Prepared by the

Committee on Rules of Practice and Procedure

Judicial Conference of the United States

August 2023

PRELIMINARY DRAFT

Proposed Amendments to the Federal Rules of Appellate,

Bankruptcy, and Civil Procedure

Request for Comments on Amendments to:

Appellate Rules

6 and 39;

Bankruptcy Rules 3002.1 and 8006; Official Forms 410, 410C13-

M1, 410C13-M1R, 410C13-N, 410C13-NR,

410C13-M2, and 410C13-M2R; and

Civil Rules

16, 26, and new Rule 16.1

Written Comments Due By

February 16, 2024

COMMITTEE ON RULES OF PRACTICE AND PROCEDURE

OF THE

JUDICIAL CONFERENCE OF THE UNITED STATES

WASHINGTON, D.C. 20544

JOHN D. BATES

CHAIR

H. THOMAS BYRON III

SECRETARY

CHAIRS OF ADVISORY COMMITTEES

JAY S. BYBEE

APPELLATE RULES

REBECCA B. CONNELLY

BANKRUPTCY RULES

ROBIN L. ROSENBERG

CIVIL RULES

JAMES C. DEVER III

CRIMINAL RULES

PATRICK J. SCHILTZ

EVIDENCE RULES

MEMORANDUM

TO: The Bench, Bar, and Public

FROM: Honorable John D. Bates, Chair

Committee on Rules of Practice and Procedure

DATE: August 15, 2023

RE: Request for Comments on Proposed Amendments to Federal Rules and Forms

____________________________________________________________________________

The Judicial Conference Committee on Rules of Practice and Procedure (Standing

Committee) has approved for publication for public comment the following proposed amendments

to existing rules and forms, as well as one new rule:

• Appellate Rules 6 and 39;

• Bankruptcy Rules 3002.1 and 8006;

• Bankruptcy Official Forms 410, 410C13-M1, 410C13-M1R, 410C13-N, 410C13-

NR, 410C13-M2, and 410C13-M2R; and

• Civil Rules 16, 26, and new Rule 16.1.

The proposals, supporting materials, and instructions on submitting written comments are

posted on the Judiciary’s website at:

https://www.uscourts.gov/rules-policies/proposed-amendments-published-public-comment

Preliminary Draft of Proposed Amendments | August 2023

Page 2 of 157

Memorandum to the Bench, Bar, and Public

Page 2

Opportunity to Submit Written Comments

Comments concerning the proposals must be submitted electronically no later than

February 16, 2024. Please note that comments are part of the official record and publicly

available.

Opportunity to Appear at Public Hearings

On the following dates, the advisory committees will conduct public hearings on the

proposals either virtually or in person:

• Appellate Rules on October 18, 2023, and January 24, 2024;

• Bankruptcy Rules on January 12, 2024, and January 19, 2024; and

• Civil Rules on October 16, 2023, January 16, 2024, and February 6, 2024.

If you wish to appear and present testimony regarding a proposed rule or form, you must

notify the office of Rules Committee Staff at least 30 days before the scheduled hearing by

emailing RulesCommittee_Secretary@ao.uscourts.gov. Hearings are subject to cancellation due

to lack of requests to testify.

At this time, the Standing Committee has only approved the proposals for publication and

comment. After the public comment period closes, all comments will be carefully considered by

the relevant advisory committee as part of its consideration of whether to proceed with a proposal.

Under the Rules Enabling Act, 28 U.S.C. §§ 2072-2077, if any of the published proposals

are later approved, with or without revision, by the relevant advisory committee, the next steps are

approval by the Standing Committee and the Judicial Conference, and then adoption by the

Supreme Court. If adopted by the Court and transmitted to Congress by May 1, 2025, absent

congressional action, the proposals would take effect on December 1, 2025.

If you have questions about the rulemaking process or pending rules amendments, please

contact the Rules Committee Staff at 202-502-1820 or visit https://www.uscourts.gov/rules-

policies.

Preliminary Draft of Proposed Amendments | August 2023

Page 3 of 157

TABLE OF CONTENTS

Page

PART I: FEDERAL RULES OF APPELLATE

PROCEDURE

Excerpt from the Report of the Advisory Committee on

Appellate Rules (May 2023) ............................................................. 6

Rule 6. Appeal in a Bankruptcy Case ............................. 26

Rule 39. Costs ................................................................... 47

PART II: FEDERAL RULES OF BANKRUPTCY

PROCEDURE

Excerpt from the Report of the Advisory Committee on

Bankruptcy Rules (December 2022) ............................................... 54

Excerpt from the Report of the Advisory Committee on

Bankruptcy Rules (May 2023) ........................................................ 56

Rule 3002.1. Notice Relating to Claims Secured by a Security

Interest in the Debtor’s Principal Residence in

a Chapter 13 Case............................................... 61

Rule 8006. Request for Leave to Take a Direct Appeal to a

Court of Appeals After Certification ................. 80

Official Bankruptcy Forms

Form 410. Proof of Claim .................................................... 82

Form 410C13- Motion Under Rule 3002.1(f)(1) to Determine

M1 the Status of the Mortgage Claim ...................... 88

Form 410C13- Response to Motion Under Rule 3002.1(f)(1) to

M1R Determine the Status of the Mortgage Claim ..... 90

Form 410C13-N Trustee’s Notice of Payments Made .................. 93

Form 410C13- Response to Trustee’s Notice of Payments

NR Made ................................................................... 95

Form 410C13- Motion Under Rule 3002.1(g)(4) to Determine

M2 Final Cure and Payment of Mortgage Claim…...98

Preliminary Draft of Proposed Amendments | August 2023

Page 4 of 157

TABLE OF CONTENTS

Page

Form 410C13- Response to Motion to Determine Final Cure

M2R and Payment of Mortgage Claim ..................... 100

PART III: FEDERAL RULES OF CIVIL PROCEDURE

Excerpt from the Report of the Advisory Committee on

Civil Rules (May 2023) ................................................................. 106

Rule 16. Pretrial Conferences; Scheduling; Management ... 120

Rule 16.1. Multidistrict Litigation .......................................... 123

Rule 26. Duty to Disclose; General Provisions Governing

Discovery .............................................................. 137

APPENDIX:

Procedures for Committees on Rules

of Practice and Procedure ............................................................ 142

List of Committee Members ........................................................ 147

Preliminary Draft of Proposed Amendments | August 2023

Page 5 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

COMMITTEE ON RULES OF PRACTICE AND PROCEDURE

OF THE

JUDICIAL CONFERENCE OF THE UNITED STATES

WASHINGTON, D.C. 20544

JOHN D. BATES

CHAIR

H. THOMAS BYRON III

SECRETARY

CHAIRS OF ADVISORY COMMITTEES

JAY S. BYBEE

APPELLATE RULES

REBECCA B. CONNELLY

BANKRUPTCY RULES

ROBIN L. ROSENBERG

CIVIL RULES

JAMES C. DEVER III

CRIMINAL RULES

PATRICK J. SCHILTZ

EVIDENCE RULES

MEMORANDUM

TO: Hon. John D. Bates, Chair

Committee on Rules of Practice and Procedure

FROM: Judge Jay Bybee, Chair

Advisory Committee on Appellate Rules

RE: Report of the Advisory Committee on Appellate Rules

DATE: May 11, 2023

*

_____________________________________________________________________________

I. Introduction

The Advisory Committee on Appellate Rules met on Wednesday, March 29,

2023, in West Palm Beach, Florida. * * *

* * * * *

*

Revised to incorporate changes that were made by the Committee on Rules of Practice and

Procedure (Standing Committee) at its June 6, 2023 meeting.

Preliminary Draft of Proposed Amendments | August 2023

Page 6 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

It also seeks publication of two proposed amendments, one to Rule 39, dealing

with costs on appeal, and one to Rule 6, dealing with appeals in bankruptcy cases.

(Part III of this report.)

* * * * *

III. Action Items for Approval for Publication

A. Costs on Appeal (21-AP-D)

Rule 39 governs costs on appeal. Some costs are taxable in the court of appeals,

while others are taxable in the district court. In City of San Antonio v. Hotels.com,

141 S. Ct. 1628 (2021), the Supreme Court held that Rule 39 does not permit a district

court to alter a court of appeals’ allocation of costs, even those costs that are taxed by

the district court. The Court also observed that “the current Rules and the relevant

statutes could specify more clearly the procedure that such a party should follow to

bring their arguments to the court of appeals.” Id. at 1638.

The Advisory Committee seeks publication of proposed amendments to Rule

39. The proposal is designed to accomplish several things:

First, it clarifies the distinction between (1) the court of appeals deciding which

parties must bear the costs and, if appropriate, in what percentages and (2) the court

of appeals, the district court (or the clerk of either) calculating and taxing the dollar

amount of costs upon the proper party or parties. It uses the term “allocated” for the

former and the term “taxed” for the latter. Rule 39(a) established default rules for the

allocation of costs; these default rules can be displaced by party agreement or court

order.

Second, it codifies the holding in Hotels.com, providing that the allocation of

costs by the court of appeals applies to both the costs taxable in the court of appeals

and the costs taxable in the district court.

Third, it responds to the need identified in Hotels.com for a clearer procedure

that a party should follow if it wants to ask the court of appeals to reconsider the

allocation of costs. It does this by providing for a motion for reconsideration of the

allocation. To prevent delay, it provides that the mandate must not be delayed while

awaiting determination of such a motion for reconsideration while making clear that

the court of appeals retains jurisdiction to decide the motion.

Fourth, it makes Rule 39’s structure more parallel. The current Rule lists the

costs taxable in the district court but not the costs taxable in the court of appeals.

The proposed amendment lists the costs taxable in the court of appeals.

The proposal does not, however, deal with one significant issue. Most costs on

appeal are modest. The Advisory Committee learned that some parties do not even

Preliminary Draft of Proposed Amendments | August 2023

Page 7 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

bother to file bills of costs because the price of lawyer time to do so exceeds the value

of the costs themselves. But one cost on appeal—indeed, the cost involved in

Hotels.com—can be quite significant: the premium paid for a supersedeas bond.

Because of the bond premium, the bill of costs in Hotels.com was for more than $2.3

million.

The Advisory Committee was unable to come up with a good way to make sure

that the judgment winner in the district court is aware of the cost of the supersedeas

bond early enough to ask the court of appeals to reallocate the costs. Allowing a party

to move for reallocation in the court of appeals after the bill of costs is filed in the

district court would mean that both courts are dealing with the same costs issue at

the same time. Creating a long period to seek reallocation in the court of appeals

would mean that the case would be less fresh in the judges’ minds and begin to look

like a wholly separate appeal. Requiring disclosure in the bill of costs filed in the

court of appeals would be odd because those costs are not sought in the court of

appeals. Plus, a party might forego the relatively minor costs taxable in the court of

appeals and care only about costs taxable in the district court. It would be possible to

have the court of appeals tax the costs itself, but that would be a major departure

from the principle, endorsed by the Supreme Court in Hotels.com, that the court

closest to the cost should tax it.

For this reason, the Appellate Rules Committee believes that the easiest and

most obvious time for disclosure is when the bond is before the district court for

approval. It has requested the Civil Rules Committee to consider amending Civil Rule

62 to require that disclosure.

Even without such an amendment to Civil Rule 62, however, the Appellate

Rules Committee believes that the following proposed amendment to Appellate Rule

39 is worthwhile and therefore asks the Standing Committee to publish it for public

comment. The proposal has been revised since the Advisory Committee’s March 2023

meeting in accordance with the suggestions of the style consultants.

Preliminary Draft of Proposed Amendments | August 2023

Page 8 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

Rule 39. Costs 1

(a) Against Whom AssessedAllocating Costs Among the Parties. The 2

following rules apply to allocating costs among the parties unless the law 3

provides, the parties agree, or the court orders otherwise: 4

(1) if an appeal is dismissed, costs are taxed allocated against the appellant; 5

(2) if a judgment is affirmed, costs are taxed allocated against the appellant; 6

(3) if a judgment is reversed, costs are taxed allocated against the appellee; 7

(4) if a judgment is affirmed in part, reversed in part, modified, or vacated, 8

each party bears its own costs costs are taxed only as the court orders. 9

(b) Reconsideration. Once the allocation of costs is established by the entry of 10

judgment, a party may seek reconsideration of that allocation by filing a 11

motion in the court of appeals within 14 days after the entry of judgment. But 12

issuance of the mandate under Rule 41 must not be delayed awaiting a 13

determination of the motion. The court of appeals retains jurisdiction to decide 14

the motion after the mandate issues. 15

(c) Costs Governed by Allocation Determination. The allocation of costs 16

applies both to costs taxable in the court of appeals under (e) and to costs 17

taxable in district court under (f). 18

(b)(d) Costs For and Against the United States. Costs for or against the United 19

States, its agency, or officer will be assessed allocated under Rule 39(a) only if 20

authorized by law. 21

(e) Costs on Appeal Taxable in the Court of Appeals. 22

(1) Costs Taxable. The following costs on appeal are taxable in the court 23

of appeals for the benefit of the party entitled to costs: 24

(A) the production of necessary copies of a brief or appendix, or copies 25

of records authorized by Rule 30(f); 26

(B) the docketing fee; and 27

(C) a filing fee paid in the court of appeals. 28

(c)(2) Costs of Copies. Each court of appeals must, by local rule, setfix the 29

maximum rate for taxing the cost of producing necessary copies of a brief 30

or appendix, or copies of records authorized by Rule 30(f). The rate must 31

not exceed that generally charged for such work in the area where the 32

Preliminary Draft of Proposed Amendments | August 2023

Page 9 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

clerk’s office is located and should encourage economical methods of 33

copying. 34

(d)(3) Bill of Costs; Objections; Insertion in Mandate. 35

(1)(A) A party who wants costs taxed in the court of appeals must—36

within 14 days after entry of judgment is entered—file with the 37

circuit clerk and serve an itemized and verified bill of those costs. 38

(2)(B) Objections must be filed within 14 days after service of the bill of 39

costs is served, unless the court extends the time. 40

(3)(C) The clerk must prepare and certify an itemized statement of costs 41

for insertion in the mandate, but issuance of the mandate must 42

not be delayed for taxing costs. If the mandate issues before costs 43

are finally determined, the district clerk must—upon the circuit 44

clerk’s request—add the statement of costs, or any amendment of 45

it, to the mandate. 46

(e)(f) Costs on Appeal Taxable in the District Court. The following costs on 47

appeal are taxable in the district court for the benefit of the party entitled to 48

costs under this rule: 49

(1) the preparation and transmission of the record; 50

(2) the reporter’s transcript, if needed to determine the appeal; 51

(3) premiums paid for a bond or other security to preserve rights pending 52

appeal; and 53

(4) the fee for filing the notice of appeal. 54

Committee Note 55

In City of San Antonio v. Hotels.com, 141 S. Ct. 1628 (2021), the Supreme Court 56

held that Rule 39 does not permit a district court to alter a court of appeals’ allocation 57

of the costs listed in subdivision (e) of that Rule. The Court also observed that “the 58

current Rules and the relevant statutes could specify more clearly the procedure that 59

such a party should follow to bring their arguments to the court of appeals.” Id. at 60

1638. The amendment does so. Stylistic changes are also made. 61

Subdivision (a). Both the heading and the body of the Rule are amended to 62

clarify that allocation of the costs among the parties is done by the court of appeals. 63

The court may allow the default rules specified in subdivision (a) to operate based on 64

the judgment, or it may allocate them differently based on the equities of the 65

situation. Subdivision (a) is not concerned with calculating the amounts owed; it is 66

Preliminary Draft of Proposed Amendments | August 2023

Page 10 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

concerned with who bears those costs, and in what proportion. The amendment also 67

specifies a default for mixed judgments: each party bears its own costs. 68

Subdivision (b). The amendment specifies a procedure for a party to ask the 69

court of appeals to reconsider the allocation of costs established pursuant to 70

subdivision (a). A party may do so by motion in the court of appeals within 14 days 71

after the entry of judgment. The mandate is not stayed pending resolution of this 72

motion, but the court of appeals retains jurisdiction to decide the motion after the 73

mandate issues. 74

Subdivision (c). Codifying the decision in Hotels.com, the amendment also 75

makes clear that the allocation of costs by the court of appeals governs the taxation 76

of costs both in the court of appeals and in the district court. 77

Subdivision (d). The amendment uses the word “allocated” to match 78

subdivision (a). 79

Subdivision (e). The amendment specifies which costs are taxable in the 80

court of appeals and clarifies that the procedure in that subdivision governs the 81

taxation of costs taxable in the court of appeals. The docketing fee, currently $500, is 82

established by the Judicial Conference of the United States pursuant to 28 U.S.C. § 83

1913. The reference to filing fees paid in the court of appeals is not a reference to the 84

$5 fee paid to the district court required by 28 U.S.C. § 1917 for filing a notice of 85

appeal from the district court to the court of appeals. Instead, the reference is to filing 86

fees paid in the court of appeals, such as the fee to file a notice of appeal from a 87

bankruptcy appellate panel. 88

Subdivision (f). The provisions governing costs taxable in the district court 89

are lettered (f) rather than (e). The filing fee referred to in this subdivision is the $5 90

fee required by 28 U.S.C. § 1917 for filing a notice of appeal from the district court to 91

the court of appeals. 92

B. Appeals in Bankruptcy Cases

The Advisory Committee on Bankruptcy Rules has asked the Advisory

Committee on Appellate Rules to consider amendments to Appellate Rule 6 dealing

with appeals in bankruptcy cases. Two different concerns led to this request.

Resetting time to appeal. The first concern involves resetting the time to

appeal in cases where a district court is exercising original jurisdiction in a

bankruptcy case. Federal Rule of Appellate Procedure 4(a)(4)(A) resets the time to

appeal if various post-judgment motions are timely made in the district court. To be

timely in an ordinary civil case, the motion must be made within 28 days of the

judgment. Fed. R. Civ. P. 50(b), 52(b), 59. But in a bankruptcy case, the equivalent

Preliminary Draft of Proposed Amendments | August 2023

Page 11 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

motions must be made within 14 days of the judgment. Fed. R. Bankr. P. 7052,

9015(c), 9023.

So what happens if a district court itself—rather than a bankruptcy court—

decides a bankruptcy proceeding in the first instance and a post-judgment motion is

made on the 20

th

day after judgment? Does the motion have resetting effect or not?

The Court of Appeals for the First Circuit has said no. In re Lac-Mégantic Train

Derailment Litigation, 999 F.3d 72, 84 (1

st

Cir. 2021). The Bankruptcy Rules and their

time limits apply to a bankruptcy case heard in the district court.

This result, while sensible, is not obvious from the text of the Federal Rules of

Appellate Procedure. That’s because Rule 6 provides:

(a) Appeal From a Judgment, Order, or Decree of a District

Court Exercising Original Jurisdiction in a Bankruptcy Case. An

appeal to a court of appeals from a final judgment, order, or decree of a

district court exercising jurisdiction under 28 U.S.C. §1334 is taken as

any other civil appeal under these rules.

And Rule 4(a)(4)(A) gives resetting effect to motions that are filed “within the time

allowed” by “the Federal Rules of Civil Procedure”—which is 28 days, not 14 days .

The Bankruptcy Rules Committee considered amending Bankruptcy Rules

7052, 9015(c), and 9023 to provide 28 days for the motions if the proceeding is heard

by the district court, but that would undermine the goal of expedition and disrupt the

uniformity of bankruptcy rules. It considered asking the Appellate Rules Committee

to consider amending Appellate Rule 4(a)(4)(A) to acknowledge the different timing

rules, but that would complicate an already quite complicated rule with material that

doesn’t apply to non-bankruptcy cases. It settled on asking the Appellate Rules

Committee to consider amending Appellate Rule 6(a)—the rule that deals with

bankruptcy appeals where the district court exercised original jurisdiction—to

acknowledge the different timing rules.

The Appellate Rules Committee agreed.

*

It proposes to add a sentence to

Appellate Rule 6(a): “But the reference in Rule 4(a)(4)(A) to the time allowed for

motions under certain Federal Rules of Civil Procedure must be read as a reference

to the time allowed for the equivalent motions under the applicable Federal Rule of

Bankruptcy Procedure, which may be shorter than the time allowed under the Civil

Rules.” The Committee Note provides a table of the equivalent motions and the time

allowed under the current version of the applicable Bankruptcy Rule.

*

At the meeting, the Committee agreed in principle and asked the subcommittee to refine

the language and provide a Committee Note for its consideration by email. The subcommittee

did so, and the full Advisory Committee without dissent approved the proposal below.

Preliminary Draft of Proposed Amendments | August 2023

Page 12 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

Direct appeals. The second concern involves direct appeals in bankruptcy

cases. Appeals in bankruptcy are governed by 28 U.S.C. § 158. The default rule for

appeals from an order of the bankruptcy court is that such appeals go either to the

district court for the district where the bankruptcy court is located or (in the circuits

that have established a bankruptcy appellate panel (BAP)) to the BAP for that circuit.

Under § 158, the losing party then has a further appeal as of right to the court of

appeals from a final judgment of the district court or BAP.

The bankruptcy appeal process thus creates a redundancy whenever an appeal

is taken to the court of appeals under § 158(d)(1), and the two-tiered procedure can

be quite time-consuming. That can be problematic in the bankruptcy context, where

quick resolution of the parties’ disputes is sometimes critical.

In response to these concerns, as part of the Bankruptcy Abuse Prevention and

Consumer Protection Act of 2005 (BAPCPA), Congress amended § 158(d) to provide

that, in certain circumstances, appeals may be taken directly from orders of the

bankruptcy court to the courts of appeals, bypassing the intervening appeal to the

district court or BAP. To do so, Congress added § 158(d)(2), which provides:

(A) The appropriate court of appeals shall have jurisdiction of appeals

described in the first sentence of subsection (a) if the bankruptcy court,

the district court, or the bankruptcy appellate panel involved, acting on

its own motion or on the request of a party to the judgment, order, or

decree described in such first sentence, or all the appellants and

appellees (if any) acting jointly, certify that—

(i) the judgment, order, or decree involves a question of law as

to which there is no controlling decision of the court of

appeals for the circuit or of the Supreme Court of the United

States, or involves a matter of public importance;

(ii) the judgment, order, or decree involves a question of law

requiring resolution of conflicting decisions; or

(iii) an immediate appeal from the judgment, order, or decree

may materially advance the progress of the case or

proceeding in which the appeal is taken;

and if the court of appeals authorizes the direct appeal of the judgment,

order, or decree.

(B) If the bankruptcy court, the district court, or the bankruptcy appellate

panel—

Preliminary Draft of Proposed Amendments | August 2023

Page 13 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

(i) on its own motion or on the request of a party, determines that a

circumstance specified in clause (i), (ii), or (iii) of subparagraph

(A) exists; or

(ii) receives a request made by a majority of the appellants and a

majority of appellees (if any) to make the certification described

in subparagraph (A);

then the bankruptcy court, the district court, or the bankruptcy

appellate panel shall make the certification described in subparagraph

(A).

(C) The parties may supplement the certification with a short statement of

the basis for the certification.

(D) An appeal under this paragraph does not stay any proceeding of the

bankruptcy court, the district court, or the bankruptcy appellate panel

from which the appeal is taken, unless the respective bankruptcy court,

district court, or bankruptcy appellate panel, or the court of appeals in

which the appeal is pending, issues a stay of such proceeding pending

the appeal.

(E) Any request under subparagraph (B) for certification shall be made not

later than 60 days after the entry of the judgment, order, or decree.

28 U.S.C. § 158(d)(2).

Under this statute, any order of the bankruptcy court—final or interlocutory—

can be certified for direct appeal to the court of appeals if it meets the remaining

statutory requirements. Those requirements are similar to, but looser than, the

standards for certification under 28 U.S.C. § 1292(b), which permits courts of appeals

to hear appeals of interlocutory orders of the district courts in certain circumstances.

Moreover, the certification can be made by the bankruptcy court, district court, BAP,

or the parties. Under the Bankruptcy Rules, even if a bankruptcy court order has

been certified for direct appeal to the court of appeals, the appellant must still file a

notice of appeal to the district court or BAP in order to render the certification

effective. As with § 1292(b), the court of appeals must also authorize the direct appeal.

Under this structure, a court of appeals’ decision to authorize a direct appeal

does not determine whether an appeal will go forward, but instead in what court the

appeal will be heard. The party asking that the appeal from the bankruptcy court be

heard directly in the court of appeals might be an appellee rather than an appellant.

Accordingly, the Bankruptcy Rules Committee seeks a clarifying amendment to

Bankruptcy Rule 8006(g) providing that any party to the appeal may file a request

that the court of appeals authorize a direct appeal:

Preliminary Draft of Proposed Amendments | August 2023

Page 14 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

(g) Request After Certification for a Court of Appeals To

Authorize a Direct Appeal.

Within 30 days after the certification has become effective under

(a), any party to the appeal may ask the court of appeals to authorize a

direct appeal by filing a petition with the circuit clerk in accordance with

Fed. R. App. P. 6(c).

Current Appellate Rule 6(c), which governs direct appeals, largely relies on

Rule 5, which governs appeals by permission. But the proposed amendment to the

Bankruptcy Rules revealed that Appellate Rule 5 is not a good fit for direct appeals

in bankruptcy cases. That’s because Rule 5 was designed for the situation in which

the court of appeals is deciding whether to allow an appeal at all. But in the direct

appeal context, that’s not the question. Instead, in the direct appeal context, there is

an appeal; the question is which court is going to hear that appeal.

1

More generally, experience with direct appeals shows considerable confusion

in applying the Appellate Rules. This is primarily due to the manner in which Rule

6(c) cross-references Rule 5 and to its failure to take into account that an appeal of

the bankruptcy court order in question is already proceeding in the district court or

BAP, which results in uncertainty about precisely what steps are necessary to perfect

an appeal after the court of appeals authorizes a direct appeal.

For these reasons, the Appellate Rules Committee proposes to overhaul Rule

6(c) and make it largely self-contained. Parties will not need to refer to Rule 5 unless

expressly referred to a specific provision of Rule 5 by Rule 6(c) itself. Rule 6(c) makes

Rule 5 inapplicable except to the extent provided for in other parts of Rule 6(c).

The proposed amendments also spell out in more detail how parties should

handle initial procedural steps in the court of appeals once authorization for a direct

appeal is granted, taking into account that an appeal from the same order will already

be pending in the district court or BAP. The proposed Rule 6(c)(2) permits any party

to the appeal to ask the court of appeals to authorize a direct appeal. It also adds

provisions governing contents of the petition, answer or cross-petition, oral argument,

form of papers, number of copies, and length limits. It also makes clear that no notice

of appeal to the court of appeals needs to be filed, and provides for calculating time,

notification of the order authorizing a direct appeal, and payment of fees. It adds a

provision governing stays pending appeal, makes clear that steps already taken in

1

A caveat: 28 U.S.C. § 158(a)(3) allows appeals from a bankruptcy court to a district court

(or BAP) of otherwise unappealable interlocutory orders with leave of court. Authorization of

a direct appeal under § 158(d)(2) subsumes leave to appeal. Fed. R. Bankr. P. 8004(e). (“If

leave to appeal an interlocutory order or decree is required under 28 U.S.C. § 158(a)(3), an

authorization of a direct appeal by the court of appeals under 28 U.S.C. § 158(d)(2) satisfies

the requirement.”).

Preliminary Draft of Proposed Amendments | August 2023

Page 15 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

pursuing the appeal need not be repeated, and provides for making the record

available to the circuit clerk. It requires all parties, not just the appellant or applicant

for direct appeal, to file a representation statement. Additional changes in language

are made to better match the relevant statutes.

None of these are intended to make major changes to existing procedures but

to clarify those procedures. The proposal has been revised since the Advisory

Committee’s March 2023 meeting in accordance with the suggestions of the style

consultants.

Rule 6. Appeal in a Bankruptcy Case or Proceeding 1

(a) Appeal From a Judgment, Order, or Decree of a District Court 2

Exercising Original Jurisdiction in a Bankruptcy Case or Proceeding. 3

An appeal to a court of appeals from a final judgment, order, or decree of a 4

district court exercising original jurisdiction in a bankruptcy case or 5

proceeding under 28 U.S.C. §1334 is taken as any other civil appeal under 6

these rules. But the reference in Rule 4(a)(4)(A) to the time allowed for motions 7

under certain Federal Rules of Civil Procedure must be read as a reference to 8

the time allowed for the equivalent motions under the applicable Federal Rule

*

9

of Bankruptcy Procedure, which may be shorter than the time allowed under 10

the Civil Rules. 11

(b) Appeal From a Judgment, Order, or Decree of a District Court or 12

Bankruptcy Appellate Panel Exercising Appellate Jurisdiction in a 13

Bankruptcy Case or Proceeding. 14

(1) Applicability of Other Rules. These rules apply to an appeal to a 15

court of appeals under 28 U.S.C. §158(d)(1) from a final judgment, order, 16

or decree of a district court or bankruptcy appellate panel exercising 17

appellate jurisdiction in a bankruptcy case or proceeding under 28 18

U.S.C. §158(a) or (b), but with these qualifications: 19

(A) Rules 4(a)(4), 4(b), 9, 10, 11, 12(c), 13–20, 22–23, and 24(b) do not 20

apply; 21

(B) the reference in Rule 3(c) to “Forms 1A and 1B in the Appendix of 22

Forms” must be read as a reference to Form 5; 23

(C) when the appeal is from a bankruptcy appellate panel, “district 24

court,” as used in any applicable rule, means “bankruptcy 25

appellate panel”; and 26

*

“Rule” was changed to “Rules” by the Standing Committee at its June 6, 2023 meeting.

Preliminary Draft of Proposed Amendments | August 2023

Page 16 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

(D) in Rule 12.1, "district court" includes a bankruptcy court or 27

bankruptcy appellate panel. 28

(2) Additional Rules. In addition to the rules made applicable by Rule 29

6(b)(1), the following rules apply: 30

(A) Motion for Rehearing. 31

(i) If a timely motion for rehearing under Bankruptcy Rule 32

8022 is filed, the time to appeal for all parties runs from 33

the entry of the order disposing of the motion. A notice of 34

appeal filed after the district court or bankruptcy appellate 35

panel announces or enters a judgment, order, or decree—36

but before disposition of the motion for rehearing—37

becomes effective when the order disposing of the motion 38

for rehearing is entered. 39

(ii) If a party intends to challenge the order disposing of the 40

motion—or the alteration or amendment of a judgment, 41

order, or decree upon the motion—then the party, in 42

compliance accordance with Rules 3(c) and 6(b)(1)(B), must 43

file a notice of appeal or amended notice of appeal. The 44

notice or amended notice must be filed within the time 45

prescribed by Rule 4—excluding Rules 4(a)(4) and 4(b)—46

measured from the entry of the order disposing of the 47

motion. 48

(iii) No additional fee is required to file an amended notice. 49

(B) The record on appeal. 50

(i) Within 14 days after filing the notice of appeal, the 51

appellant must file with the clerk possessing the record 52

assembled in accordance with Bankruptcy Rule 8009—and 53

serve on the appellee—a statement of the issues to be 54

presented on appeal and a designation of the record to be 55

certified and made available to the circuit clerk. 56

(ii) An appellee who believes that other parts of the record are 57

necessary must, within 14 days after being served with the 58

appellant's designation, file with the clerk and serve on the 59

appellant a designation of additional parts to be included. 60

(iii) The record on appeal consists of: 61

• the redesignated record as provided above; 62

Preliminary Draft of Proposed Amendments | August 2023

Page 17 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

• the proceedings in the district court or bankruptcy 63

appellate panel; and 64

• a certified copy of the docket entries prepared by the 65

clerk under Rule 3(d). 66

(C) Making the Record Available. 67

(i) When the record is complete, the district clerk or 68

bankruptcy-appellate-panel clerk must number the 69

documents constituting the record and promptly make it 70

available to the circuit clerk. If the clerk makes the record 71

available in paper form, the clerk will not send documents 72

of unusual bulk or weight, physical exhibits other than 73

documents, or other parts of the record designated for 74

omission by local rule of the court of appeals, unless 75

directed to do so by a party or the circuit clerk. If unusually 76

bulky or heavy exhibits are to be made available in paper 77

form, a party must arrange with the clerks in advance for 78

their transportation and receipt. 79

(ii) All parties must do whatever else is necessary to enable the 80

clerk to assemble the record and make it available. When 81

the record is made available in paper form, the court of 82

appeals may provide by rule or order that a certified copy 83

of the docket entries be made available in place of the 84

redesignated record. But at any time during the appeal’s 85

pendency, any party may request at any time during the 86

pendency of the appeal that the redesignated record be 87

made available. 88

(D) Filing the Record. When the district clerk or bankruptcy-89

appellate-panel clerk has made the record available, the circuit 90

clerk must note that fact on the docket. The date as noted on the 91

docket serves as the filing date of the record. The circuit clerk 92

must immediately notify all parties of that the filing date. 93

(c) Direct Appeal Review from a Judgment, Order, or Decree of a 94

Bankruptcy Court by Permission Authorization Under 28 U.S.C. § 95

158(d)(2). 96

(1) Applicability of Other Rules. These rules apply to a direct appeal 97

from a judgment, order, or decree of a bankruptcy court by permission 98

authorization under 28 U.S.C. § 158(d)(2), but with these qualifications: 99

Preliminary Draft of Proposed Amendments | August 2023

Page 18 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

(A) Rules 3–4, 5(a)(3) (except as provided in this subdivision (c)), 6(a), 100

6(b), 8(a), 8(c), 9–12, 13–20, 22–23, and 24(b) do not apply; and 101

(B) as used in any applicable rule, ‘‘district court’’ or ‘‘district clerk’’ 102

includes—to the extent appropriate—a bankruptcy court or 103

bankruptcy appellate panel or its clerk; and 104

(C) the reference to “Rules 11 and 12(c)” in Rule 5(d)(3) must be read 105

as a reference to Rules 6(c)(2)(B) and (C). 106

(2) Additional Rules. In addition to the rules made applicable by (c)(1), 107

the following rules apply: 108

(A) Petition to Authorize a Direct Appeal. Within 30 days after a 109

certification of a bankruptcy court’s order for direct appeal to the 110

court of appeals under 28 U.S.C. § 158(d)(2) becomes effective 111

under Bankruptcy Rule 8006(a), any party to the appeal may ask 112

the court of appeals to authorize a direct appeal by filing a 113

petition with the circuit clerk under Bankruptcy Rule 8006(g). 114

(B) Contents of the Petition. The petition must include the 115

material required by Rule 5(b)(1) and an attached copy of: 116

(i) the certification; and 117

(ii) the notice of appeal of the bankruptcy court’s judgment, order, 118

or decree filed under Bankruptcy Rule 8003 or 8004. 119

(C) Answer or Cross-Petition; Oral Argument. Rule 5(b)(2) 120

governs an answer or cross-petition. Rule 5(b)(3) governs oral 121

argument. 122

(D) Form of Papers; Number of Copies; Length Limits. Rule 123

5(c) governs the required form, number of copies to be filed, and 124

length limits applicable to the petition and any answer or cross-125

petition. 126

(E) Notice of Appeal; Calculating Time. A notice of appeal to the 127

court of appeals need not be filed. The date when the order 128

authorizing the direct appeal is entered serves as the date of the 129

notice of appeal for calculating time under these rules. 130

(F) Notification of the Order Authorizing Direct Appeal; Fees; 131

Docketing the Appeal. 132

Preliminary Draft of Proposed Amendments | August 2023

Page 19 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

(i) When the court of appeals enters the order authorizing the 133

direct appeal, the circuit clerk must notify the bankruptcy 134

clerk and the district court clerk or bankruptcy-appellate-135

panel clerk of the entry. 136

(ii) Within 14 days after the order authorizing the direct 137

appeal is entered, the appellant must pay the bankruptcy 138

clerk any unpaid required fee, including: 139

the fee required for the appeal to the district court 140

or bankruptcy appellate panel; and 141

the difference between the fee for an appeal to the 142

district court or bankruptcy appellate panel and the 143

fee required for an appeal to the court of appeals. 144

(iii) The bankruptcy clerk must notify the circuit clerk once the 145

appellant has paid all required fees. Upon receiving the 146

notice, the circuit clerk must enter the direct appeal on the 147

docket. 148

(G) Stay Pending Appeal. Bankruptcy Rule 8007 applies to any 149

stay pending appeal. 150

(A)(H) The Record on Appeal. Bankruptcy Rule 8009 governs the 151

record on appeal. If a party has already filed a document or 152

completed a step required to assemble the record for the appeal 153

to the district court or bankruptcy appellate panel, the party need 154

not repeat that filing or step. 155

(B)(I) Making the Record Available. Bankruptcy Rule 8010 governs 156

completing the record and making it available. When the court of 157

appeals enters the order authorizing the direct appeal, the 158

bankruptcy clerk must make the record available to the circuit 159

clerk. 160

(C) Stays Pending Appeal. Bankruptcy Rule 8007 applies to stays 161

pending appeal. 162

163

(D)(J) Duties of the Circuit Clerk. When the bankruptcy clerk has 164

made the record available, the circuit clerk must note that fact on 165

the docket. The date as noted on the docket serves as the filing 166

date of the record. The circuit clerk must immediately notify all 167

parties of that the filing date. 168

Preliminary Draft of Proposed Amendments | August 2023

Page 20 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

(E)(K) Filing a Representation Statement. Unless the court of 169

appeals designates another time, within 14 days after entry of the 170

order granting permission to appeal authorizing the direct appeal 171

is entered, the attorney for each party to the appeal the attorney 172

who sought permission must file a statement with the circuit 173

clerk naming the parties that the attorney represents on appeal. 174

Committee Note 175

Subdivision (a). Minor stylistic and clarifying changes are made to 176

subdivision (a). In addition, subdivision (a) is amended to clarify that, when a district 177

court is exercising original jurisdiction in a bankruptcy case or proceeding under 28 178

U.S.C. § 1334, the time in which to file post-judgment motions that can reset the time 179

to appeal under Rule 4(a)(4)(A) is controlled by the Federal Rules of Bankruptcy 180

Procedure, rather than the Federal Rules of Civil Procedure. 181

The Bankruptcy Rules partially incorporate the relevant Civil Rules but in 182

some instances shorten the deadlines for motions set out in the Civil Rules. See Fed. 183

R. Bankr. P. 9015(c) (any renewed motion for judgment under Civil Rule 50(b) must 184

be filed within 14 days of entry of judgment); Fed. R. Bankr. P. 7052 (any motion to 185

amend or make additional findings under Civil Rule 52(b) must be filed within 14 186

days of entry of judgment); Fed. R. Bankr. P. 9023 (any motion to alter or amend the 187

judgment or for a new trial under Civil Rule 59 must be filed within 14 days of entry 188

of judgment). 189

Motions for attorney’s fees in bankruptcy cases or proceedings are governed by 190

Bankruptcy Rule 7054(b)(2)(A), which incorporates without change the 14-day 191

deadline set in Civil Rule 54(d)(2)(B). Under Appellate Rule 4(a)(4)(A)(iii), such a 192

motion resets the time to appeal only if the district court so orders pursuant to Civil 193

Rule 58(e), which is made applicable to bankruptcy cases and proceedings by 194

Bankruptcy Rule 7058. 195

Motions for relief under Civil Rule 60 in bankruptcy cases or proceedings are 196

governed by Bankruptcy Rule 9024. Appellate Rule 4(a)(4)(A)(vi) provides that a 197

motion for relief under Civil Rule 60 resets the time to appeal only if the motion is 198

made within the time allowed for filing a motion under Civil Rule 59. In a bankruptcy 199

case or proceeding, motions under Civil Rule 59 are governed by Bankruptcy Rule 200

9023, which, as noted above, requires such motions to be filed within 14 days of entry 201

of judgment. 202

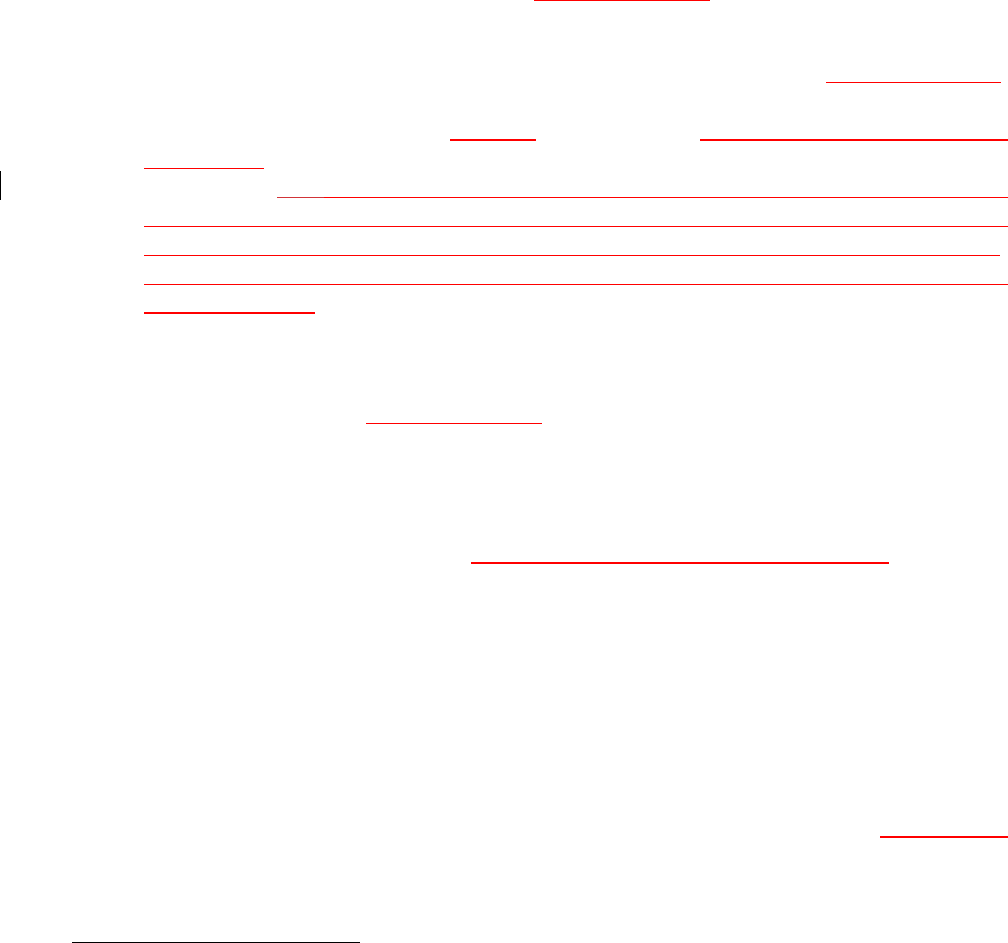

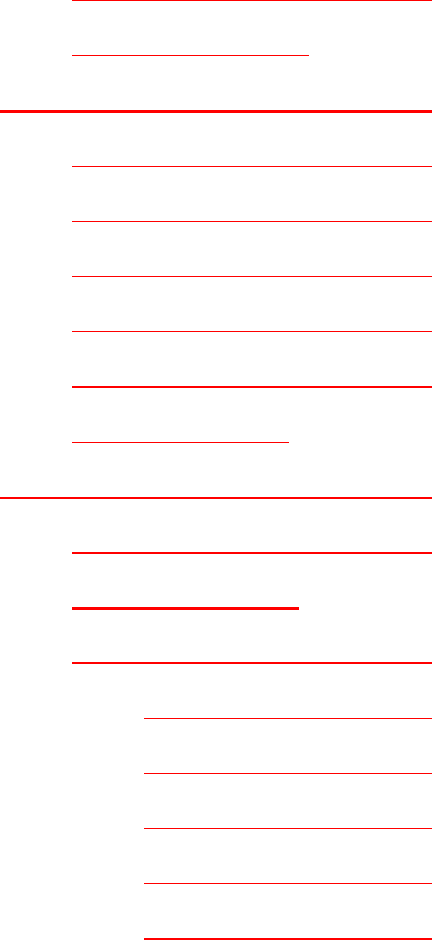

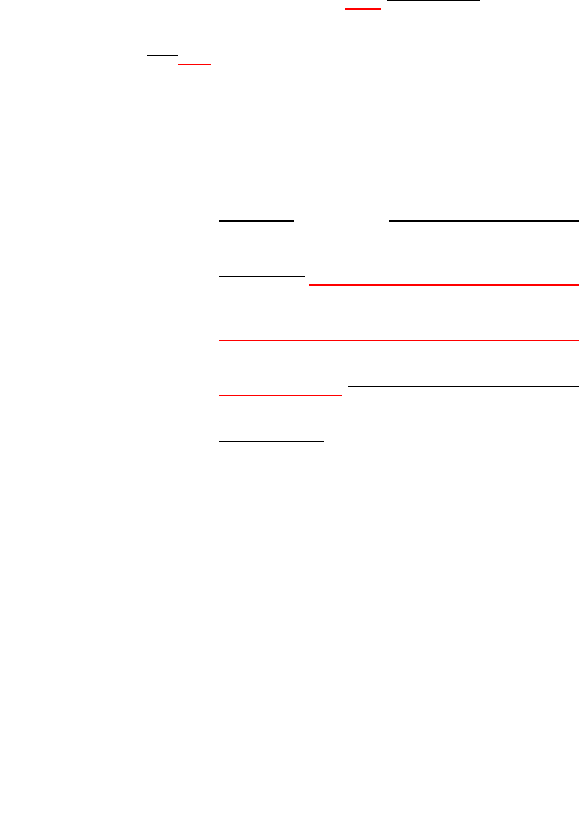

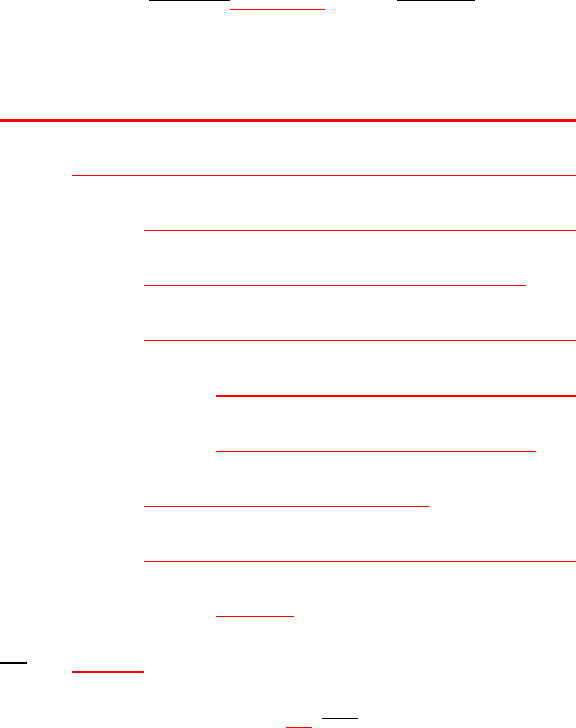

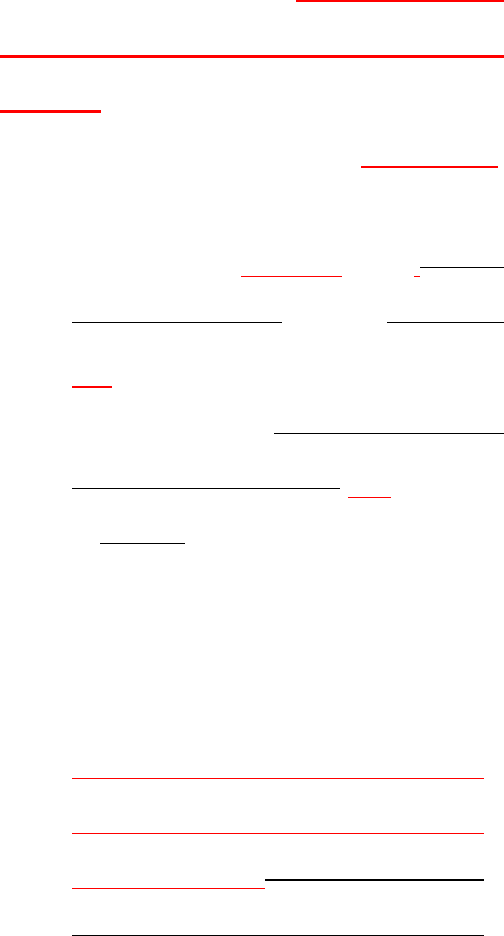

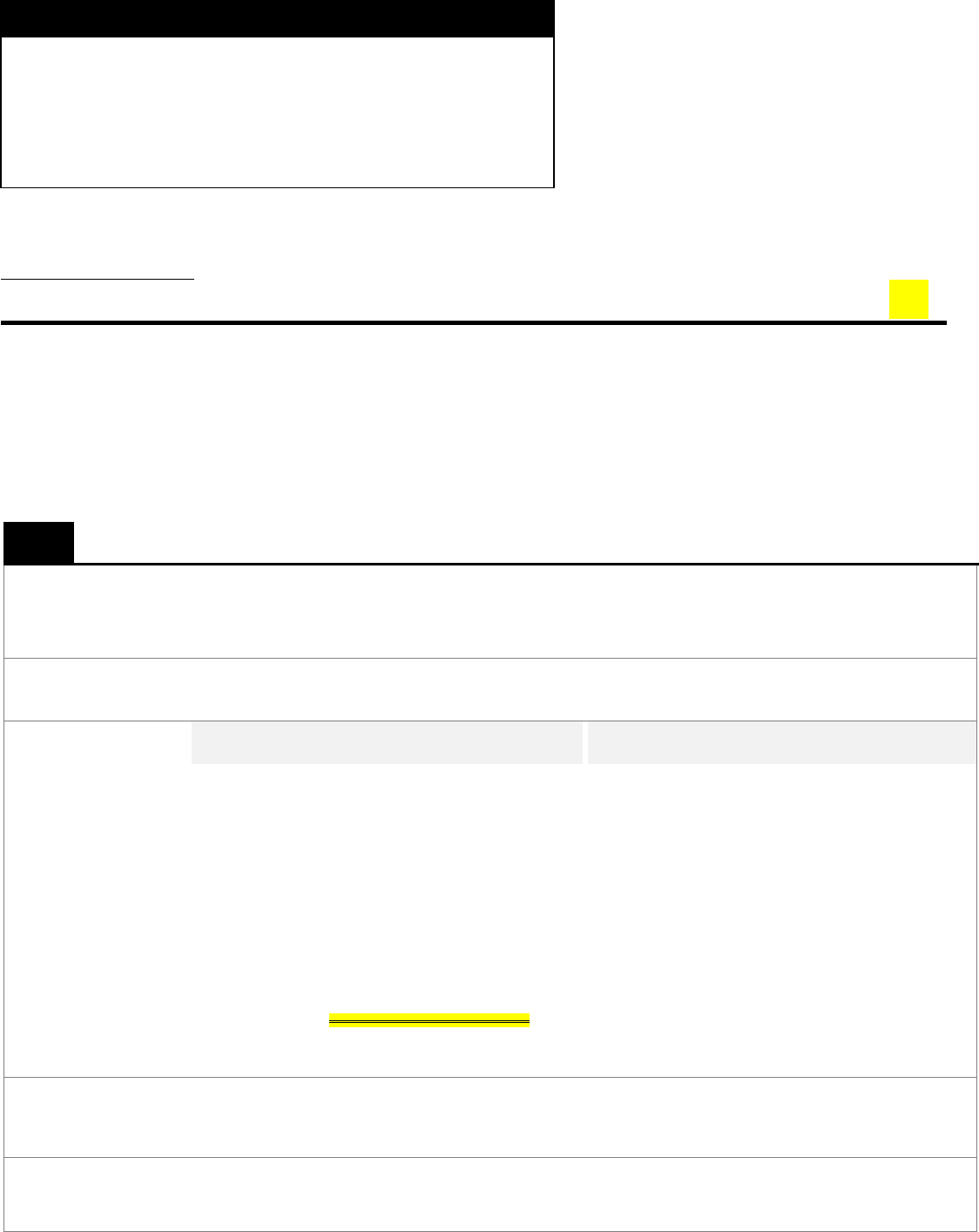

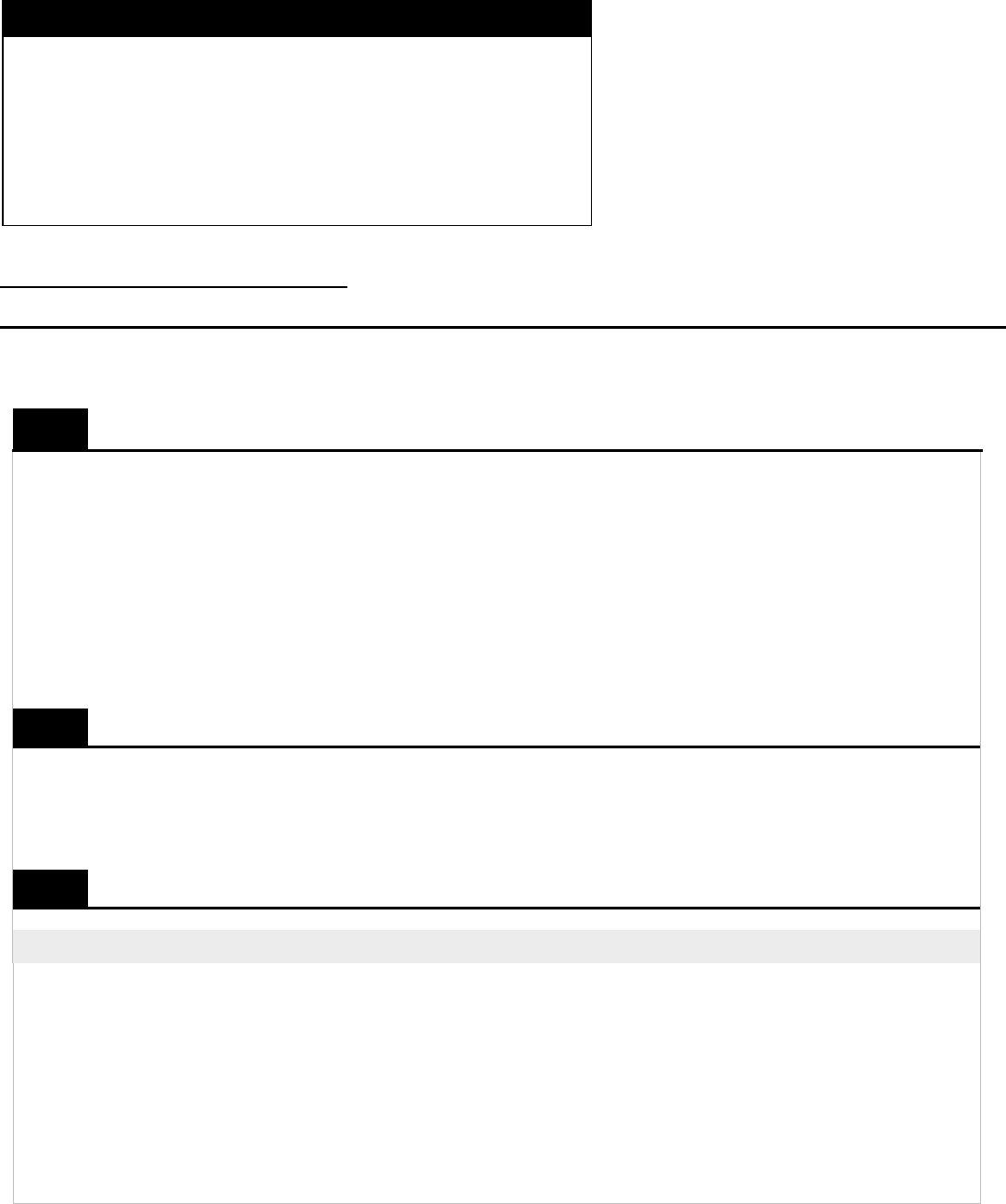

Civil Rule Bankruptcy Rule Time Under Bankruptcy Rule

50(b) 9015(c) 14 days

52(b) 7052 14 days

59 9023 14 days

54(d)(2)(B) 7054(b)(2)(A) 14 days

Preliminary Draft of Proposed Amendments | August 2023

Page 21 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

60 9024 14 days

Of course, the Bankruptcy Rules may be amended in the future. If that 203

happens, the time allowed for the equivalent motions under the applicable 204

Bankruptcy Rule may change. 205

Subdivision (b). Minor stylistic and clarifying changes are made to the 206

header of subdivision (b) and to subdivision (b)(1). Subdivision (b)(1)(C) is amended 207

to correct the omission of the word “bankruptcy” from the phrase “bankruptcy 208

appellate panel.” Stylistic changes are made to subdivision (b)(2)(D).

*

209

Subdivision (c). Subdivision (c) was added to Rule 6 in 2014 to set out 210

procedures governing discretionary direct appeals from orders, judgments, or decrees 211

of the bankruptcy court to the court of appeals under 28 U.S.C. § 158(d)(2). 212

Typically, an appeal from an order, judgment, or decree of a bankruptcy court 213

may be taken either to the district court for the relevant district or, in circuits that 214

have established bankruptcy appellate panels, to the bankruptcy appellate panel for 215

that circuit. 28 U.S.C. § 158(a). Final orders of the district court or bankruptcy 216

appellate panel resolving appeals under § 158(a) are then appealable as of right to 217

the court of appeals under § 158(d)(1). 218

That two-step appeals process can be redundant and time-consuming and 219

could in some circumstances potentially jeopardize the value of a bankruptcy estate 220

by impeding quick resolution of disputes over disposition of estate assets. In the 221

Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, Congress 222

enacted 28 U.S.C. § 158(d)(2) to provide that, in certain circumstances, appeals may 223

be taken directly from orders of the bankruptcy court to the courts of appeals, 224

bypassing the intervening appeal to the district court or bankruptcy appellate panel. 225

Specifically, § 158(d)(2) grants the court of appeals jurisdiction of appeals from 226

any order, judgment, or decree of the bankruptcy court if (a) the bankruptcy court, 227

the district court, the bankruptcy appellate panel, or all parties to the appeal certify 228

that (1) “the judgment, order, or decree involves a question of law as to which there 229

is no controlling decision of the court of appeals for the circuit or of the Supreme Court 230

of the United States, or involves a matter of public importance”; (2) “the judgment, 231

order, or decree involves a question of law requiring resolution of conflicting 232

decisions”; or (3) “an immediate appeal from the judgment, order, or decree may 233

materially advance the progress of the case or proceeding in which the appeal is 234

taken” and (b) “the court of appeals authorizes the direct appeal of the judgment, 235

order, or decree.” 28 U.S.C. § 158(d)(2). 236

*

The Standing Committee removed the “(D)” from the citation for the subsection reference at its June 6,

2023 meeting.

Preliminary Draft of Proposed Amendments | August 2023

Page 22 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

Bankruptcy Rule 8006 governs the procedures for certification of a bankruptcy 237

court order for direct appeal to the court of appeals. Among other things, Rule 8006 238

provides that, to become effective, the certification must be filed in the appropriate 239

court, the appellant must file a notice of appeal of the bankruptcy court order to the 240

district court or bankruptcy appellate panel, and the notice of appeal must become 241

effective. Fed. R. Bankr. P. 8006(a). Once the certification becomes effective under 242

Rule 8006(a), a petition seeking authorization of the direct appeal must be filed with 243

the court of appeals within 30 days. Id. 8006(g). 244

Rule 6(c) governs the procedures applicable to a petition for authorization of a 245

direct appeal and, if the court of appeals grants the petition, the initial procedural 246

steps required to prosecute the direct appeal in the court of appeals. 247

As promulgated in 2014, Rule 6(c) incorporated by reference most of Rule 5, 248

which governs petitions for permission to appeal to the court of appeals from 249

otherwise non-appealable district court orders. It has become evident over time, 250

however, that Rule 5 is not a perfect fit for direct appeals of bankruptcy court orders 251

to the courts of appeals. The primary difference is that Rule 5 governs discretionary 252

appeals from district court orders that are otherwise non-appealable, and an order 253

granting a petition for permission to appeal under Rule 5 thus initiates an appeal 254

that otherwise would not occur. By contrast, an order granting a petition to authorize 255

a direct appeal under Rule 6(c) means that an appeal that has already been filed and 256

is pending in the district court or bankruptcy appellate panel will instead be heard 257

in the court of appeals. As a result, it is not always clear precisely how to apply the 258

provisions of Rule 5 to a Rule 6(c) direct appeal. 259

The new amendments to Rule 6(c) are intended to address that problem by 260

making Rule 6(c) self-contained. Thus, Rule 6(c)(1) is amended to provide that Rule 5 261

is not applicable to Rule 6(c) direct appeals except as specified in Rule 6(c) itself. Rule 262

6(c)(2) is also amended to include the substance of applicable provisions of Rule 5, 263

modified to apply more clearly to Rule 6(c) direct appeals. In addition, stylistic and 264

clarifying amendments are made to conform to other provisions of the Appellate Rules 265

and Bankruptcy Rules and to ensure that all the procedures governing direct appeals 266

of bankruptcy court orders are as clear as possible to both courts and practitioners. 267

Subdivision (c)—Title. The title of subdivision (c) is amended to change 268

“Direct Review” to “Direct Appeal” and “Permission” to “Authorization,” to be 269

consistent with the language of 28 U.S.C. § 158(d)(2). In addition, the language “from 270

a Judgment, Order, or Decree of a Bankruptcy Court” is added for clarity and to be 271

consistent with other subdivisions of Rule 6. 272

Subdivision (c)(1). The language of the first sentence is amended to be 273

consistent with the title of subdivision (c). In addition, the list of rules in subdivision 274

(c)(1)(A) that are inapplicable to direct appeals is modified to include Rule 5, except 275

as provided in subdivision (c) itself. Subdivision (c)(1)(C), which modified certain 276

Preliminary Draft of Proposed Amendments | August 2023

Page 23 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

language in Rule 5 in the context of direct appeals, is therefore deleted. As set out in 277

more detail below, the provisions of Rule 5 that are applicable to direct appeals have 278

been added, with appropriate modifications to take account of the direct appeal 279

context, as new provisions in subdivision (c)(2). 280

Subdivision (c)(2). The language “to the rules made applicable by (c)(1)” is 281

added to the first sentence for consistency with other subdivisions of Rule 6. 282

Subdivision (c)(2)(A). Subdivision (c)(2)(A) is a new provision that sets out 283

the basic procedure and timeline for filing a petition to authorize a direct appeal in 284

the court of appeals. It is intended to be substantively identical to Bankruptcy Rule 285

8006(g), with minor stylistic changes made in light of the context of the Appellate 286

Rules. 287

Subdivision (c)(2)(B). Subdivision (c)(2)(B) is a new provision that specifies 288

the contents of a petition to authorize a direct appeal. It provides that, in addition to 289

the material required by Rule 5, the petition must include an attached copy of the 290

certification under § 158(d)(2) and a copy of the notice of appeal to the district court 291

or bankruptcy appellate panel. 292

Subdivision (c)(2)(C). Subdivision (c)(2)(C) is a new provision. For clarity, it 293

specifies that answers or cross-petitions are governed by Rule 5(b)(2) and oral 294

argument is governed by Rule 5(b)(3). 295

Subdivision (c)(2)(D). Subdivision (c)(2)(D) is a new provision. For clarity, 296

it specifies that the required form, number of copies to be filed, and length limits 297

applicable to the petition and any answer or cross-petition are governed by Rule 5(c). 298

Subdivision (c)(2)(E). Subdivision (c)(2)(E) is a new provision that 299

incorporates the substance of Rule 5(d)(2), modified to take into account that the 300

appellant will already have filed a notice of appeal to the district court or bankruptcy 301

appellate panel. It makes clear that a second notice of appeal to the court of appeals 302

need not be filed, and that the date of entry of the order authorizing the direct appeal 303

serves as the date of the notice of appeal for the purpose of calculating time under the 304

Appellate Rules. 305

Subdivision (c)(2)(F). Subdivision (c)(2)(F) is a new provision. It largely 306

incorporates the substance of Rules 5(d)(1)(A) and 5(d)(3), with some modifications. 307

Subdivision (c)(2)(F)(i) now requires that when the court of appeals enters an 308

order authorizing a direct appeal, the circuit clerk must notify the bankruptcy clerk 309

and the clerk of the district court or the clerk of the bankruptcy appellate panel of the 310

order. 311

Subdivision (c)(2)(F)(ii) requires that, within 14 days of entry of the order 312

authorizing the direct appeal, the appellant must pay the bankruptcy clerk any 313

Preliminary Draft of Proposed Amendments | August 2023

Page 24 of 157

Excerpt from the May 11, 2023 Report of the Advisory Committee on Appellate Rules

(revised July 14, 2023)

required filing or docketing fees that have not yet been paid. Thus, if the appellant 314

has not yet paid the required fee for the initial appeal to the district court or 315

bankruptcy appellate panel, the appellant must do so. In addition, the appellant 316

must pay the bankruptcy clerk the difference between the fee for the appeal to the 317

district court or bankruptcy appellate panel and the fee for an appeal to the court of 318

appeals, so that the appellant has paid the full fee required for an appeal to the court 319

of appeals. 320

Subdivision (c)(2)(F)(iii) then requires the bankruptcy clerk to notify the circuit 321

clerk that all fees have been paid, which triggers the circuit clerk’s duty to docket the 322

direct appeal. 323

Subdivision (c)(2)(G). Subdivision (c)(2)(G) was formerly subdivision 324

(c)(2)(C). It is substantively unchanged, continuing to provide that Bankruptcy Rule 325

8007 governs stays pending appeal, but reflects minor stylistic revisions. 326

Subdivision (c)(2)(H). Subdivision (c)(2)(H) was formerly subdivision 327

(c)(2)(A). It continues to provide that Bankruptcy Rule 8009 governs the record on 328

appeal, but adds a sentence clarifying that steps taken to assemble the record under 329

Bankruptcy Rule 8009 before the court of appeals authorizes the direct appeal need 330

not be repeated after the direct appeal is authorized. 331

Subdivision (c)(2)(I). Subdivision (c)(2)(I) was formerly subdivision (c)(2)(B). 332

It continues to provide that Bankruptcy Rule 8010 governs provision of the record to 333

the court of appeals. It adds a sentence clarifying that when the court of appeals 334

authorizes the direct appeal, the bankruptcy clerk must make the record available to 335

the court of appeals. 336

Subdivision (c)(2)(J). Subdivision (c)(2)(J) was formerly subdivision 337

(c)(2)(D). It is unchanged other than a stylistic change and being renumbered. 338

Subdivision (c)(2)(K). Subdivision (c)(2)(K) was formerly subdivision 339

(c)(2)(E). Because any party may file a petition to authorize a direct appeal, it is 340

modified to provide that the attorney for each party—rather than only the attorney 341

for the party filing the petition—must file a representation statement. In addition, 342

the phrase “granting permission to appeal” is changed to “authorizing the direct 343

appeal” to conform to the language used throughout the rest of subdivision (c), and a 344

stylistic change is made. 345

* * * * *

Preliminary Draft of Proposed Amendments | August 2023

Page 25 of 157

PROPOSED AMENDMENTS TO THE

FEDERAL RULES OF APPELLATE PROCEDURE

1

Rule 6. Appeal in a Bankruptcy Case or 1

Proceeding 2

(a) Appeal From a Judgment, Order, or Decree of a 3

District Court Exercising Original Jurisdiction in 4

a Bankruptcy Case or Proceeding. An appeal to a 5

court of appeals from a final judgment, order, or 6

decree of a district court exercising original 7

jurisdiction in a bankruptcy case or proceeding under 8

28 U.S.C. § 1334 is taken as any other civil appeal 9

under these rules. But the reference in 10

Rule 4(a)(4)(A) to the time allowed for motions 11

under certain Federal Rules of Civil Procedure must 12

be read as a reference to the time allowed for the 13

equivalent motions under the applicable Federal 14

1

New material is underlined in red; matter to be omitted

is lined through.

Preliminary Draft of Proposed Amendments | August 2023

Page 26 of 157

2 FEDERAL RULES OF APPELLATE PROCEDURE

Rules of Bankruptcy Procedure, which may be 15

shorter than the time allowed under the Civil Rules. 16

(b) Appeal From a Judgment, Order, or Decree of a 17

District Court or Bankruptcy Appellate Panel 18

Exercising Appellate Jurisdiction in a 19

Bankruptcy Case or Proceeding. 20

(1) Applicability of Other Rules. These rules 21

apply to an appeal to a court of appeals under 22

28 U.S.C. § 158(d)(1) from a final judgment, 23

order, or decree of a district court or 24

bankruptcy appellate panel exercising 25

appellate jurisdiction in a bankruptcy case or 26

proceeding under 28 U.S.C. § 158(a) or (b), 27

but with these qualifications: 28

* * * * * 29

(C) when the appeal is from a bankruptcy 30

appellate panel, ‘‘district court,’’ as 31

Preliminary Draft of Proposed Amendments | August 2023

Page 27 of 157

FEDERAL RULES OF APPELLATE PROCEDURE 3

used in any applicable rule, means 32

‘‘bankruptcy appellate panel’’; and 33

* * * * * 34

(2) Additional Rules. In addition to the rules 35

made applicable by Rule 6(b)(1), the 36

following rules apply: 37

(A) Motion for Rehearing. 38

* * * * * 39

(ii) If a party intends to challenge 40

the order disposing of the 41

motion—or the alteration or 42

amendment of a judgment, 43

order, or decree upon the 44

motion—then the party, in 45

compliance accordance with 46

Rules 3(c) and 6(b)(1)(B), 47

must file a notice of appeal or 48

amended notice of appeal. 49

Preliminary Draft of Proposed Amendments | August 2023

Page 28 of 157

4 FEDERAL RULES OF APPELLATE PROCEDURE

The notice or amended notice 50

must be filed within the time 51

prescribed by Rule 4—52

excluding Rules 4(a)(4) and 53

4(b)—measured from the 54

entry of the order disposing of 55

the motion. 56

* * * * * 57

(C) Making the Record Available. 58

* * * * * 59

(ii) All parties must do whatever 60

else is necessary to enable the 61

clerk to assemble the record 62

and make it available. When 63

the record is made available in 64

paper form, the court of 65

appeals may provide by rule 66

or order that a certified copy 67

Preliminary Draft of Proposed Amendments | August 2023

Page 29 of 157

FEDERAL RULES OF APPELLATE PROCEDURE 5

of the docket entries be made 68

available in place of the 69

redesignated record. But at 70

any time during the appeal’s 71

pendency, any party may 72

request at any time during the 73

pendency of the appeal that 74

the redesignated record be 75

made available. 76

(D) Filing the Record. When the district 77

clerk or bankruptcy-appellate-panel 78

clerk has made the record available, 79

the circuit clerk must note that fact on 80

the docket. The date as noted on the 81

docket serves as the filing date of the 82

record. The circuit clerk must 83

immediately notify all parties of that 84

the filing date. 85

Preliminary Draft of Proposed Amendments | August 2023

Page 30 of 157

6 FEDERAL RULES OF APPELLATE PROCEDURE

(c) Direct Appeal Review from a Judgment, Order, 86

or Decree of a Bankruptcy Court by Permission 87

Authorization Under 28 U.S.C. § 158(d)(2). 88

(1) Applicability of Other Rules. These rules 89

apply to a direct appeal from a judgment, 90

order, or decree of a bankruptcy court by 91

permission authorization under 28 U.S.C. 92

§ 158(d)(2), but with these qualifications: 93

(A) Rules 3–4, 5(a)(3) (except as 94

provided in this subdivision (c)), 6(a), 95

6(b), 8(a), 8(c), 9–12, 13–20, 22–23, 96

and 24(b) do not apply; and 97

(B) as used in any applicable rule, 98

‘‘district court’’ or ‘‘district clerk’’ 99

includes—to the extent appropriate—100

a bankruptcy court or bankruptcy 101

appellate panel or its clerk; and 102

Preliminary Draft of Proposed Amendments | August 2023

Page 31 of 157

FEDERAL RULES OF APPELLATE PROCEDURE 7

(C) the reference to ‘‘Rules 11 and 103

12(c)’’ in Rule 5(d)(3) must be read 104

as a reference to Rules 6(c)(2)(B) and 105

(C). 106

(2) Additional Rules. In addition to the rules 107

made applicable by (c)(1), the following rules 108

apply: 109

(A) Petition to Authorize a Direct 110

Appeal. Within 30 days after a 111

certification of a bankruptcy court’s 112

order for direct appeal to the court of 113

appeals under 28 U.S.C. § 158(d)(2) 114

becomes effective under Bankruptcy 115

Rule 8006(a), any party to the appeal 116

may ask the court of appeals to 117

authorize a direct appeal by filing a 118

petition with the circuit clerk under 119

Bankruptcy Rule 8006(g). 120

Preliminary Draft of Proposed Amendments | August 2023

Page 32 of 157

8 FEDERAL RULES OF APPELLATE PROCEDURE

(B) Contents of the Petition. The 121

petition must include the material 122

required by Rule 5(b)(1) and an 123

attached copy of: 124

(i) the certification; and 125

(ii) the notice of appeal of the 126

bankruptcy court’s judgment, 127

order, or decree filed under 128

Bankruptcy Rule 8003 or 129

8004. 130

(C) Answer or Cross-Petition; Oral 131

Argument. Rule 5(b)(2) governs an 132

answer or cross-petition. Rule 5(b)(3) 133

governs oral argument. 134

(D) Form of Papers; Number of 135

Copies; Length Limits. Rule 5(c) 136

governs the required form, number of 137

copies to be filed, and length limits 138

Preliminary Draft of Proposed Amendments | August 2023

Page 33 of 157

FEDERAL RULES OF APPELLATE PROCEDURE 9

applicable to the petition and any 139

answer or cross-petition. 140

(E) Notice of Appeal; Calculating 141

Time. A notice of appeal to the court 142

of appeals need not be filed. The date 143

when the order authorizing the direct 144

appeal is entered serves as the date of 145

the notice of appeal for calculating 146

time under these rules. 147

(F) Notification of the Order 148

Authorizing Direct Appeal; Fees; 149

Docketing the Appeal. 150

(i) When the court of appeals 151

enters the order authorizing 152

the direct appeal, the circuit 153

clerk must notify the 154

bankruptcy clerk and the 155

district court clerk or 156

Preliminary Draft of Proposed Amendments | August 2023

Page 34 of 157

10 FEDERAL RULES OF APPELLATE PROCEDURE

bankruptcy-appellate-panel 157

clerk of the entry. 158

(ii) Within 14 days after the order 159

authorizing the direct appeal 160

is entered, the appellant must 161

pay the bankruptcy clerk any 162

unpaid required fee, 163

including: 164

• the fee required for the 165

appeal to the district court 166

or bankruptcy appellate 167

panel; and 168

• the difference between the 169

fee for an appeal to the 170

district court or 171

bankruptcy appellate 172

panel and the fee required 173

Preliminary Draft of Proposed Amendments | August 2023

Page 35 of 157

FEDERAL RULES OF APPELLATE PROCEDURE 11

for an appeal to the court 174

of appeals. 175

(iii) The bankruptcy clerk must 176

notify the circuit clerk once 177

the appellant has paid all 178

required fees. Upon receiving 179

the notice, the circuit clerk 180

must enter the direct appeal on 181

the docket. 182

(G) Stay Pending Appeal. Bankruptcy 183

Rule 8007 applies to any stay pending 184

appeal. 185

(A)(H) The Record on Appeal. Bankruptcy 186

Rule 8009 governs the record on 187

appeal. If a party has already filed a 188

document or completed a step 189

required to assemble the record for 190

the appeal to the district court or 191

Preliminary Draft of Proposed Amendments | August 2023

Page 36 of 157

12 FEDERAL RULES OF APPELLATE PROCEDURE

bankruptcy appellate panel, the party 192

need not repeat that filing or step. 193

(B)(I) Making the Record Available. 194

Bankruptcy Rule 8010 governs 195

completing the record and making it 196

available. When the court of appeals 197

enters the order authorizing the direct 198

appeal, the bankruptcy clerk must 199

make the record available to the 200

circuit clerk. 201

(C) Stays Pending Appeal. Bankruptcy 202

Rule 8007 applies to stays pending 203

appeal. 204

(D)(J) Duties of the Circuit Clerk. When 205

the bankruptcy clerk has made the 206

record available, the circuit clerk 207

must note that fact on the docket. The 208

date as noted on the docket serves as 209

Preliminary Draft of Proposed Amendments | August 2023

Page 37 of 157

FEDERAL RULES OF APPELLATE PROCEDURE 13

the filing date of the record. The 210

circuit clerk must immediately notify 211

all parties of that the filing date. 212

(E)(K) Filing a Representation Statement. 213

Unless the court of appeals designates 214

another time, within 14 days after 215

entry of the order granting permission 216

to appeal authorizing the direct appeal 217

is entered, the attorney for each party 218

to the appeal the attorney who sought 219

permission must file a statement with 220

the circuit clerk naming the parties 221

that the attorney represents on appeal. 222

Committee Note 223

Subdivision (a). Minor stylistic and clarifying 224

changes are made to subdivision (a). In addition, 225

subdivision (a) is amended to clarify that, when a district 226

court is exercising original jurisdiction in a bankruptcy case 227

or proceeding under 28 U.S.C. § 1334, the time in which to 228

file post-judgment motions that can reset the time to appeal 229

under Rule 4(a)(4)(A) is controlled by the Federal Rules of 230

Preliminary Draft of Proposed Amendments | August 2023

Page 38 of 157

14 FEDERAL RULES OF APPELLATE PROCEDURE

Bankruptcy Procedure, rather than the Federal Rules of Civil 231

Procedure. 232

The Bankruptcy Rules partially incorporate the 233

relevant Civil Rules but in some instances shorten the 234

deadlines for motions set out in the Civil Rules. See Fed. R. 235

Bankr. P. 9015(c) (any renewed motion for judgment under 236

Civil Rule 50(b) must be filed within 14 days of entry of 237

judgment); Fed. R. Bankr. P. 7052 (any motion to amend or 238

make additional findings under Civil Rule 52(b) must be 239

filed within 14 days of entry of judgment); Fed. R. Bankr. P. 240

9023 (any motion to alter or amend the judgment or for a 241

new trial under Civil Rule 59 must be filed within 14 days 242

of entry of judgment). 243

Motions for attorney’s fees in bankruptcy cases or 244

proceedings are governed by Bankruptcy Rule 245

7054(b)(2)(A), which incorporates without change the 14-246

day deadline set in Civil Rule 54(d)(2)(B). Under Appellate 247

Rule 4(a)(4)(A)(iii), such a motion resets the time to appeal 248

only if the district court so orders pursuant to Civil Rule 249

58(e), which is made applicable to bankruptcy cases and 250

proceedings by Bankruptcy Rule 7058. 251

Motions for relief under Civil Rule 60 in bankruptcy 252

cases or proceedings are governed by Bankruptcy Rule 253

9024. Appellate Rule 4(a)(4)(A)(vi) provides that a motion 254

for relief under Civil Rule 60 resets the time to appeal only 255

if the motion is made within the time allowed for filing a 256

motion under Civil Rule 59. In a bankruptcy case or 257

proceeding, motions under Civil Rule 59 are governed by 258

Bankruptcy Rule 9023, which, as noted above, requires such 259

motions to be filed within 14 days of entry of judgment. 260

Preliminary Draft of Proposed Amendments | August 2023

Page 39 of 157

FEDERAL RULES OF APPELLATE PROCEDURE 15

Civil Rule Bankruptcy

Rule

Time Under

Bankruptcy Rule

50(

b

) 9015(c) 14 da

y

s

52(b) 7052 14 da

y

s

59 9023 14 da

y

s

54(d)(2)(B) 7054(b)(2)(A) 14 da

y

s

60 9024 14 da

y

s

Of course, the Bankruptcy Rules may be amended in 261

the future. If that happens, the time allowed for the 262

equivalent motions under the applicable Bankruptcy Rule 263

may change. 264

Subdivision (b). Minor stylistic and clarifying 265

changes are made to the header of subdivision (b) and to 266

subdivision (b)(1). Subdivision (b)(1)(C) is amended to 267

correct the omission of the word “bankruptcy” from the 268

phrase “bankruptcy appellate panel.” Stylistic changes are 269

made to subdivision (b)(2). 270

Subdivision (c). Subdivision (c) was added to Rule 271

6 in 2014 to set out procedures governing discretionary 272

direct appeals from orders, judgments, or decrees of the 273

bankruptcy court to the court of appeals under 28 U.S.C. § 274

158(d)(2). 275

Typically, an appeal from an order, judgment, or 276

decree of a bankruptcy court may be taken either to the 277

district court for the relevant district or, in circuits that have 278

established bankruptcy appellate panels, to the bankruptcy 279

appellate panel for that circuit. 28 U.S.C. § 158(a). Final 280

orders of the district court or bankruptcy appellate panel 281

resolving appeals under § 158(a) are then appealable as of 282

right to the court of appeals under § 158(d)(1). 283

Preliminary Draft of Proposed Amendments | August 2023

Page 40 of 157

16 FEDERAL RULES OF APPELLATE PROCEDURE

That two-step appeals process can be redundant and 284

time-consuming and could in some circumstances 285

potentially jeopardize the value of a bankruptcy estate by 286

impeding quick resolution of disputes over disposition of 287

estate assets. In the Bankruptcy Abuse Prevention and 288

Consumer Protection Act of 2005, Congress enacted 28 289

U.S.C. § 158(d)(2) to provide that, in certain circumstances, 290

appeals may be taken directly from orders of the bankruptcy 291