Appendix 8

1 November 2023

INTRA-GOVERNMENTAL TRANSACTION (IGT) BUY/SELL

Section 1—Buy/Sell Transactions

Reimbursable activity in which goods or services are transferred between two federal entities is referred to as Buy/Sell

activity. Federal entities should have the appropriate Statutory Authority, such as the Economy Act, prior to engaging in

an agreement for Buy/Sell transactions. This section provides federal entities with guidance concerning reimbursable activity

between trading partners,

otherwise referred to as Buy/Sell activity.

The IGT Buy/Sell sub-category consists of exchange transactions impacting: Assets and Liabilities; Revenue and

Expenses; and Advances/Prepayments and Deferred Credits (Reciprocal Categories 22, 23 and 24). These business

events and their associated accounting activities should be agreed-upon by trading partners and managed through a

formal Buy/Sell agreement. The standard Interagency Agreement (IAA) form is comprised of two sections described

below: The General Terms and Conditions (GT&C) Section (Form 7600A) and Order Requirements and Funding

Information (Order) Section (Form 7600B). For the purposes of these business rules, the Requesting Agency is the Buyer

and the Servicing Agency is the Seller.

Intra-governmental Buy/Sell transactions involve two key functions that generate information about the agreement:

acquisition management and financial management. The acquisition function relates to the type of Buy/Sell activity and

the specific terms and conditions of the acquisition. During the acquisition, trading partners establish a timeline for the

delivery and payment schedule. The financial function of an agreement tracks key business activities that initiate

accounting events and corresponding U.S. Standard General Ledger (USSGL) transactions throughout the life of the

agreement. The financial function includes the approval of the Order, the capture of work-in-progress activity for the

accrual of costs incurred by the Servicing Agency but not yet paid by the Requesting Agency, the exchange of

performance-related data and payment for the goods or services. In G-Invoicing, these details are collectively captured in

the Order and the Performance Transactions.

While processing transactions through Intra-governmental Payment and Collection (IPAC), trading partners must follow

the business rules to avoid the misstatement of financial balances that occurs when trading partners fail to properly

record IGT activity.

As G-Invoicing is implemented, its use will be required by all federal entities for all IGT Buy/Sell activity involving

Reciprocal Categories 22, 23 and 24. Bureau of the Fiscal Service (Fiscal Service) requires federal entities to use G-

Invoicing under the authority of 31 U.S.C. 3512(b) and 3513. G-Invoicing is not an accounting system nor a procurement

system; instead, it serves as a gateway for federal entities to agree upon the funding terms and the accounting treatment

of their reimbursable activity and exchange that data with one another for consistent financial reporting. Key changes

from manual processes include a new set of data standards and the electronic submission and approval of necessary

documentation.

G-Invoicing replaces the former 7600A/B reimbursable Interagency Agreement (IAA) between Federal Program Agencies

for Intra-governmental Reimbursable, Buy/Sell Activity. G-Invoicing provides the electronic origination, review, and

approval of Buy/Sell IAAs. G-Invoicing is a Moderate rated application and approved to process and store Controlled

Unclassified Information (CUI). Federal entities must have implemented G-Invoicing for New Orders by October 1, 2022.

The mandated implementation deadline was October 1, 2022, for New Orders and includes Orders with a Period of

Performance beginning October 1, 2022, or later. All IGT Buy/Sell activity must be implemented into G-Invoicing by

October 1, 2025. Please refer to the IPAC System Enforcement Control Timeline below for further detail. Federal entities

must implement the entire transaction lifecycle which includes GT&Cs, Orders, and Performance Transactions that initiate

fund settlement. These business events and their associated accounting activities should be agreed-upon by trading partners

and managed through G-Invoicing. G-Invoicing is not required for transactions that are non-Buy/Sell IGT sub-category

transactions, or intra-Treasury Account Symbol (TAS) transactions.

Federal entities will use G-Invoicing to reflect their agreement on the funding terms and the accounting treatment of their

reimbursable activity and to exchange that data with one another for consistent financial reporting. In summary, G-Invoicing

serves as:

Appendix 8

2 November 2023

An agreement broker (the mechanism by which federal entities arrange and negotiate the terms of the IAA

electronically),

A data exchange utility (the facilitation of the exchange of the information between federal entities that ensures

well-defined lines of communication)

A conduit for sharing data and exchanging information on Buy/Sell IGT activity.

Each federal entity will still be responsible for preparing its respective USSGL entries following appropriate USSGL

attributes and guidance; however, IGT activity documented in G-Invoicing will allow federal entities to accurately identify

the respective accounting triggers. Further, each federal entity is still responsible for their own Anti-Deficiency Act (ADA)

monitoring.

Outlined below are key G-Invoicing releases where crucial functionality was delivered to help support the G-Invoicing

mandate:

Table 1: G-Invoicing Releases

Release Number

Key Deliverables/Functionality

R2.1

G-Invoicing was available for government-wide use, which allowed users to begin brokering GT&Cs

within the system.

R2.2

Allowed users to begin brokering Orders within the system.

R2.3

Allowed users to begin submitting Performance Transactions within G-Invoicing.

R3.0

Completed the transaction lifecycle generating settlement based upon the Performance Transactions.

R3.2

R3.3

R4.0

There were three Organizational Data Access Model Releases completed in Calendar Year 2020 to

migrate federal entity accounts over to a Group Access Model. The transition from a flat to a

hierarchical model provided several key benefits including decentralized user administration,

simplified management for access, and a foundation for future planned Workflow enhancements.

R4.1

Delivered Seller-Facilitated Order (SFO) functionality.

R4.2

Delivered GT&C Workflow functionality for the federal entity that initiates the GT&C. Also, this

release marked the point in which our Performance and Order Application Programming Interface

(APIs) were built to the specifications published on the G-Invoicing website in June 2020.

R4.3

Delivered GT&C Workflow functionality in Shared Draft, restored User Recertification functionality

in time for year-end recertification, removed the Disbursement (DISB) Business Event Type Code

(BETC) in support of the new General Fund Disbursements BETCs, Performance UI Features and

External Remittance API.

R4.4

Delivered GT&C Workflow by Organizational Group, new Supervisor Roles, improved User API

efficiencies, a new Performance Report, a more efficient GT&C Summary List page and Undelivered

Balance enhancements.

R4.5

Delivered a new Business Application (BizApp) data element to the GT&C Header Detail tab to apply

conditional logic for governing documents and Feature Management to help control access to newly

released post-mandate functionality. This release also included portions of In-Flight Order upload tool

and 7600EZ Invoice functionality in the QA-F region for early vendor testing. Note: Order Upload

and 7600EZ are multi-phase development efforts that were not included in Production as they were

not fully developed.

R4.6

Delivered the Adjusted Trial Balance (ATB) Summary Report to assist agencies with their G-

Invoicing to GTAS reconciliation efforts. This report also provides Fiscal Service with a mechanism

for measuring/enforcing entity compliance with the mandate. Also, with this release validations were

enabled to only allow ASCII printable characters on GT&Cs.

R5.0

This major release included 7600EZ functionality for low dollar, high volume transactions,

Constructive Order Acceptance (COA) Phase I of II for GSA Rent business line activity (turned off in

Production), Order Upload functionality to assist agencies with their In-Flight Order conversion, a

date & time standardization across the application to reflect Eastern Time (ET) and Item Code

validation in the User Interface (UI) only. Also, this release included the Pre-Paid Performance

Quantity (PPQ) on Advance Line/Schedules which allows entities a way to document Performance

that was previously settled outside of G-Invoicing.

R5.1

Delivered COA Phase II (available in Production). Also, with this release validations were enabled to

only allow ASCII printable characters on Orders and Performance free-text fields. This release

Appendix 8

3 November 2023

delivered a Performance enhancement that allows for Advance PPQs for In-Flight Orders to be

submitted through entity Enterprise Resource Planning (ERP) vendor systems. This release also

enabled a validation requiring the Requesting Agency Object Class Code and delivered the Copy

Invoice functionality for 7600EZ.

R5.2

Delivered two of three Enhanced Order Modification capabilities: Order Revert and allowing

Performance during an Order Modification. This release also provided entities the ability to print

previous versions of 7600B out of G-Invoicing and compare changes to previous versions of Order

modifications. Also, this release included the Item Code API validation.

These users will transition from the manual, paper-based agreements to G-Invoicing, which will be the front-end

application for users to originate IGT Buy/Sell transactions. G-Invoicing will integrate with IPAC, which will continue

to operate as the application for the settlement of funds between federal entities, transacting non-Buy/Sell activity,

reporting transactions to Central Accounting Reporting System (CARS), and researching certain transaction inquiries;

however, G-Invoicing will manage the processing and approval of GT&Cs, Orders, and Performance Transactions for

Buy/Sell activity.

The accurate reporting of Buy/Sell balances and proper elimination of Buy/Sell activity between trading partners are

predicated on accurate and timely communication of accounting events. After onboarding to G-Invoicing, federal entities

should ensure that the GT&C, Order, and Performance Transactions all contain correct dates and details of all accounting

events. These details include a TAS/BETC for both the Buyer and the Seller, capitalization indicator,

advance/prepayment transactions, advance liquidation, and receipt/acceptance details. Key dates include the Performance

Date (date on which delivery of goods/completion of services takes place) and the Transaction Date (date on which the

transaction is entered into G-Invoicing). Ensuring the accuracy and timeliness of these specific details will help reduce

the number of common errors and reconciling issues of Buy/Sell transactions.

The process model for IGT Buy/Sell transactions is described

in the following subsection:

Note: Federal entities should never have Buy/Sell activity with Treasury General Fund (099) as their trading partner.

1.1—IGT Buy/Sell Process Model and Phases

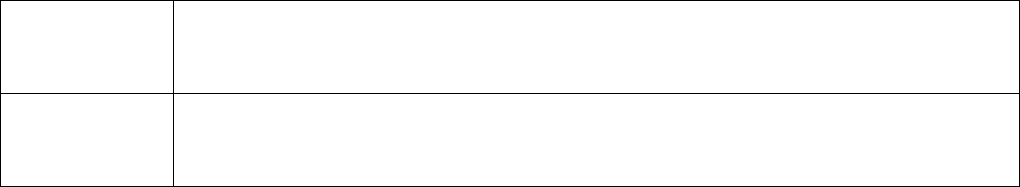

The Buy/Sell process model is defined by these four distinct phases of activity:

IAA Initiation and GT&C

Order

Performance Transactions/Receipt and Acceptance

Funds Settlement/IAA Closeout

Each phase is characterized by specific business and accounting event(s) and is

governed by a particular set of business rules to

guide the decision-making process throughout the

Buy/Sell lifecycle, as displayed below in Figures 1 and 2.

From the inception of a Buy/Sell transaction, trading partners must communicate with each other to

ensure proper account

postings and eliminations. The objective of effective communication for all Buy/Sell transactions is to promote consistent

accounting treatment of each transaction by both trading partners and to resolve inconsistencies effectively and efficiently.

Data elements form the foundation of the IGT Buy/Sell process model. The Federal Intra-governmental Data Standards (FIDS)

are designed to capture the necessary information trading partners rely upon for the correct accounting of IGT Buy/Sell

business events from initiation through settlement. Trading partners’ consistent use and thorough communication of the FIDS

facilitates the accurate recording of business events in every stage of the Buy/Sell transaction lifecycle. Each phase of IGT

Buy/Sell activities is supported through FIDS, including the movement of funds between trading partners, an effective

reconciliation process, and audit traceability.

When federal entities develop an IAA with their trading partners, the G-Invoicing transactions must leverage the FIDS to

trigger accounting events related to the respective business activities of the agreement. Some of the data elements may not

need to be recorded in the federal entity financial systems but will be used to facilitate communication and understanding

necessary for both trading partners to record and reconcile IGT Buy/Sell transactions accurately.

Appendix 8

4 November 2023

Figure 1: Buy/Sell Transactions completed in the IPAC environment.

Figure 2: Buy/Sell Transactions completed in the G-Invoicing environment.

Initiation and GT&C Phase

The Initiation phase revolves around the establishment of the GT&C and other administrative activities that occur before work

has started on fulfilling an Order. The IGT Buy/Sell process for reimbursable activity begins with the Buyer's identification of

a bona fide need for the procurement of goods/services made through a request by the Buyer to the Seller.

A Buy/Sell agreement that defines the terms and conditions, scope, and responsibilities for trading partners during the

exchange is referred to as the GT&C. Data is exchanged for approval and a broad range of transactions; no funds are

transferred and no accounting entries are created.

Once the Seller acknowledges the Buyer’s request for goods/services, both trading partners engage in communication to

negotiate the terms and conditions of the GT&C. The objective of this negotiation period is for trading partners to concur on

and document the details of the GT&C before performing any services or delivering any goods. Trading partners are

encouraged, but not required, to leverage Form 7600A to document their GT&Cs. These forms are aligned to the FIDS and

will assist trading partners in documenting all required data attributes for entry into G-Invoicing. GT&Cs negotiated in G-

Invoicing are considered the authoritative source as both parties must enter and approve this data directly in G-Invoicing.

G-Invoicing will assign a unique identifier for each GT&C. Federal entities may use this number to track their GT&Cs but

will also have the ability to associate their own unique identifier to each GT&C in their internal accounting systems. Orders

in G-Invoicing must reference an active GT&C.

Appendix 8

5 November 2023

Establish an Order

The Order section of the Buy/Sell agreement specifies the terms, quantities, prices, accounting data, and actions of each

trading partner under the overarching GT&C. It serves as the funding section of the agreement that creates a fiscal obligation

and details the necessary products/services requirements. Funding information is provided for both trading partners, and all

required points of contact sign to authorize the Order. It communicates the TAS/BETC for each Order Schedule Line and

contains unique lines of accounting or other accounting data.

The Order will also identify the specific Buyer requirements for the expected delivery of products or services by the Seller.

Finally, this section of the agreement identifies the roles and responsibilities for both trading partners to ensure effective

management of the Order and use of the related funds.

Within G-Invoicing, the Buyer or the Seller may complete the Order from an active GT&C and submit it to their trading

partner for review and approval. G-Invoicing does not allow for a mix of Buyer Initiated and Seller Facilitated Orders under a single

agreement so each GT&C must indicate which trading partner is responsible for creating the Orders. This is determined by selecting

Requesting or Servicing Agency under the Order Originating Partner Indicator (OOPI) field. If the two trading partners need a mix of

Buyer Initiated and Seller Facilitated Orders, they will need to create separate GT&Cs.

Performance Transactions/Receipt and Acceptance Phase

The Rece

ipt and Acceptance phase revolves around the delivery/receipt of goods/services and the

associated work-in-progress

activities. As Orders are fulfilled in accordance with the IAAs, accruals should be recorded by each partner to recognize

revenue/expense and any receivables/payables.

The Federal Accounting Standards Advisory Board (FASAB) states that revenue from IGT Buy/Sell transactions is earned

and recorded as goods are delivered and as services are performed. (SFFAS 7, Accounting for Revenue and Other Financing

Sources and Concepts for Reconciling Budgetary and Financial Accounting.) SFFAS 5, Accounting for Liabilities of The

Federal Government, states that a corresponding expense is recognized in the period that an exchange occurs. The point at

which the Buyer and Seller agree that “control of an asset” is transferred, or when “a performance obligation is satisfied” will

be the point at which revenue is recognized. Thus, both trading partners should exchange performance-related data with one

another surrounding the delivery and acceptance of goods, along with the receipt and consumption of services.

The same revenue and accrual recognition principles should apply for federal entity accounting, whether the partners are

working within G-Invoicing or the IPAC environment; the main difference is how data is being communicated.

As the Seller performs the work necessary to deliver the agr

eed-upon goods/services within the IPAC environment, the Seller

will report

the accrual amount to the Buyer, at a minimum, on a quarterly basis. Upon receipt of the

goods/services, the Buyer

performs receipt and acceptance procedures to accept or reject the

goods/services and communicates the results to the Seller.

Next, the Seller

submits an invoice to the Buyer and records the invoiced amount in the

receivables account. The Buyer records

the billed amount in the payables ac

count. For advances, once

the Order is filled, the Seller recognizes revenue and liquidates

the deferred revenue. The Buyer reduces

the prepayment and records an expense after receipt and acceptance. For complete

guidance on the recording of the IGT Buy/Sell exchange transactions, please see USS

GL Implementation Guidance.

G-Invoicing allows users to submit Performance Transactions.

Within G-Invoicing, the Buyer and the Seller must agree on the Freight On Board (FOB) Point at the Order level to establish

which partner’s Performance Transaction initiates fund settlement.

Regardless of the FOB Point, accruals are recorded as of the Performance Date entered by the Seller.

Advances and Deferred Payments transactions have other accounting rules. Please use the G-Invoicing Program Guide

for

support with the recording of accounting events in the G-Invoicing environment.

Appendix 8

6 November 2023

Fund Settlement and IAA/Closeout Phase

The Settlement/Closeout phase includes the payment and collection activities as well as the closeout of

the agreement. After

the performance has been accomplished according to the terms documented in the agreement, then funds may be transferred

between the trading partners.

At fund settlement, prior to transitioning to G-Invoicing, the Buyer or the Seller should initiate a payment/collection

transaction in IPAC according to the payment terms agreed-upon in the IAA. The IPAC transaction should include a unique

identifier so that the payment/collection can be readily identified by each partner. Also, the appropriate IGT sub-category data

element should be selected in IPAC to accurately categorize the type of transaction. The IGT sub-category data element was added to

IPAC as an optional data element in December 2021. It became a required field in the UI on October 1, 2022, and a required field on

the Bulk File on October 1, 2023.

Within G-Invoicing, fund settlement occurs upon completion of the Performance Transaction, as G-Invoicing will create the

IPACs on the federal entities’ behalf. If federal entities agree upon FOB Point Source, an IPAC is automatically generated

after the Seller has delivered/performed goods/services and completed an appropriate Performance Transaction within G-

Invoicing.

If f

ederal entities agree upon FOB Point Destination, an IPAC is automatically generated after the Buyer has 1) completed its

receipt and acceptance process and has entered an appropriate Performance Transaction into G-Invoicing or 2) the amount of

Constructive Receipt Days have expired and the application applies an approval on behalf of the Buyer, whichever occurs

first.

Treasury has established an IPAC

cutoff date that requires all IPAC Buy/Sell transactions to be successfully processed no fewer

than three business days before the close of

each month or five business days before the close of year-end reporting. It is the

responsibility of each federal entity to confirm that transactions initiated manually or via bulk file upload have completed

successfully within IPAC, and to obtain a transaction confirmation. Federal entities have 90 days after the billing date to

enter adjustments to payments or collections. Trading partners must collaborate with one another before initiating

adjustments in IPAC. Within G-Invoicing, settlement will occur based on Performance Transactions submitted, regardless of

cut-off, as information is readily available to determine the details of the transaction. Adjustments to quantity of Performance

Transactions can also be completed in G-Invoicing on an open Order referencing the initial Performance Transaction.

As the agreement approaches its end date, the Buyer and the Seller must monitor each Order included in the

agreement. During

closeout, the Seller identifies Orders that are approaching an end date

and checks the status with the Buyer to confirm that they

are ready for closeout. The Buyer reviews the

Order status and performs procedures to close out and deobligate the Order if

the Statutory Authority for the agreement mandated it. Additionally, the Seller

determines if any third-party supporting

contracts are open that need to be deobligated and closed. E

ach Schedule within an Order must either be Fully Performed, Modified

down to the amount that was performed (and paid), have a Final Performance Indicator of ‘F’ (final) as the most recent reported

Delivered/Performed, or Cancelled before an Order can systematically be closed. Finally, the

Seller verifies that all final costs have

been determined based on the agreed-upon amounts in the GT&C. Please see

Assisted Acquisitions USSGL

Implementation Guidance to view common accounting scenarios and for further clarification on business rules involving

the accounting of Assisted Acquisitions.

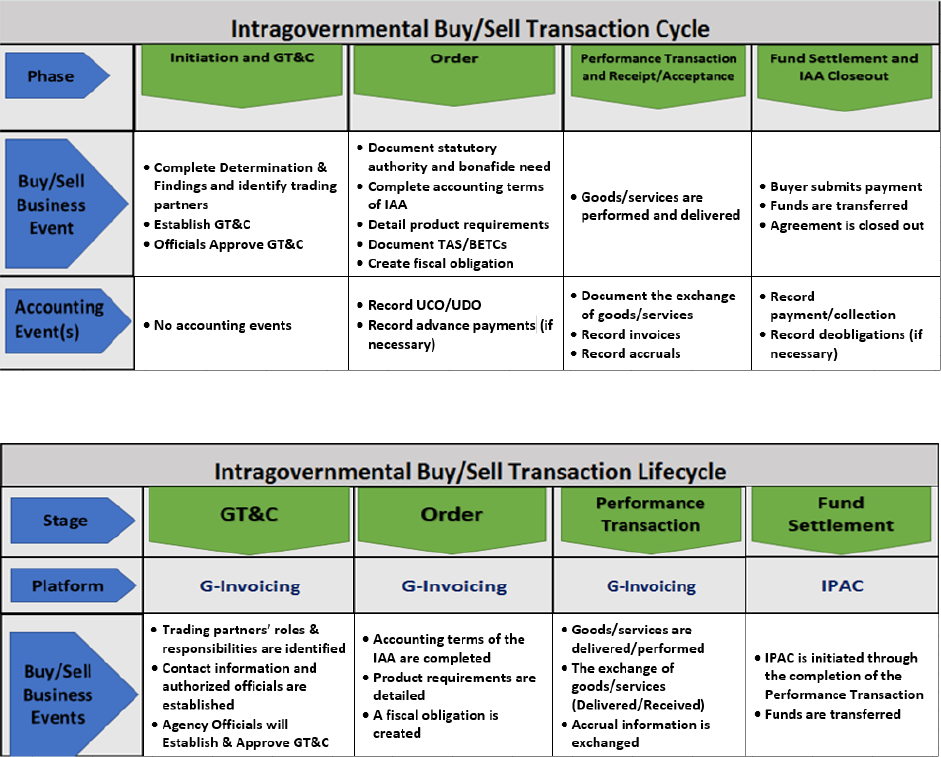

1.2—Measuring Government-wide G-Invoicing Progress

Fiscal Service will measure a federal entities’ G-Invoicing implementation progress by comparing submitted GTAS data to

IGT Buy/Sell activity in G-Invoicing. Two different categories of controls were implemented. The first category is Policy

Controls that monitors federal entity progress by presenting implementation progress percentages through the IGT Quarterly

Scorecard Process. The second category is System Controls that impacts a federal entities’ ability to process IGT Buy/Sell

activity directly through IPAC by adding a data element that requires the identification of the IGT sub-category for IPAC

transactions.

Appendix 8

7 November 2023

IPAC System Enforcement Control

Federal entities currently use the IPAC application for the following categories of IGT transactions:

Buy/Sell

Expenditure Transfer – Non-Exchange

Benefits

Custodial Transfer – Non-Exchange

Custodial Transfer - Exchange

Capital Transfer

Investments

Borrowings

Other/Miscellaneous

Through an analysis of IPAC data, Fiscal Service identified a gap in the current required data elements that prevented Fiscal

Service and federal entities from accurately categorizing transactions. To enhance the quality of the data, Fiscal Service has

introduced a new data element to the IPAC application that requires federal entities to categorize the type of IGT transactions

initiated through IPAC based on the categories documented above. Two methods are available for a federal entity to submit

IPAC transactions: through the Bulk File, or manually through the UI. The following phased approach establishes this new

data element as a system control:

October 2021 – Publish Bulk File specifications

December 2021 – Optional through UI

October 2022 – Required through UI, Optional through the Bulk File

October 2023 – Required through Bulk File

October 2025 – Remove Buy/Sell option through the UI and Bulk File

The phased approach documented above achieves the following:

Accommodate a timeframe for federal entities to implement through an optional period starting December 2021 that

becomes required in phases.

Accommodate a timeframe for ERP vendors and federal entities to update their Bulk File submission format by FY

2024.

Allow federal entities to leverage IPAC for Buy/Sell transactions until FY 2026.. Delayed billing is an example of

activity that could continue until FY 2026. Any delayed billing that is anticipated to occur beyond FY 2025 should

be communicated to Fiscal Service to discuss the scope and volume of transactions.

Remove the ability to initiate an IPAC transaction categorized as Buy/Sell in its entirety at the beginning of FY

2026.

Monitoring Federal Entity Implementation

The establishment of a metric, to be documented on each significant federal entity’s Quarterly IGT scorecard beginning in Q2

FY 2023, is required to appropriately measure a federal entity’s G-Invoicing implementation progress. Fiscal Service will

leverage a federal entity’s data from GTAS as the baseline measurement for the metric. The metric established for FY 2023

only includes a measurement of a federal entity’s new TAS. For FY 2024 and beyond, all TASes will be measured. The

metric will identify the Overall, intra-departmental, and inter-departmental percentages as illustrated in the graphic below.

Note: Federal entities may continue to leverage credit cards for IGT Buy/Sell activities (U.S. General Service

Administration’s SmartPay for example) in line with Treasury guidance and thresholds. Please refer to TFM Volume 1, Part

5, Chapter 7000 for more information regarding credit card guidance. Federal entities may accept credit cards issued under

the U.S. General Services Administration’s SmartPay contract for Buy/Sell transactions, subject to the maximum transaction

limits, for intra-governmental collections.

Appendix 8

8 November 2023

Streamlined Approach to Fund Settlement (7600EZ)

Fiscal Service, in coordination with the government-wide community, established a more efficient process flow to fund

settlement to accommodate specific business lines and low dollar activity. This new process exchanges sufficient data needed

for the reconciliation of Buy/Sell activity while using a smaller sub-set of data from the normal Order processes already

established. This process expedites fund settlement by combining the Order/Performance phases and requiring less data

elements and approvals.

The 7600EZ process includes a threshold of $10,000. Orders greater than this amount are not included in this streamlined

process flow and should follow the established Order processes currently in G-Invoicing. Some business lines have been

granted an exemption to this threshold and federal entities are encouraged to leverage 7600EZ for the following business

lines:

GSA Fleet Leasing

GSA Global Supplies

Government Publishing Office (GPO) Print Orders

DLA Supply Transactions

DLA Supply Transactions is a new addition to this list. For the business lines referenced above, Fiscal Service recommends

the use of the 7600EZ process. All other business lines must be brokered and agreed upon in the General Terms & Conditions

(GT&C) between both trading partners.

Constructive Order Acceptance (GSA Rent)

Constructive Order Acceptance functionality will only be used for GSA Rent activity. This G-Invoicing functionality is not

changing the current Buyer Initiated Orders (BIO) or SFO flows. Please contact Fiscal Service if your federal entity wants to

leverage Constructive Order Acceptance functionality within G-Invoicing. Requests would be fully vetted through existing

government-wide working groups with the appropriate stakeholders to review and analyze the request for government-wide

impact. The Servicing Agency will supply all required Order data. The Requesting Agency will have 7 calendar days to

review, correct, or approve the submitted Order. If no action is taken by the Requesting Agency within that timeframe and

the data provided by the Servicing Agency passes all validations, G-Invoicing will constructively change the Order status to

‘Open’ and allow subsequent Performance transactions to be processed. The GSA Rent business line will begin leveraging

the G-Invoicing Constructive Order Acceptance functionality in FY 2025.

G-Invoicing Implementation Plans

Federal entities are required to submit quarterly updates to their G-Invoicing Agency Implementation Plans. Federal entities

need to include any changes to their system/process readiness and implementation/data strategy. These updates will be

reviewed and analyzed by Treasury. Federal entities can submit their quarterly updates by resubmitting their Attachment As

Appendix 8

9 November 2023

(part of the G-Invoicing Agency Implementation Plan). Attachment As are used to capture more detailed information for each

Implementation Entity (IE) under an overarching G-Invoicing Agency Implementation Plan.

Federal entities are required to submit a complete Attachment A when updating any of the Attachment A sections/data. The

quarterly Attachment A submissions will be used to update the Trading Partner Directory. If a federal entity does not have

any plan updates, the federal entity is still required to submit an email to IGT@fiscal.treasury.gov, stating that there are no

applicable quarterly updates to provide by the required quarterly due date.

The quarterly updates to the G-Invoicing Agency Implementation Plans must be submitted to IGT@fiscal.treasury.gov

.

Treasury will track the submission of these quarterly updates through the IGT scorecard process which will reflect if the

federal entity met the required quarterly deadline. This information will be reviewed during the quarterly IGT scorecard

meeting between Treasury and the individual federal entities.

Quarterly G-Invoicing Agency Implementation Plan Due Dates:

1

st

Quarter

December 31

2

nd

Quarter

March 31

3

rd

Quarter

June 30

4

th

Quarter

September 30

In addition to the Attachment A, federal entities may also submit updates to the Trading Partner Directory by completing an

ALC Implementation Status Update template, commonly known as the Attachment B. This template is not required as part of

the quarterly submission process; however, it’s highly encouraged that federal entities use the Attachment B to submit

updates in real time as they make any progress with their G-Invoicing implementation. This template also allows federal

entities to submit more granular updates on their specific business lines that may share an ALC but have a different

implementation date. The Attachment A & B templates are located under the Agency Implementation

section of the Fiscal

Service website.

Section 2—IGT Buy/Sell Transaction Types

There are two primary types of Buy/Sell IGTs: services provided and goods sold or leased. An Order request may include

both goods and services. Each transaction type possesses unique accounting and reporting characteristics. The recognition of a

particular transaction type further aids trading partners in capturing IGT Buy/Sell activity in the appropriate accounts.

Each Buy

/Sell transaction type can be supported through the assisted acquisition process. Assisted acquisition is the term used

to describe the process by which the Buyer uses the contracts or contracting services/vehicles of the Seller to obtain goods and

services from a third-party provider that typically is a non-federal entity. In the process, the Seller performs acquisition

activities on a Buyer's behalf, such as awarding and administering a contract, task Order, or delivery Order. As the non-federal

entity performs on the contract agreement, the Seller incurs costs, including administration fees, and

bills the Buyer for

reimbursement. The following sections provide a description for each transaction

type.

Services P

rovided

A service refers to the performance of work or tasks provided by the Seller on behalf of the Buyer. For

reimbursables, the

Seller incurs costs to provide services and bills the Buyer. Revenue is earned from the

sale of services provided.

Goods Sold or Leased

As defined in this guide, a good is a tangible product sold or leased where the

Seller manufactures, distributes, or owns the

goods that are sold or leased to the Buyer. Revenue is

earned from the sale of any purchased or finished goods and processes

for sale or use. Revenue also is

earned for work-in-progress on an accrual basis. Goods are further categorized into the

following groups:

Appendix 8

10 November 2023

Inventory and Property, Plant, and Equipment (PP&E). Inventory and PP&E are assets, as

they could generate

future revenue. Although both act as assets, reporting varies.

o Inventory and Related Property. Inventories are tangible property, other than long-term fixed

assets. As an

asset, inventory is reported at the amount paid to obtain the asset not its selling

price. The asset is expensed

as “cost of goods sold” as inventory is sold.

o PP&E. PP&E are long-term, or fixed, tangible assets that have an estimated useful life of two or

more years,

are not intended for sale in the ordinary course of business and are intended to be

used or available for use

by the federal entity.

1

Accounting for PP&E involves the depreciation of the cost of the asset over its useful

life. Depreciation is a non-cash expense that reduces the value of

an asset because of wear and tear, age, or

obsolescence. Most assets lose their value over

time and must be replaced after their useful life ends.

o Capitalization thresholds affect whether the costs of acquiring PP&E are capitalized or expensed.

Depending on a federal entity’s established threshold, an asset may be expensed in its entirety at the

date of

acquisition, or the cost of the asset may be depreciated over its useful life.

See F

iscal Service’s USSGL Implementation Guidance (approved by the Issues Resolution Committee and the

USSGL Board) for Intra-governmental Capital Asset and Inventory Buy/Sell Transactions on Fiscal Service’s

website.

Goods Other Than Inventory and PP&E. Goods, other than inventory and PP&E, are expensed

when purchased by

the Buyer.

Intra-governmental Lease. An intra-governmental lease is an agreement between federal entities in which one

entity (a lessor) conveys the right to control the use of an underlying asset to another entity (a lessee) for a specified

period of time in exchange for consideration. Under SFFAS 54 guidance, leases may include agreements that meet

the definition of a lease, even though they are not explicitly identified as leases.

To determine whether an IAA conveys the right to control the use of the underlying asset, a federal entity should

assess whether the agreement gives the lessee both of the following:

o The right to obtain economic benefits or services from use of the underlying asset as specified in the

contract or agreement; and

o The right to control access to the economic benefits or services of the underlying asset as specified in the

agreement.

Intra-governmental leases exclude agreements that transfer ownership of the underlying asset by the end of the term,

agreements for services (except certain agreements that contain both a lease component and a service component),

assets under construction, and software licenses.

A lessee should recognize lease payments paid to the lessor as expenses, while the lessor recognizes lease receipts as

revenue, based on the payment provisions of the IAA and other applicable standards. No intra-governmental leases

should be reported on the Balance Sheet, other than the appropriate assets/liabilities for rent paid in advance or for

rent due. Rental increases/decreases, lease incentives, and lease concessions associated with intra-governmental

leases should be recognized by the lessee and lessor when incurred as increases/reductions to lease rental expense

and income.

Intra-governmental Leasehold Reimbursable Work Agreement. An agreement whereby one federal entity (the

provider-lessor) acquires, constructs, improves, and/or alters an underlying asset that is or will be leased to another

federal entity (the customer-lessee), and the customer-lessee agrees to reimburse the provider-lessor for direct and

indirect costs for the acquisition, construction, improvement, and/or alteration.

For real property acquisitions and leasehold improvements in which the provider-lessor is considered the

predominant beneficiary per Technical Bulletin 2023-01, customer-lessees should initially recognize an intra-

governmental reimbursable work asset for the amount payable for reimbursable work acquisition, construction,

improvement, and/or alteration costs. This asset should be amortized as the customer-lessee has access to the

benefits/services resulting from the reimbursable work.

For r

eal property acquisitions and leasehold improvements in which the provider-lessor is considered the

predominant beneficiary per Technical Bulletin 2023-01, provider-lessors should initially recognize an intra-

1

SFFAS No. 6, “Accounting for Property, Plant, and Equipment”

Appendix 8

11 November 2023

governmental unearned reimbursable work revenue liability for the amount receivable for reimbursable work

acquisitions, construction, improvements, and/or alterations. Revenue should be recognized as the provider-lessor

provides access to the economic benefits/services resulting from the reimbursable work.

Both entities should coordinate the timing and amounts of amortization/earned revenue to facilitate elimination of

inter-entity balances.

For leasehold improvements in which the customer-lessee is considered the predominant beneficiary per Technical

Bulletin 2023-01, the customer-lessee should recognize the PP&E in accordance with SFFAS 6.

2.1—Trading Partner Roles and Responsibilities

Trading partner roles and responsibilities within this IGT sub-category appear in Table 2. Trading

partners define roles and

responsibilities at the initiation for each phase through the life of an agreement.

Table 2: Key Stakeholders for Buy/Sell

Role

Federal Entity

Responsibility

Servicing

Agency

Seller Confirms data elements with Buyer during negotiations for GT&Cs

and Orders.

Reports data elements established at initiation and updated throughout

the life of agreement to Buyer on a recurring basis (for example,

quarterly) and completes the Performance Transaction in G-Invoicing

in a timely manner, if onboarded G-Invoicing.

Tracks and accounts for work in progress and services performed to

date and reports accrual amount to Buyer on a quarterly basis via

Performance Transactions.

Initiates or confirms payments and collections received from the Buyer

and verifies the successful settlement of funds with CARS.

Documents differences with trading partners and creates a corrective

action plan or submits to Fiscal Service for dispute resolution, as

appropriate.

Requesting

Agency

Buyer Confirms data elements with Seller during negotiations for GT&Cs

and Orders.

Submits request for goods/services in a timely manner.

Confirms receipt via Performance Transactions and accounts for

goods/services accepted.

Initiates or confirms IPAC transactions for payment and collection to

the Seller and verifies the successful settlement of funds within CARS.

Documents differences with trading partners and creates a corrective

action plan for recurring differences or submits to Fiscal Service for

dispute resolution, as appropriate.

2.2—Business Rules for Buy/Sell

The following key laws and policy sources govern the financial management of Buy/Sell activity:

SFFAS No. 3

, “Accounting for Inventory and Related Property,” establishes accounting standards

that apply to

several types of tangible property, other than long-term fixed assets, held by federal entities.

Appendix 8

12 November 2023

SFFAS No. 4, “Managerial Cost Accounting Standards and Concepts,” as amended by SFFAS No. 55 “Amending Inter-

entity Cost Provisions” requires the recognition of the full cost of goods and services.

SFFAS No. 5, “Accounting for Liabilities of The Federal Government,” requires an expense to be recognized in the

same accounting period in which an exchange has occurred, and the recognition of a

liability when the Buyer

receives goods or services in return for payment to the Seller.

SFFAS No. 6, “Accounting for Property, Plant, and Equipment,” establishes accounting standards

for federally

owned PP&E, deferred maintenance, and cleanup costs.

SFFAS No. 7, “Accounting for Revenue and Other Financing Sources and Concepts for

Reconciling Budgetary and

Financial Accounting,” establishes accounting standards for

recognizing exchange revenue at the point in which the

Buyer and Seller agree that “control of an asset” is transferred, or when “a performance obligation is satisfied.”

SF

FAS No. 54, “Leases,” as amended by SFFASs 60 & 61 “Omnibus Amendments: Lease-Related Topics”,

revise the financial reporting standards for federal lease accounting. Agreements between federal entities that

convey a right to control the use of an underlying asset to another federal entity for a specified period of time in

exchange for consideration are considered intra-governmental leases. The lease payments between the lessee

and lessor are recognized as expenses/revenue as incurred.

Title 31 U.S.C. § 1501, “Documentary Evidence Requirement for Government Obligations,”

requires that an amount

be recorded as an obligation of the U.S. Government only when

supported by documentary evidence of a binding

agreement between a federal entity. The binding

agreement must be in writing, in a way and form for a purpose

authorized by law and must be

executed before the end of the period of availability for obligation of the appropriation

or fund

used for specific goods to be delivered, real property to be bought or leased, or work or service to

be

provided.

Title 31 U.S.C. §1535, “Agency Agreements,” allows one federal entity to provide goods or

services to other federal

entities or major organizational units within a federal entity.

OMB Circular No. A-11, Section 20.12, “What do I need to know about reimbursable work?”, permits the use of

advances or reimbursements in exchange for providing goods and services

between federal entities according to laws

that establish revolving funds, provisions in

appropriations or substantive laws that allow federal entities to use the

amounts they collect, or the

Economy Act (31 U.S.C. §1535).

Federal Acquisition Regulation (FAR) Vol. I, Subpart 4.6, “Contract Reporting,” requires federal entities

to report

all procurement actions that exceed the micro-purchase threshold (currently $10,000) and

modifications to those

transactions regardless of dollar value, to the Federal Procurement Data

System (FPDS).

FAR Vol. I, Subpart 17.5, “Interagency Acquisitions,” establishes the

Economy Act as the prevailing law for IAAs to

provide goods and services

when more specific Statutory Authority does not exist.

Office of Federal Procurement Policy, “Interagency Acquisitions Guidance,” defines interagency

acquisition types

and agreement structure.

FASAB Staff Issues Technical Bulletin 2017-1

, “Intra-governmental Exchange Transactions,” offers clarifications

on intra-governmental exchange transactions and consistency in the reporting of revenue and cost information.

The following subsections define the business rules and policies governing the accounting and reporting

of IGT

Buy/Sell activities according to each Buy/Sell phase. These business rules focus on the accounting

of Buy/Sell IGTs,

not the procurement or payment processes. Trading partners should refer to

the Financial Management Line of

Business (

FMLoB), “Standard Business Processes for Reimbursable Management, Receivables Management,

and Payment Management,” for detailed guidance on procurement or payment processes. Trading

partners must

reconcile receivables and payables, advances to and advances from, and revenue and

expenses for all reimbursable

accounts and must report balances to Fiscal Service.

It is critical that the account balances reported in the confirmation process equal the amounts reported in

the federal

entity’s audited financial statements and GTAS submission to Fiscal Service.

FASAB Technical Bulletin 2020-01

, “Loss Allowance for Intra-governmental Receivables,” clarifies that the

recognition of an allowance for losses on accounts receivable applies to both intra-governmental receivables and

receivables from non-federal entities.

FASAB Technical Bulletin 2023-01, “Intra-governmental Leasehold Reimbursable Work Agreements,” provides

accounting requirements for intra-governmental leasehold reimbursable work agreements (often referred to in

practice as reimbursable work authorizations). These reimbursable costs typically are beyond what may be included

in the tenant improvement allowances of the lease agreement for the related underlying asset.

Appendix 8

13 November 2023

2.3—Business Rules for Initiation and GT&C

The Buyer initiates the Buy/Sell process with identification of a bona fide need for an exchange of goods

or services. The

bona fide need rule

2

is one of the fundamental principles of appropriations law. A

fiscal year appropriation may be obligated

only to meet a legitimate or bona fide need arising in, or in some cases before, but continuing to exist in the fiscal year for

which the appropriation was made. The

following paragraphs include business rules for the initiation phase.

Est

ablishment of a GT&C: Trading partners are authorized to engage in Buy/Sell activity

according to the Economy Act

(Title 31 U.S.C. §1535) or non-Economy Act authorities, such as

intra-governmental revolving funds. A single Statutory

Authority to perform the transaction must be agreed-upon and documented later in the Order. The terms and conditions of an

agreement must be captured,

negotiated, and approved by both trading partners.

Trading partners should use the recommended standard IAA form

for G-Invoicing when brokering their GT&Cs.

Trading partners must agree on a single Statutory Authority to govern the activity of the Order section of the

agreement.

Assisted Acquisition: Trading partners must follow the same business rules as applied to transactions

for goods and services

when accounting for administration fees associated with assisted acquisition

services. A GT&C agreement is recommended

by Fiscal Service for all IGT activity types. However, other guidance (such as OMB policy) may require a completed

agreement for certain intra-governmental transaction types, such as assisted acquisitions. Federal entities should ensure they

are in adherence with such guidance. If the Order requires assisted acquisition support, one of the following circumstances

must apply:

The Order will be made appropriately under an existing contract of the Seller entered into before placement of

the Order, to meet the requirements of the Seller for the same or similar goods or services.

Th

e Seller has capabilities or expertise to enter into a contract for such goods or services that are not available

within the Seller entity.

The Seller is specifically authorized by law or regulation to purchase such goods or services on behalf of other

federal entities.

See Assisted Acquisitions Guidance

for further information on proper transactions and IGT eliminations.

2.4—Business Rules for Order

Order Acceptance: Work is authorized once both trading partners have approved the Order. The

Seller operates at risk

without an approved Order. For an accepted Order, the Seller must record an

unfilled customer Order and the Buyer must

record an undelivered Order in their respective general

ledgers.

Advance Payments/Collections: The Economy Act (Title 31 U.S.C. 1535) permits advance payments for intra-

governmental transactions in which it is the prevailing Statutory Authority. Other Statutory Authorities or federal entity-

specific Statutory Authorities may allow or prohibit advance payments. If an advance payment is requested by the Buyer or

the Seller, trading partners should ensure they have the appropriate authority, and must cite the agreed-upon Statutory

Authority allowing for an advance within the Order section of the IAA. If allowed, trading partners must account for

advances, as follows:

Advance payments may not be exp

ensed. Revenue should not be recognized until costs are incurred from

providing goods or services.

Advance payments should not be used to facilitate positive cash flow for a federal entity.

Federal entities should ensure regular billings and collection activities support positive cash flow.

The Buyer must record the advance payment as an asset (USSGL account 141000, “Advances and

Prepayments”).

The Seller must record the advance payment as a liability (that is, USSGL account 231000, “Liability for

Advances and Prepayments”).

2

Government Accountability Office Red Book, Vol. I [underlying statute in U.S.C. §1502(a)]

Appendix 8

14 November 2023

Federal entities should refer to the current USSGL transaction codes on the USSGL website, Section III,

“Account Transactions” for detailed accounting entries.

For Assisted Acquisition, in no event will the Seller require, or the Buyer pay, any fee or charge that exceeds

actual indirect costs associated with administering or managing the contract vehicle, but in effect, the Seller

must cover its full cost. The business transaction cannot result in the trading partner earning a profit or incurring

a loss.

2.5—Business Rules for Performance Transactions/Receipt and Acceptance

As the Seller performs the work necessary to deliver goods or services, the Buyer and the Seller must post their related

accounting transactions in their respective systems during the same accounting period according to the current USSGL

transaction codes. For more details on the receipt and acceptance process, trading partners should refer to FAR Vol. I, Subpart

17.5, “Interagency Acquisitions” along with the Standard IAA Instructions

. Users of G-Invoicing may use the FIDS-based

documents to complete Orders.

Delivered/Performed: Performance Transaction submitted by the Seller to indicate that they have transferred control or

performed the good/service to the Buyer. The completion of this transaction would indicate a receivable/revenue being

recorded by the Seller and should be reciprocated with expense/payable recorded by the Buyer. If the Order is operating under

FOB Point of Source, this Performance Transaction will automatically initiate settlement through the IPAC application.

Received/Accepted: Performance Transaction submitted by the Buyer to indicate receipt and acceptance of the goods/services

from the Seller, which will occur after the Seller has completed a Delivered/Performed transaction. If the Order is operating

under FOB Point of Destination, this Performance Transaction will automatically initiate settlement through the IPAC

application. If receipt and acceptance is not provided by the expiration of the agreed-upon Constructive Receipt Days,

automatic receipt and acceptance will be generated through G-Invoicing to align with the Seller’s Delivered/Performed

transaction and initiate settlement.

Advance: Performance Transaction submitted by the Seller to collect an advance payment from the Buyer. The Seller will be

able to initiate the Advance Performance Transaction to generate an advance collection/payment of funds regardless of FOB

Point domain value. Completion of this Performance Transaction will automatically initiate fund settlement through the IPAC

application. Any Delivered/Performed transactions against Schedules with an advance balance will not initiate settlement but

should be used to draw down the advance balance on the Schedule. Upon, completion of settlement of an advance payment,

the Buyer and Seller must record the appropriate asset and liability to reflect the advanced balance.

Ca

lculation: Advance Payment – Delivered/Performed = Open advance/prepaid balance

Deferred Payment: Performance Transaction submitted by the Seller to communicate work completed. The completion of this

transaction would indicate a receivable and revenue recorded by the Seller and should be reciprocated with an expense and

payable by the Buyer. This Performance Transaction does not initiate fund settlement through the IPAC application and is

designed to only communicate the amount of work completed by the Seller. The amount of Deferred Payment cannot exceed

the undelivered balance on the Schedule. Deferred Payment transactions reduce the amount of the undelivered balance for that

Accounting Period. For Deferred Payments transactions, the amount of the accrual entry will equal the amount of the Deferred

Payment transaction in G-Invoicing. The Deferred Payment transaction completed in G-Invoicing is only applicable to the

Accounting Period referenced on the Performance Transaction (must be an open Accounting Period). G-Invoicing will

consider this Deferred Payment amount as life-to-date and any subsequent Deferred Payment transactions submitted for the

same Accounting Period will override the previous Deferred Payment transaction.

The Performance Transactions completed by the Seller and Buyer should be reconciled by both federal entities, at a minimum,

on a quarterly basis to ensure both parties agree.

Recording Capitalized Assets: Federal entities should follow the

Intra-governmental Capital Asset and Inventory

Buy/Sell Transactions document concerning USSGL guidance on capitalized assets located on Fiscal Service’s website.

Recording Intra-governmental Leases: Federal entities should follow the Intra-governmental Leases document

concerning

USSGL guidance on intra-governmental leases located on Fiscal Service’s website.

Appendix 8

15 November 2023

2.6—Business Rules for Fund Settlement and IAA Closeout

Billing and Payment Requirements: IPAC facilitates the intra-governmental transfer of funds, with related TAS/BETC, from

one federal entity to another and posts the transaction data from both federal entities to their respective CARS Account

Statements. An IPAC transaction may be initiated either manually through the IPAC application or through the completion of

specific Performance Transactions in G-Invoicing during the transition phase leading up to the G-Invoicing mandate.

Following the G-Invoicing mandate, the only manual IPAC transactions that will be allowed to occur are expiring agreements

that do not meet the criteria for the In-Flight Order requirement, new agreements that do not fall within the scope of the G-

Invoicing mandate, and activity outside of IGT Buy/Sell Reciprocal Categories 22, 23 and 24.

Federal entities must use IPAC for all intra-governmental Buy/Sell settlements. They must discontinue use of paper checks

and must restrict the use of credit cards for payments above the designated threshold. Fiscal Service reserves the right to

require federal entities to use IPAC to process intra-governmental transactions rather than allow these transactions to be

conducted with a government-issued card.

Trading partners must abide by the negotiated terms and conditions in the GT&C and Order, as follows:

The Buyer or the Seller may initiate an IPAC transaction when the goods and services have been accepted and

within the agreed-upon terms and conditions.

The Seller must issue a final bill, including final information from data elements, per the billing frequency as

stated in the required data elements.

If the Seller does not issue a final bill per the agreed-upon billing frequency, the Buyer should contact the Seller

immediately to obtain the final bill and close the Order.

Upon request, the Seller must provide documentation supporting the bill and actual performance consistent with

the agreed-upon terms and conditions.

The Buyer must not reject IPAC transactions that comply with the agreement terms and conditions.

The Buyer must reference the Seller’s unique identifier on all IPAC transactions.

Agreement/Order Closeout: Trading partners must monitor all Orders as they approach their end date. Generally, the Seller

initiates the agreement and Order closeout process. The following list summarizes trading partner responsibilities during this

process:

The Seller must identify Orders with an approaching end date and must check the status with the Buyer to

confirm that it is ready for closeout.

For obligation/payable balances that have shown no activity for more than 180 calendar days, the Buyer must

determine the reason for the lack of activity on the Order.

Once the Buyer determines that an Order has been fulfilled, the Buyer must inform the Seller that the Order will

be deobligated within 30 calendar days if the Statutory Authority requires deobligation.

However, if the Seller provides proof of continuing or unbilled work, an Order’s unliquidated obligation/payable

balances will remain available for use and will be reflected as such in both the Buyer’s and Seller’s respective

accounting systems.

The Seller must review the status of the Order to determine if any third-party supporting contracts are open that

need to be deobligated and closed.

The Seller must refer to the FAR for appropriate closeout procedures for contracts.

Trading partners should recognize that the FAR may have varying windows for closeout depending upon the

type of Orders and contracts the Seller has in place with third parties.

The Seller must verify that all final costs have been determined based on the agreement.

Note: Federal entities must ascertain that the intra-governmental accounts receivable and payable transactions are valid and

actively in collection. Intra-governmental collections between trading partners should not exceed 30 calendar days. Proper

documentation and a thorough understanding of responsibilities mitigate the risks of one federal entity not paying its trading

partner for goods/services. If collection cannot be made, federal entities should seek assistance from the Office of Legal

Counsel at the Department of Justice (DOJ).

Appendix 8

16 November 2023

Fiscal Service does not have the authority to collect debt from other federal entities on behalf of a federal entity; however,

Treasury will be monitoring the aging of IGTs to resolve longstanding differences between trading partners.

Section 3— Reciprocal Categories and Eliminating USSGL Accounts

TFM Volume I, Part 2, Chapter 4700, Appendix 3, presents the Reciprocal Categories and eliminating accounts used by the

Seller and the Buyer. For IGT Buy/Sell exchange transactions, Reciprocal Categories 22, 23 and 24, the trading partners are

defined as:

Servicing Agency (Seller): Provides services, products, and goods incurring the reimbursable costs. It accounts for

work in progress and services performed to date.

Requesting Agency (Buyer): Documents a bona fide need and receives services, products, or goods. It accounts for

services, goods, and products received and accepted.

Limited Use of USSGL Accounts

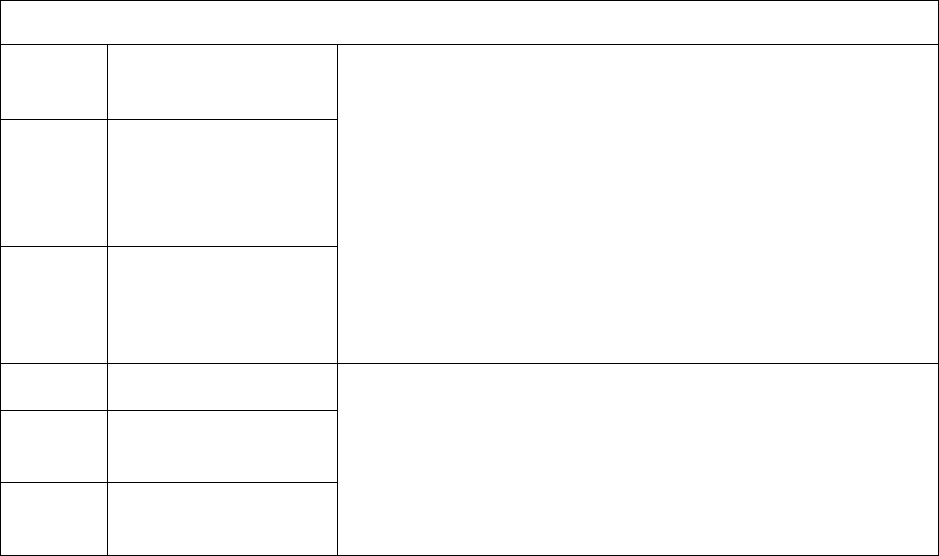

Table 3 outlines the USSGL accounts reserved for special use in Buy/Sell transactions.

Table 3: Limited Use Accounts for Buy/Sell

USSGL USSGL Name Description

131900 Allowance for Loss on

Accounts Receivable

If an allowance for loss on intra-governmental account receivables is

recorded in USSGLs 131900, 136700, or 137700, document the

applicable use so that it is available for Fiscal Service upon request.

136700 Allowance for Loss on

Penalties and Fines

Receivable - Not

Otherwise Classified

137700 Allowance for Loss on

Administrative Fees

Receivable - Not

Otherwise Classified

590000 Other Revenue

If revenues are generated from Buy/Sell activity that is not from goods

(USSGL account 510000), services (USSGL account 520000) or leases

(USSGL account 593900), document the applicable use so that it is

available for Fiscal Service upon request.

590900 Contra Revenue for Other

Revenue (Exchange)

593900 Contra Revenue for

Lessor Lease Revenue

3.1—Common Errors for Buy/Sell Transactions

There are several common errors trading partners make when posting the accounting treatment for Buy/Sell transactions.

Table 4 contains the list of the common errors, and the solutions federal entities can use to correct the errors.

Appendix 8

17 November 2023

Table 4: Common Errors for Buy/Sell Transactions

Error Type

Description

Solution

Timing

Differences for

Recording

Advances

For advances, differences occur when the

Buyer prepays the Seller and recognizes an

asset, but the Seller does not recognize a

liability. Communication needs to

continue as goods and services are

rendered, and the Buyer and Seller need to

reduce the asset and the liability

accordingly.

Mitigating timing differences for

recording advances is accomplished

through the required data element for

advances/non-advances.

The advance/non-advance data element

signifies the use of advances. This

element, in conjunction with agreed-

upon terms, allows for consistent

accounting treatment of the advance

transactions over the life of the

agreement or until the advance is fully

liquidated.

Ineffective

Communication

Between

Procurement and

Accounting

Functions

Procurement and accounting personnel

often have unaligned policies and fail to

communicate effectively with each other,

which is further complicated by the lack of

communication between trading partners

for Buy/Sell transactions. As a result,

procurement business activities and the

associated accounting events may be out

of sync.

The Buy/Sell process model bridges the

gap between procurement and accounting

by providing greater visibility into the

accounting of Buy/Sell transactions. It

provides guidance for the proper

recordation of Buy/Sell transactions set in

the context of the three phases of the

Buy/Sell process and associated business

activities, thereby facilitating coordination

between the procurement and accounting

function. The Buy/Sell IGT business rules

allow both functions to establish shared

objectives and performance measures,

thereby improving compliance with

policies and providing a more

comprehensive view of controls.

Federal entities need to communicate the

terms of the contract such as whether a

transaction is an assisted acquisition,

whether the purchase will be capitalized

and whether it is sold out of inventory or

from services provided.

3.2—Buy/Sell Reconciliation Procedures

In addition to the IGT-wide reconciliation procedures, trading partners must define and perform specific

reconciliation(s) for

this sub-category. They should document these reconciliations and incorporate them

into management’s existing OMB

Circular No. A-123, “Management's Responsibility for Enterprise Risk Management and Internal Control,”

Appendix A,

procedures. There are reconciliation procedures that federal entities should perform at the

Order level for each phase of

Buy/Sell activity on a quarterly basis, at a minimum. The purpose

of reconciling Buy/Sell activity between trading partners at

the Order level is to confirm that

both the Buyer and Seller are capturing the correct entries in their subsidiary ledgers and

general ledgers

and to facilitate further communication related to the status of the Order.

Federal entities should create and maintain a documented catalog of all Buy/Sell agreements. During the

initiation phase,

federal entities should add each newly established agreement to the catalog, using the

agreement number data element as a point

Appendix 8

18 November 2023

of reference. The catalog should capture for each

agreement, at a minimum, the agreement number, trading partner agency

identifier, and period of

performance and funding expiration date. Maintaining a catalog of all agreements will allow federal

entities to

validate the actual number of agreements they have with a trading partner and to monitor activity for

agreements

with approaching end dates. Federal entities must confirm that only valid agreements make up their

payable and receivable

balances.

The Seller should use the data elements to monitor and convey accounting events during the receipt and

acceptance and

settlement phases, to track delivery status, and to monitor activity in receivable accounts

and collections. The Seller should

communicate updates to the Buyer on a quarterly basis, at a minimum,

to assist with reconciliation of payables/receivables and

disbursements/collections and to address any

out-of-balance conditions. Federal entities should use the data elements as a

supporting to

ol during audits.

Trading partners must reconcile the account balances listed in Table 5. Federal entities should refer to the summary of

eliminating Buy/Sell USSGL accounts (TFM Volume I, Part 2, Chapter 4700, Appendix 3) to support reconciliation

procedures. Where differences are

identified, federal entities must document the difference including, but not limited to, the

difference amount,

USSGL accounts impacted, rationale for the difference, and the status of communication with trading

partners (for example, contact made, unresponsive trading partner).

Table 5: Required Reconciliations for Buy/Sell Balances

Reciprocal Category

Requesting Agency (Buyer)

Servicing Agency (Seller)

22

Accounts Payable

Accounts Receivable

23

Advances to Seller

Advances from Buyer

24

Expenses/Capitalized Purchases

Revenue