (year of execution), the leading indicator here proposes to track the

quarterly performance in obligations against multi-year plans for New Obligations Authority in both the

Agency Baseline Commitment (ABC) and the project Management Agreement as well as a multi-year cost

plan for the project. Analyzing current project Estimate at Completion (EAC) and life-cycle cost plans will

enable more immediate identification of potential issues that could affect the overall ABC. By monitoring

the extent to which either the Agency or project is unable to realize the basis for their commitments,

management will be encouraged to consider whether an adjustment in the agreements and recalculation

of confidence levels should be pursued.

The addition of quarterly reporting of actual costs against a multi-year cost plan will enable management

to regularly monitor any trends of ongoing expenditures, either in excess or below the plans that are tied

to the internal and external cost and schedule commitments. This perspective is often not regularly

reported in monthly project status reports.

As with the other leading indicators, the data may be displayed in either tabular or graphical form.

Examples are shown below.

36

Figure 4-1 Management Agreement and ABC Plan vs. Actual

Figure 4-2 Commitment Cost Plan vs. Actual

0

5

10

15

20

25

30

35

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

FY09

FY10

FY11

FY12

FY13

FY14

Project Management Agreement

Management Agreement Realization

Agency Baseline Commitment

Realization

0

10

20

30

40

50

60

70

80

90

100

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

FY09

FY10

FY11

FY12

FY13

RY$M Cost

Commitment Cost Plan

Actual Costs

37

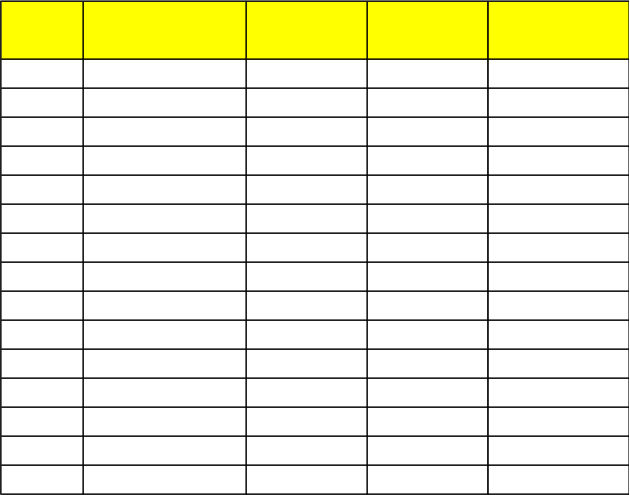

Table 4-1 Spreadsheet Example for Capturing Plan vs. Actual Measures

4.1.3. UFE

Measuring the use of cost margins—Unallocated Future Expenses (UFE)—against a plan enables

evaluation of time-phased releases in the context of the planned life-cycle activities and identified risks.

Utilization of UFE ahead of the anticipated needs and phasing may signal threats to the life-cycle cost

estimates or schedules, as it may indicate that identified risk mitigation needs have been underscoped,

that unidentified risks are being realized, that scope has been added, or baseline costs underestimated.

UFE plans and actuals should be measured for both project-managed and Agency-managed UFE.

Multi-year plans should incorporate local guidance or rules of thumb, and reporting should note reasons

for major releases or expenditures. Reporting may be done in either tabular or graphical form, as

illustrated in the examples below.

Plan Actual Plan Actual Plan Actual

FY16Q1 $100 $10 $80 $8 $20 $5

FY16Q2 $100 $40 $80 $35 $40 $30

FY16Q3 $100 $60 $80 $55 $60 $50

FY16Q4 $100 $100 $80 $80 $80 $65

FY17Q1 $200 $30 $170 $25 $30 $15

FY17Q2 $200 $60 $170 $55 $60 $40

FY17Q3 $200 $120 $170 $110 $130 $90

FY17Q4 $200 $200 $170 $170 $170 $150

FY18Q1 $300 $100 $270 $90 $50 $45

FY18Q2 $300 $300 $270 $200 $120 $115

FY18Q3 $300 $300 $270 $270 $220 $250

FY18Q4 $300 $300 $270 $270 $270 $275

FY19Q1 $200 $50 $180 $45 $40 $35

FY19Q2 $200 $100 $180 $90 $80 $75

FY19Q3 $200 $150 $180 $140 $150 $130

FY19Q4 $200 $180 $180 $180 $180 $180

Note: $M. Amounts are cumulative per year

Date

Cost

Mgmt Agreement

ABC NOA

38

Table 4-2 Example Spreadsheet for Project and Agency UFE Usage

Figure 4-3 UFE Burndown with Life-Cycle Review Notations

Date

PM UFE

Plan

Agency

UFE

Plan

PM UFE ($M)

Agency UFE

($M)

FY16Q1 70 20 $70 $20

FY16Q2 70 20 $70 $20

FY16Q3 70 20 $70 $20

FY16Q4 70 20 $70 $20

FY17Q1 70 20 $65 $20

FY17Q2 70 20 $65 $20

FY17Q3 70 20 $60 $20

FY17Q4 60 20 $55 $20

FY18Q1 60 20 $40 $15

FY18Q2 60 20 $40 $15

FY18Q3 60 20 $40 $15

FY18Q4 50 20 $30 $15

FY19Q1 50 20 $30 $15

FY19Q2 50 20 $20 $15

FY19Q3 40 20 $20 $10

FY19Q4 40 20 $10 $10

0

10

20

30

40

50

60

70

80

UFE Burndown($M)

PM UFE Plan Agency UFE Plan PM UFE ($M) Agency UFE ($M)

39

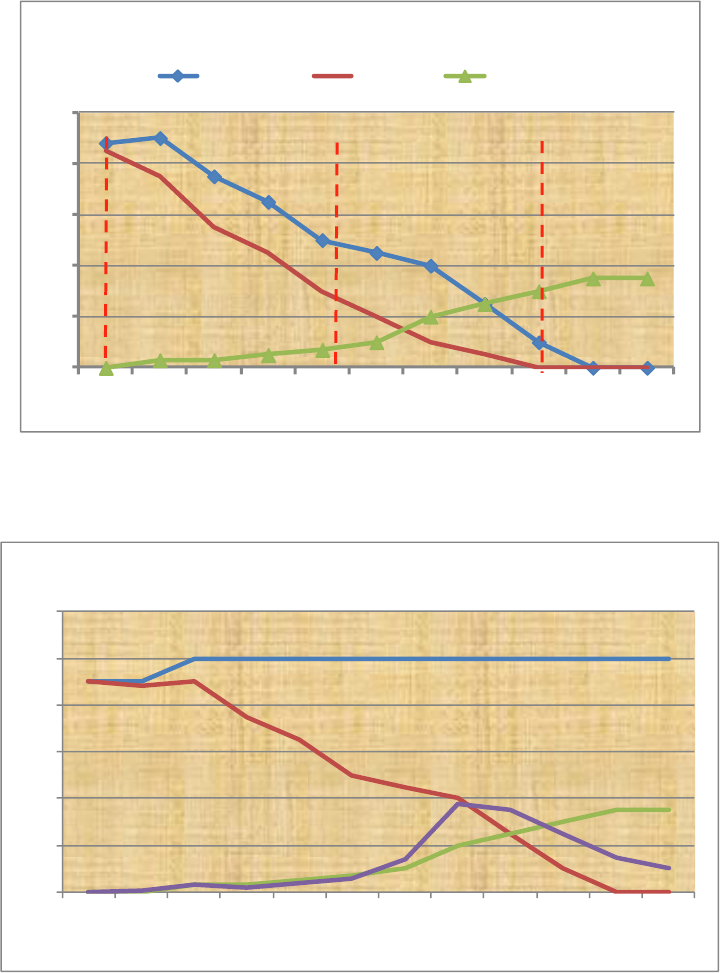

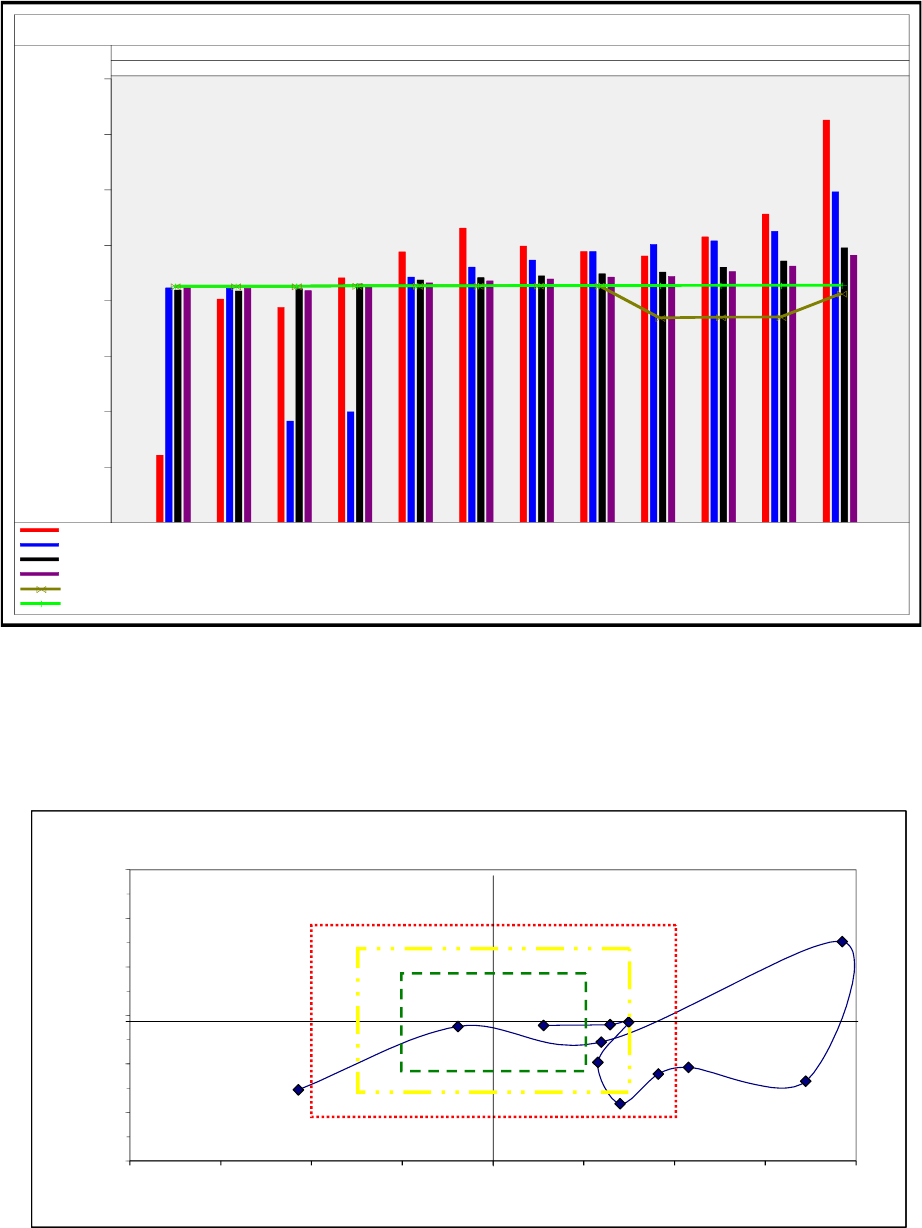

4.1.4. EVM

Earned Value Management (EVM) is one of the recognized methods of measuring integrated cost and

schedule performance against a plan. Based on the recorded performance to date, EVM will identify

variances, help identify trends, and predict resulting changes in the schedule and Estimate at Completion

(EAC). Traditionally reserved for application on contracts, NASA has extended EVM application to the

project level, taking in the integrated performance on multiple contracts and civil service efforts.

EVM establishes a baseline for measuring progress. That is, accomplishment (also known as Budgeted Cost

of Work Performed (BCWP) is compared to the Actual Cost of Work Performed (ACWP) to determine cost

variances and compared to the Budgeted Cost of Work Scheduled (BWCS) to identify schedule variances.

Additionally, the Cost Performance Index (CPI) and Schedule Performance Index (SPI) can be generated

from the Earned Value Measurement System. As shown in Figure 4-5, A CPI >1 indicates the project is

under-running costs, whereas a CPI<1 indicates an over-run. Likewise, a SPI >1 indicates the project is

ahead of schedule and an SPI <1 indicates being behind schedule. The EVMS provides trend analyses and

can generate a mathematical EAC, which can be compared to the Budgeted Estimate at Completion (BAC).

Several software packages (e.g., wInsight) will generate a series of mathematical EACs that can provide the

project with an estimated range of EAC possibilities based on trend information.

The graph below illustrates a trend analysis of the EAC, CPI, SPI, and the available/planned BAC. Although

the display below is an example of a contractor report and limited to a one-year period, the reported

elements are those intended for application at the project level. Reporting across multiple years is

expected. Early in the project, level of effort tasks can dominate and effectively cancel out useful reporting

on other elements, so if it is possible it is most desirable to report the results both with and without the

Level of Effort (LOE) elements.

40

Figure 4-4 Example Plot of EVM Parameters

The display below provides more insight into the variation of the CPI and SPI over time and the “bullseye”

provides at a glance interpretation of the performance.

Figure 4-5 EVM CPI vs. SPI Bullseye Chart Example

800

900

1,000

1,100

1,200

1,300

1,400

1,500

2007

OCT NOV DEC

2008

JAN FEB M AR APR M AY JUN JUL AU G SEP

Northrop Grumman Ship Systems N00024-04-2204 FPIF PROD

Element: 00000000 Name: Project LevelEAC / BAC

Dollars in Millions

CPI 3p Ave 1,4251,2551,2141,1791,1881,1981,2301,1871,1401,0871,102821

CPI 6p Ave 1,2951,2241,2071,2011,1881,1721,1601,1428998821,1211,122

CPI SPI 1,1941,1711,1591,1501,1481,1441,1411,1361,1291,1211,1171,118

CUM CPI 1,1811,1611,1511,1431,1421,1381,1351,1311,1261,1171,1211,122

K EAC 1,1121,0701,0691,0681,1261,1261,1261,1261,1261,1251,1251,125

BAC 1,1271,1271,1271,1261,1261,1261,1261,1261,1261,1251,1251,125

Cost/Schedule Performace

0.70

0.80

0.90

1.00

1.10

1.20

1.30

0.60 0.70 0.80 0.90 1.00 1.10 1.20 1.30 1.40

CPI

SPI

ANALYZE COST & SCHEDULE

CONSIDER RE-BASELINING

FAIR PLANNING &

PERFORMANCE

EXCELLENT PLANNING

&

PERFORMANCE

Nov

Dec

May

Jul

Jun

Apr

Oct

Over-running Costs

Ahead of Schedule

Over-running Costs

BehindSchedule

Under-running Costs

Ahead of Schedule

Under-running Costs

BehindSchedule

Jan

Mar

Feb

Aug

Sep

41

Earned Value reporting is most useful when the project baselines are stable. If there is a substantial

amount of flux in the baselines (either cost or schedule), the project earned value baseline may rapidly

become out of date and the reporting against an out of date baseline may be less than helpful. In those

instances, the project should provide alternative means of measuring integrated cost and schedule

performance.

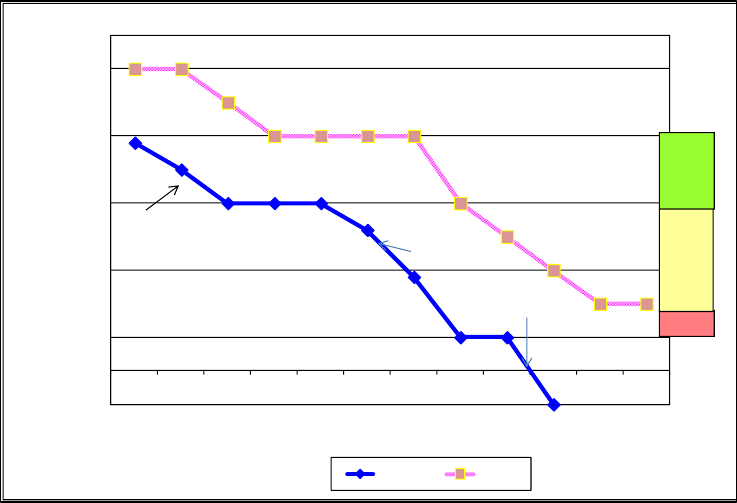

4.2. Schedule Trends

4.2.1. Why is the Leading Indicator Important?

Tracking schedule trends over a multi-year horizon provides an easily interpreted means of measuring

progress. Because of the strong correlation between cost and schedule, schedule performance is a good

predictor of cost performance. Although current reporting practices provide current schedules, tracking

near term milestones within the current year, and a status on the use of schedule margins, the shortened

performance period does not provide a complete picture of total performance.

4.2.2. Critical path slack/float

The best reporting practices on the status of schedule margin and slack provide data against an anticipated

burndown or plan, along with acceptable ranges and explanations of major releases/uses of margin or

slack. Premature use of slack in the early phases of the life cycle may indicate the inability to deliver

products as planned. The first example below shows the actual performance against plan, identifies the